Chennai and San Francisco-based subscription management platform, Chargebee, on Tuesday announced the closing of a $250 million investment round co-led by Tiger Global and Sequoia Capital, along with returning investors including Insight Partners, Sapphire and Steadview Capital.

This round follows a previous round in April raising $125 million at a $1.4 billion valuation, bringing the total investment in the company to $470 million.

In an official statement, the company said the new round of funding will be used towards product innovation and global expansion to support the billing and revenue needs of current and future subscription businesses, as well as strategic corporate growth initiatives.

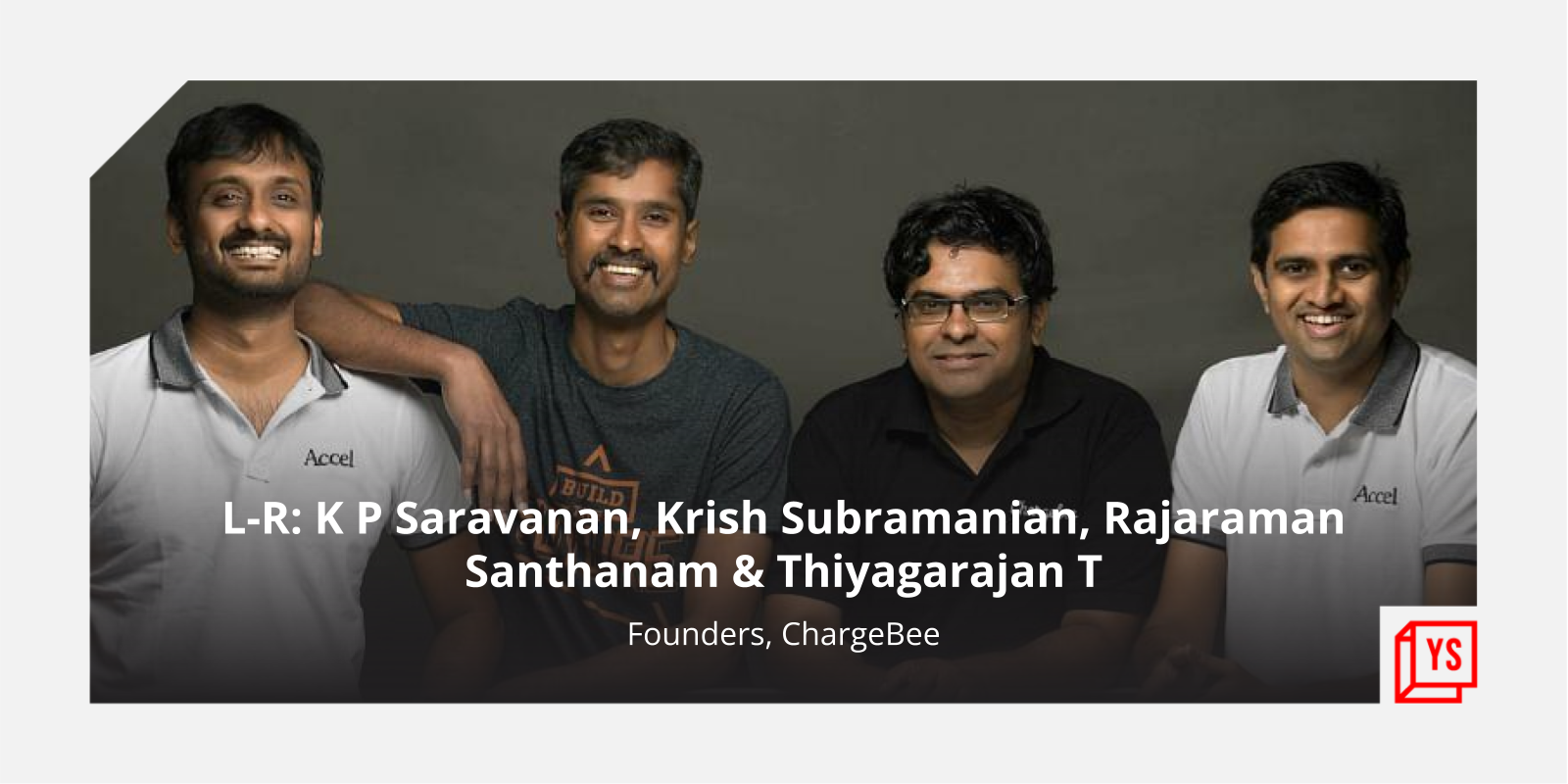

“We built Chargebee to solve infrastructure issues facing high-growth subscription businesses with a product roadmap laser focused on replacing in-house systems orchestrating the complex parts of revenue intelligence like billing and payments. As subscription offerings continue to rapidly evolve, our focus remains on providing a flexible growth engine to power, capture and understand revenue, all in real time,” said Krish Subramanian, CEO and Co-founder of Chargebee, in the statement.

“This round of funding will drive innovation to empower the next generation of businesses leveraging subscription billing models to quickly start, scale and transform,” Krish added.

Founded in 2011, Chargebee manages revenue operations of over 4,000 subscription-based businesses ranging from early-stage startups to larger enterprises, including Freshworks, Calendly, Doodle and Pret a Manger. Through simple and seamless integrations, Chargebee captures the entire revenue lifecycle from first interaction to the closing of the books each month, empowering teams to make business growth decisions with confidence.

“We believe every company will be a subscription company in the future. The predictability of a subscription business model is extremely attractive, and Chargebee is the leading revenue management partner for the subscription economy. Its platform offers customers a real-time 360-degree view into revenues and user behavior and the intelligence they can use to quickly adapt and make better business decisions,” said Tejeshwi Sharma, MD, Sequoia India.

The company recently expanded offerings to build a unified revenue management platform with strategic acquisitions of revenue recognition solution provider RevLock and churn deflection and retention platform Brightback. In the last year, the platform also added capabilities to optimize revenue growth with new payment methods and gateways, support for one-time payments to meet local tax and e-voicing regulatory and compliance requirements, enhanced reporting and analytics and updated integrations with ERPs (Netsuite and Microsoft Dynamics) and CRMs (Hubspot and Zoho) to support more complex sales motions.

The company has also expanded globally with new offices and investments in Australia and India and partnerships with industry leaders including GoCardless, Salesforce, Hubspot and PayPal.

Edited by Anju Narayanan