When Aman Bhayana, an engineering graduate from Vellore Institute of Technology (VIT), was contemplating starting something for people his age in the fintech sector, he realised most of his peers were not using cards. Instead, they were opting for UPI-based solutions.

Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application, merging several banking features, seamless fund routing, and merchant payments. It also caters to the “peer-to-peer” collect request that can be scheduled and paid as per requirement and convenience.

“Cards are good, but UPI is so much more convenient,” Aman says.

Now 23, Aman organised his thoughts and decided to focus on an age group that was till now neglected by the fintech ecosystem: teenagers.

In 2020, Aman and Meherdeep Thakur, also an engineering graduate from VIT, launched Bengaluru-based Pay Crunch, a UPI-based credit platform for college students. The secure and reliable platform aims to deliver a unique experience to students when they go out with friends to shop, party, and more. Aman initially bootstrapped the firm with Rs 1-2 lakh, before seeking further investments.

“The use case is for students, who go out but maybe fall short of some funds. They can pay then and there through UPI,” Aman says.

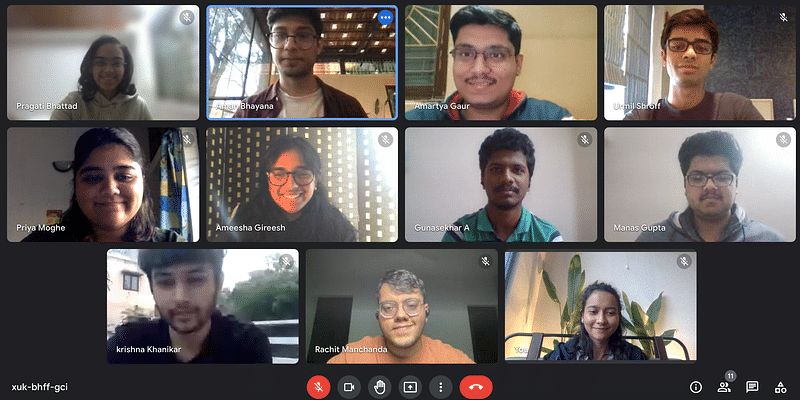

Pay Crunch team of more than 12 folks, working remotely.

How does it work?

PayCrunch is a microloan lending app that makes borrowing money easier for students. The buy now, pay later app claims to have more than 10,000 users, and aims to make financial management easier by helping track transactions.

It uses a credit system to keep a track of a student’s repayments, provide them with exciting bonuses to encourage wise financial management. The offline feature ensures lack of internet access is not an issue and enhances accessibility throughout the country.

To onboard teenagers, Pay Crunch uses an alternative financial assessment process.

“We divide our assessment of users between ability to pay and willingness to pay,” Aman says. “Both of these things are done by understanding their spending patterns. We also try to understand this pattern on social media as well,” he adds.

Pay Crunch, which currently employs 12 people, is also tying up with colleges and universities, with engaged student communities. This includes Under 25, a group with over a million students across colleges in India.

Credit: YourStory Design

The fintech startup is also in talks with restaurant chains, including Social, and fintech platform CRED, among others, to provide different schemes and products to their users.

It has plans to gamify user experience and reward them with Pay Crunch coins, which can be used to make further purchases.

The market and outlook

In the last two years, with pandemic-led accelerated digital adoption, many fintech platforms have launched BNPL schemes. These include the likes of MobiKwik, BharatPe, Bengaluru-based Zest Money, and Lazy Pay.

India's BNPL market will shoot to $45-50 billion by 2026 from $3-3.5 billion now, according to RedSeer’s research, in November 2021. The number of BNPL users in India may also rise to 80-100 million customers, from 10-15 million currently.

Alongside, teenagers have become the new favourite market segment for the startup ecosystem. From edtech to fintech, many young founders are targeting this age group.

A few fintech players who have found success with their offerings include Tiger Global-backed Slice, a credit card disbursement player for young adults; FamPay; and Junio, which offer digital financial access to those below the age of 18.

The vertical has pulled in substantial VC money in the past from marquee investors and it is widely believed that the space is poised to see strong growth, especially as the under-18s growing up today are digital natives.

Pay Crunch, which raised $500,000 from Y Combinator, is now looking to expand its user base, and get an NBFC licence, which may be difficult as the Reserve Bank of India (RBI) has brought in more regulations for private players. It also aims to launch its own payment card, among other things.

“The college-going crowd is the next big thing. While the user base keeps changing every couple of years, if tapped correctly they could be lifelong customers,” Aman says.

Edited by Teja Lele Desai