In 2017, Bengaluru entrepreneurs Paddy Raghavan and Jags Raghavan were working with Cisco for one year after their cloud cost optimisation project - Compute.io - was acquired by the multinational tech conglomerate.

Post-acquisition, they were making personal investments, researching various asset classes, reading about personal finance, and so on.

The entrepreneurs noticed many urban Indians were using credit to fund travel expenses, gadgets, and other big-ticket items, and in turn, paying high interest rates.

“Even at Cisco, we noticed folks going to Europe for a vacation - holidays that were paid for using credit card loans. At the time, we met Vikas Jain, who had quit Goldman Sachs, completed CFA level three, and was researching personal finance. Together, we decided to address the problem by connecting savings to spending and helping people avoid impulsive purchases,” Paddy says.

In 2020, the entrepreneurs launched Multipl, a free fintech app to save, invest, and spend for big-ticket expenses and for long-term wealth creation.

How Multipl works

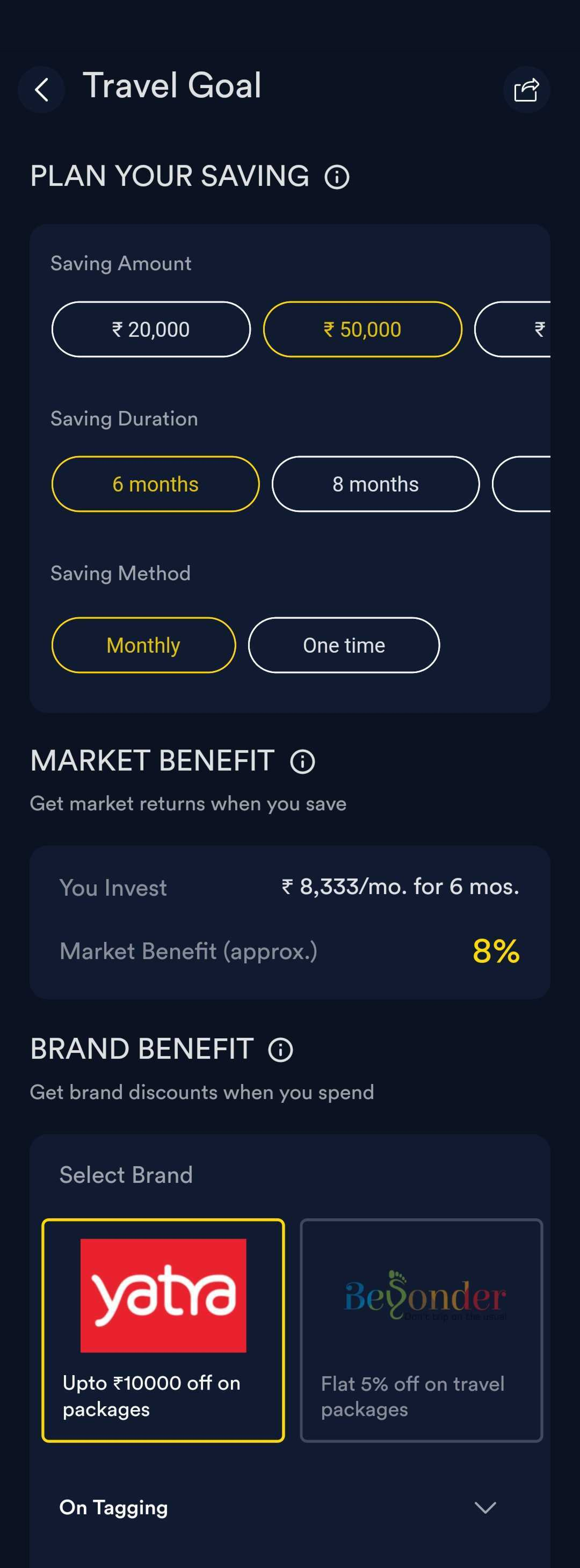

A contrast to the Buy Now Pay Later (BNPL) trend, Multipl’s models include Brand Saver, where the startup partners with brands, and users directly save with these brands for future spending.

Goal creation with tagging on the Multipl app

Another model is Market Saver, which sees Multipl invest users’ money in curated market instruments such as mutual funds, and lets the user tag them to brands to avail dual benefits, i.e., returns from the market and exclusive discounts from brands.

Paddy explains: “Let’s say a user wants to save in order to travel on a holiday. With Market Maker, the user can invest Rs 10,000 each month for nine months, which we invest in the market. At the end of the time period, the investment could be worth around Rs 95,000. We also provide discounts from brands like MakeMyTrip, so users can get around Rs 1 lakh worth of value.”

Alternatively, users can avail the Brand Saver model, where users directly save with MakeMyTrip and receive a deeper, direct discount. Paddy claims this model can help users with an investment of Rs 80,000 receive a travel package worth anywhere between Rs 90,000 and Rs 1 lakh.

Traction so far

Multipl has signed up the likes of Yatra, Ather, Wakefit, Urban Ladder, Bounce, Vedantu, Tanishq, Croma, Kalyan Jewellers, and over 200 reward partners as part of its ‘Plan Now, Pay Smart’ thesis.

The Multipl platform also features a rewards mechanism - where users receive smaller rewards in the form of brand vouchers in order to prompt recurring savings.

“In the last few months, we have gone from 1,000 downloads to one lakh users across Android and iOS. We see most of our traction from Tier 1 and Tier 2 markets, and enable users to put their money to much better use, instead of parking it in unproductive asset classes such as savings accounts or fixed deposits,” Paddy explains.

The bootstrapped startup also claims it currently has over Rs 60 crore worth investment goals started by users on its platform, and the average duration of an investment goal is between eight and nine months.

Multipl’s most popular savings categories are travel, jewellery, car and health insurance, gadgets, education, and others.

The way ahead for Multipl

According to RedSeer estimates, India’s BNPL market is expected to rise from $3-3.5 billion at present to reach $45-50 billion by 2026.

Multipl, whose vision for smart spending is an antithesis to the BNPL movement, is looking to capitalise on a relatively uncharted market, accompanied by few players like Kuvera, Scripbox, etc (although these brands don’t currently have a Brand Saver option like Multipl).

Going forward, in keeping with its ‘Plan Now, Pay Smart’ approach, the startup is looking to onboard more women users.

“We have an 80-20 split in terms of men and women users, and so we are running campaigns to incentivise more women to participate, save, and invest with us,” Paddy says.

The founders also claim that they are evaluating several other asset classes to offer users, including crypto investing and saving. But they remain clear Multipl is not going to have users play a game of chasing returns.

“We understand the rewards and the risks of an asset class like crypto, but we don’t want people to lose their capital. But we are still keeping our eyes and ears open towards all emergent asset classes,” Paddy says.

“Now, as second-time founders, we are once again building a globally-unique product with Multipl. With Compute.io, we built a project which is still part of Cisco’s cloud centre modules. We are seeing many Compute.io’s investors now investing in Multipl, which validates not only our exit but also our approach with Multipl.”

Edited by Teja Lele Desai