As we head into the third month of 2022, the Indian startup ecosystem has already added 11 new entrants to the coveted $1 billion valuation club. The country is already cheering in its new unicorns — (advanced analytics), (edtech), (HRtech), (social commerce), (blockchain), (home interior and renovation), (B2B ecommerce), (logistics), (conversational AI), Hasura (GraphQL developer), and the latest being (fintech)

And, there is more to come. According to a PwC report, over 50 Indian startups have the potential to enter the unicorn club — startups valued at over $1 billion each — in 2022.

The year 2021 saw the emergence of 44 startup unicorns against a cumulative number of 33 unicorns from 2011 to 2020.

Given the record-breaking year of 2021, in terms of fund inflow and the emergence of unicorns from the Indian startup ecosystem, 2022 is expected to continue the momentum. Let’s have a look at the 11 unicorns of 2022.

Fractal

Srikanth Velamakanni, Co-founder and Group CEO, Fractal

New York, US, and Mumbai-headquartered artificial intelligence (AI) and advanced analytics solutions provider Fractal, in January, announced raising $360 million from TPG Capital Asia, the Asia-focused private equity platform of global alternative asset firm TPG.

The definitive investment agreement between the parties is expected to close by the first quarter of 2022. According to media reports, Fractal was valued at over $1 billion as part of the funding round.

The current round will take the total equity capital raised by the company to $685 million and see TPG’s Puneet Bhatia and Vivek Mohan join Fractal’s board of directors.

LEAD

LEAD co-founders: Smita Deorah and Sumeet Mehta

Edtech startup (previously LEAD School) in January raised Series E funding of $100 million at a valuation of $1.1 billion. The first edtech unicorn of 2022 is also the first school edtech player to enter the coveted club.

The round was led by WestBridge Capital and saw participation from GSV Ventures. The company’s valuation has doubled in the last nine months on the back of strong growth in its operating and financial metrics. The current round is its fifth round of institutional funding since 2017.

LEAD will use the capital to achieve its vision of providing quality affordable education to 25 million+ students, with an annual revenue run-rate of $1 billion. Its immediate focus will be on product and curriculum innovation, growth in its footprint, and hiring top talent across functions.

In the long term, the company plans to go deeper into the country to serve students in lower-fee schools and expand internationally in similar geographies.

Darwinbox

Hyderabad-based HRtech startup raised $72 million in a funding round led by Technology Crossover Ventures (TCV), along with participation from existing investors Salesforce Ventures, Sequoia India, Lightspeed India, Endiya Partners, 3One4Capital, JGDEV, and SCB 10X.

The company’s valuation post the Series D round has crossed the $1 billion mark, with the total investment raised thus far crossing $110 million. DealShare has grown 200 percent since its last fundraise from Salesforces Ventures, about a year ago.

Founded in late 2015 by Chaitanya Peddi, Jayant Paleti, and Rohit Chennamaneni, Darwinbox aims to use the funds for global expansion by accelerating its platform innovation agenda, strengthening its product, engineering, and customer success teams, along with scaling its go-to-market (GTM) presence in South Asia, Southeast Asia, and MENA (the Middle East and North Africa).

The team added that they aim to take Darwinbox public by 2025.

DealShare

Dealshare Founding team

Social commerce platform raised $165 million in the first close of its Series E round from Dragoneer Investments Group, Kora Capital, and Unilever Ventures. Existing investors Tiger Global and Alpha Wave Global (Falcon Edge) also participated in the round.

This capital infusion saw DealShare entering the coveted billion-dollar unicorn club after its valuation rose to over $1.6 billion.

Founded in September 2018 by Vineet Rao, Sourjyendu Medda, Sankar Bora, and Rajat Shikhar, three-year-old startup DealShare uses a community-driven approach to offer high-quality, low-priced essentials for mass consumers at competitive prices, especially in Tier II and III cities.

Polygon

Polygon cofounders (L to R) Anurag Arjun, Sandeep Nailwal and Jaynti Kanani

Ethereum scaling project (previously Matic Network) raised $450 million in its first major VC financing round led by Sequoia Capital India, with participation from Tiger Global, SoftBank, Galaxy Digital, Republic Capital, Makers Fund, Alameda Research, Alan Howard, Alexis Ohanian, Steadview Capital, Elevation Capital, Animoca Brands, Spartan Fund, Dragonfly Capital, Variant Fund, and Kevin O’Leary.

The funds will be raised through a private sale of Polygon’s native MATIC token. The Web3 startup's market cap was $14.4 billion at the time of publishing.

In a statement, Polygon claimed the fundraise will allow the team to consolidate its lead in the race to scale Ethereum, obviating the need for alternative blockchains and paving the way for mass adoption of Web3 applications.

Livspace

Omnichannel home interior and renovation platform, raised $180 million in Series F with KKR participating as the lead investor.

The latest funding round, which elevated Livspace to the coveted unicorn club, also saw participation from existing investors such as Ingka Group Investments (part of largest IKEA retailer Ingka Group), Jungle Ventures, Venturi Partners, and Peugeot Investments, among others.

With the funding, Livspace will expand to new markets, focus on brand building in India and Singapore, continue investing in its platform technology and digitally integrated supply chain, and hire, develop, and nurture talent across the board to support both new and existing businesses.

ElasticRun

, a B2B ecommerce startup that supplies goods to kiranas, raised $300 million in its Series E funding round at a $1.5 billion valuation from investors such as SoftBank and Goldman Sachs. Existing investor Prosus Ventures also took part in the round, the startup said.

ElasticRun will use the capital to expand and grow its operations. It may close the Series E round with a much higher capital infusion if it receives any more interest till March 21, when the subscription ends, according to its filing.

Founded by Sandeep Deshmukh, Saurabh Nigam, and Shitiz Bansal in 2016, ElasticRun operates in over 300 cities in India and works with over 125,000 retail outlets. It helps kiranas place bulk orders for goods online, as well as provides an analytics and aggregation platform.

Xpressbees

Third-party logistics provider raised $300 million in a Series F funding round at a valuation of $1.2 billion. The round was led by private equity funds Blackstone Growth, TPG Growth, and ChrysCapital. Existing investors, Investcorp and Norwest Venture Partners, also participated in the latest round.

With this round, the total amount of capital raised by Xpressbees exceeds $500 million. Avendus Capital acted as the exclusive financial advisor to Xpressbees on this transaction.

Xpressbees, in a statement, said it will use the fresh capital to become a full-service logistics organisation, support the business in its next phase of growth, product development, and hire talent.

Uniphore

Uniphore founders: Ravi Saraogi (left) and Umesh Sachdev

, a Chennai and California-based conversational automation startup, raised $400 million in a Series E round of funding.

The round, which brings Uniphore’s total funding to more than half a billion ($610 million), is led by American venture capital (VC) firm NEA and raises the company’s valuation to $2.5 billion.

VC and growth equity firm March Capital and other existing investors along with new entities also chipped in.

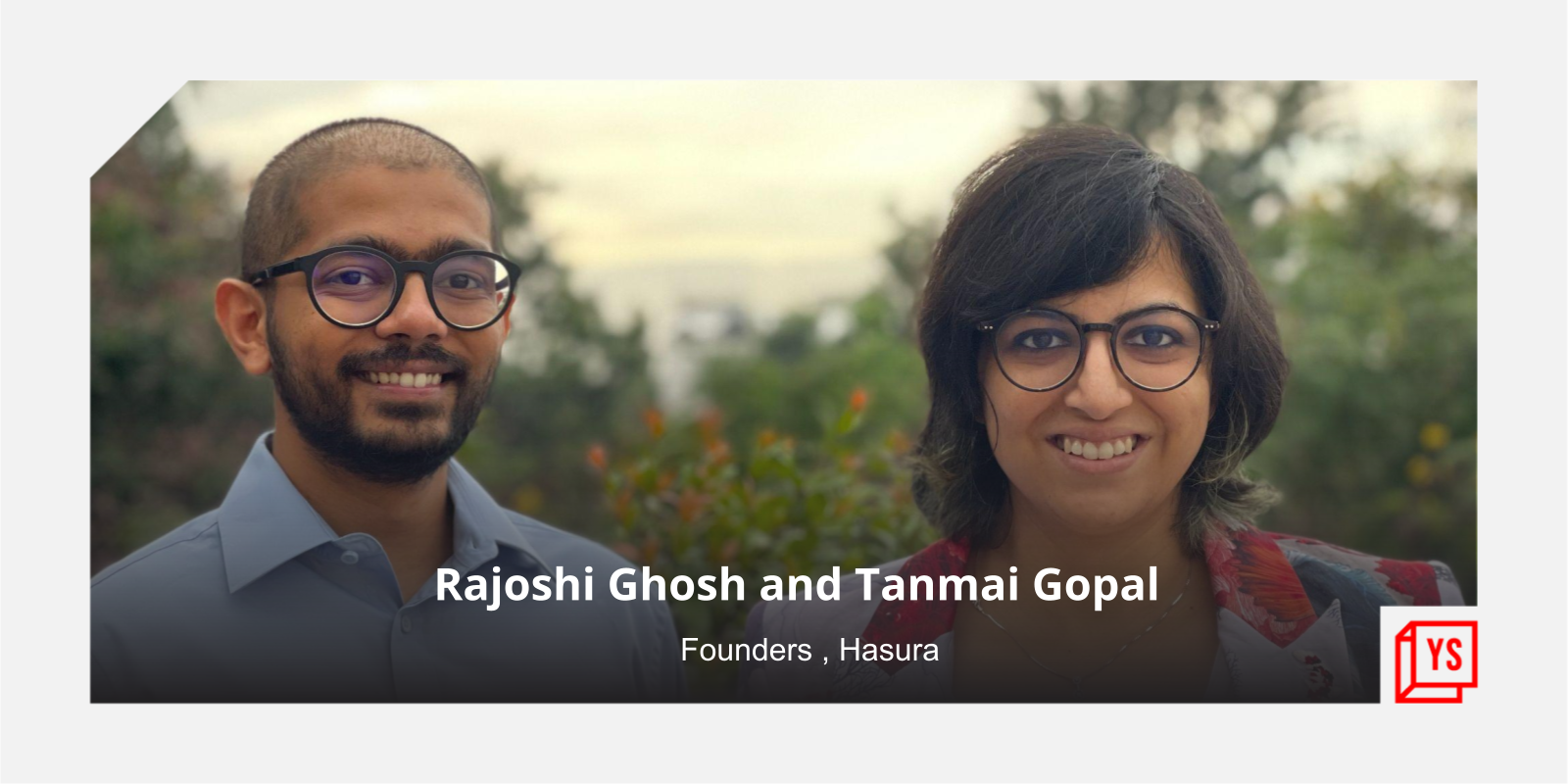

Hasura

Hasura, a GraphQL developer startup raised $100 million in a Series C funding round led by Greenoaks.

The latest round brings the total capital raised by Hasura to $136.5 million and the startup's valuation to $1 billion, making this startup the tenth unicorn of the year. Existing investors Nexus Venture Partners, Lightspeed Venture Partners, and Vertex Ventures also chipped in, according to a statement.

Hasura claims its solution has been downloaded more than 400 million times and has earned more than 25,000 GitHub stars since its introduction in 2018.

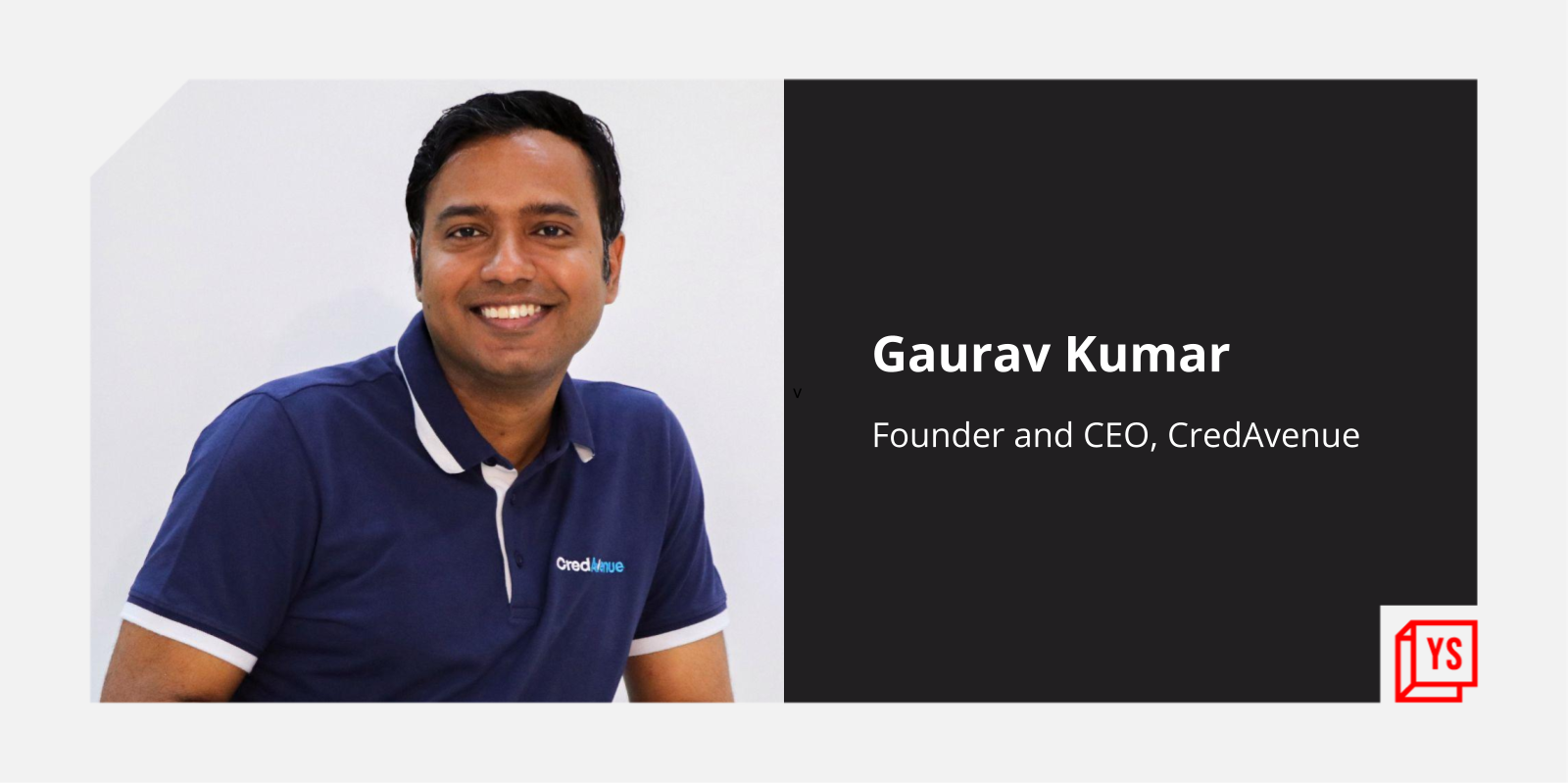

CredAvenue

Gaurav Kumar, Founder and CEO, CredAvenue

Chennai-headquartered debt marketplace for enterprises raised $137 million in a Series B round of funding, catapulting it to the famed startup unicorn club. The round, led by Insight Partners, B Capital Group and Dragoneer Investment Group, valued the company at $1.3 billion post-money, a 3X jump from its $410-million valuation in September 2021.

Incorporated in 2021 by Gaurav Kumar and Vineet Sukumar as a subsidiary of financial services marketplace , CredAvenue will nearly double the pool of capital for Employee Stock Ownership Plan (ESOP) to Rs 500 crore across two separate programmes, Co-founder and CEO of CredAvenue, Gaurav Kumar told YourStory.

The startup claims to work with over 2,300 corporates and connects them to over 750 lenders. It has a loanbook of over Rs 90,000 crore.

(Written by Trisha Medhi, with inputs from Sindhu Kashyap, Aparajita Saxena, Payal Ganguly, Malvika Maloo, Rishabh Mansur, and Ayshwaria Lakshmi.)

Edited by Suman Singh