The quintessential finance lesson every Indian child learns while growing up is ‘a penny saved is a penny earned'.

Anand Kumar Bajaj’s first lesson was no different — his father stressed the importance of saving money and using it wisely.

“My father would often share how people in small towns like ours did not have easy access to banks, and how one often needed to travel long distances to access banking facilities,” he tells YourStory.

It was a problem Anand had played witness to first-hand on numerous occasions, and it formed an essential part of his understanding of money and finance. Small towns did not have the luxurious, easy access that bigger cities enjoyed, and that didn’t sit well with him.

After graduating from BITS Pilani, and a decade at ICICI and YES Bank, he realised that the gap between banking and finance in urban metros and rural areas only kept widening. This was something that needed attention and a solution, and Anand took up the challenge.

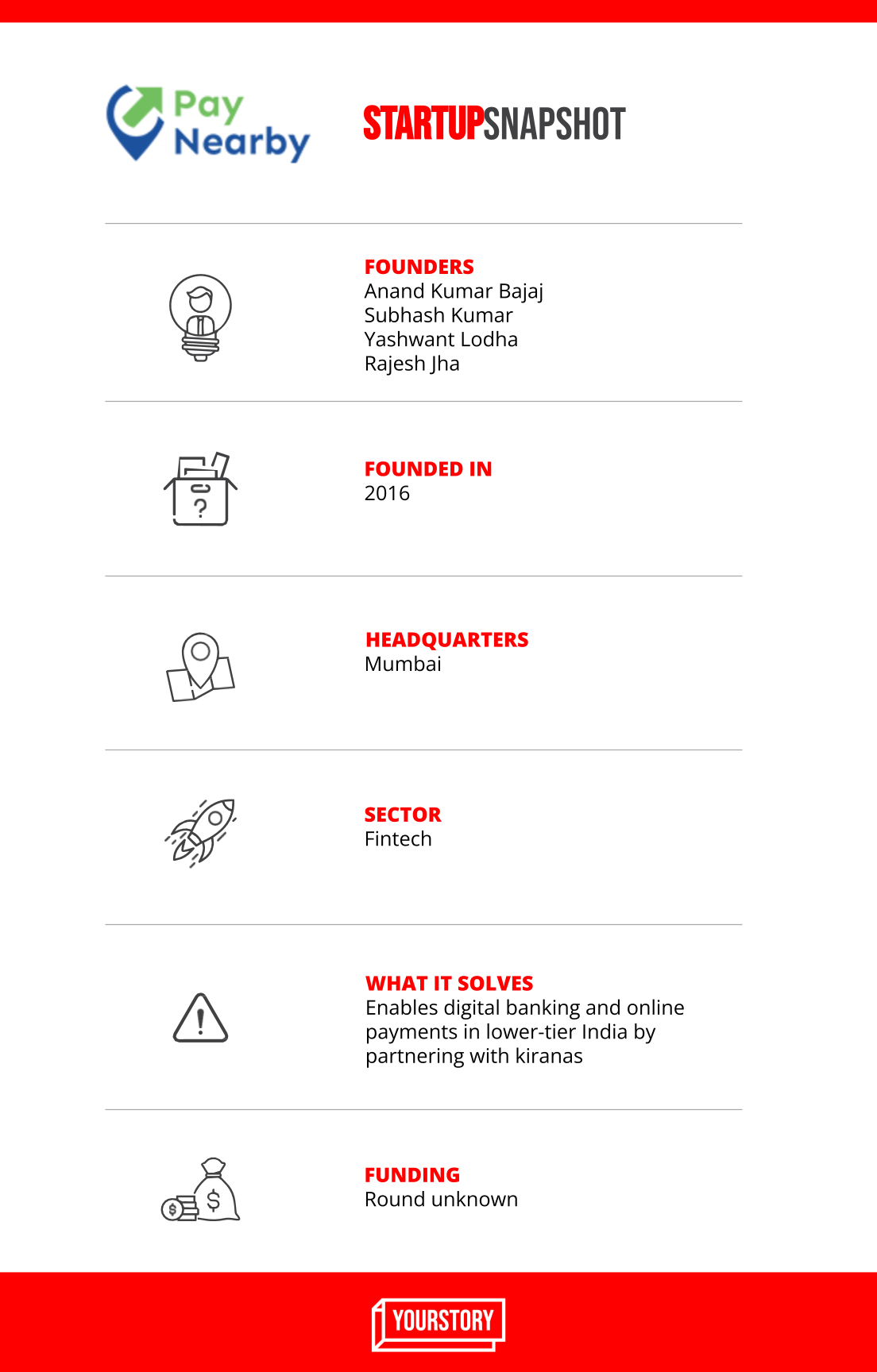

He teamed up with Subhash Kumar, Yashwant Lodha, and Rajesh Jha — all of whom have expertise in banking, payments, and financial services — and launched , a fintech startup.

PayNearby is essentially a last-mile banking services provider, which helps people in non-metros and rural India access financial services easily. The startup’s modus operandi is to partner with neighbourhood retail stores such as medical shops, tailors, newspaper vendors, and kirana stores and extend access to financial services via its platform.

The partnership with neighbourhood stores helps PayNearby in two main ways:

- It makes it easier for the startup to penetrate deeper into the country without spending too much money on setting up a whole new infrastructure.

- The trust that these small community stores have with their patrons helps with encouraging more people to use digital banking services via PayNearby.

“These small retailers are already dependable partners of place’s social ecosystem, and leveraging their connections and expertise within the community helps bring about effective changes and financial inclusion in his locality,” Anand says.

The startup, which has raised Rs 15 crore in funding from the Roha Group, has already tied up with more than 41 lakh retailers and has serviced more than 20 crore citizens to date. It is present in 17,600 pin codes across the country.

How it works

For a retailer, getting started on PayNearby’s platform is as easy as downloading the app and signing up. Anand says the UI/UX is extremely simple and even people who’ve never used a computer in their lives can get started on its app easily.

Once they’ve successfully signed up, kirana store owners can start offering services such as Aadhar banking, money transfers, utility bill payments, insurance buying, cash deposits, gold loans, travel bookings, and access to government benefits from within the app to their patrons.

“PayNearby app has over 25 services listed on it, and we’re developing a one-stop-shop model to ensure that all individuals and organisations can access financial services within their target localities,” Anand adds.

Retailers can level up by purchasing an all-inclusive digital payments package, which allows for payment collections via QR codes, UPI, Aadhar Pay, SMS and card payments, as well as PoS.

The advantage for these kirana shops that offer PayNearby’s services is that they get to earn money on top of their daily earnings via product sales. Companies and service providers that are listed on the startup’s platform, in turn, pay it a small fee for collecting money for them.

PayNearby clocks in over 20 lakh transactions every day, on average, it says. It is currently looking to raise $40 million in funding, which will help the startup offer lending services and distribute insurance services more widely.

Anand says PayNearby is associated with most major banks in the country, including YES Bank, ICICI, Axis, SBI, Federal Bank, and Karus Vyasa.

By 2025, the Mumbai-based startup hopes to get 100 million retailers to use its platform. It is also eyeing an international expansion, starting with Sri Lanka, Bangladesh, and Southeast Asian markets.

PayNearby’s competitors include the likes of Spice Money, , , JaiKisan, and , among others. Bigger startups like and are also making a bid to tap underserved users in rural India, where the next billion internet users are widely expected to hail from.

Valued at nearly $60 billion in FY20, the Indian fintech industry is expected to grow multifold to $150 billion by 2025, according to Invest India. Of this, rural fintech services are expected to account for a 30-40 percent share, especially as financial literacy improves.

Edited by Saheli Sen Gupta