Mutual funds have been gaining a lot of popularity in the recent past as an effective investment channel. According to a recent AMFI report, mutual fund assets have grown to INR 37.73 trillion as on December 31, 2021. This is more than a two-fold increase in a span of just five years. In fact, the total number of folios as on December 31, 2021 stood at 12.02 crore.

Passive strategies have been increasingly drawing investor interest across risk profiles. ETFs are one of the most popular vehicles of investing in passive strategies as they replicate the portfolio of the underlying index while trading in bite sized units on an exchange at market determined prices. Fund of Funds route is used by investors to tap the ‘untapped market’ potential by ensuring that the target fund’s investment philosophy and risk profile matches with that of the fund’s investment objective to create capital appreciation over the long term.

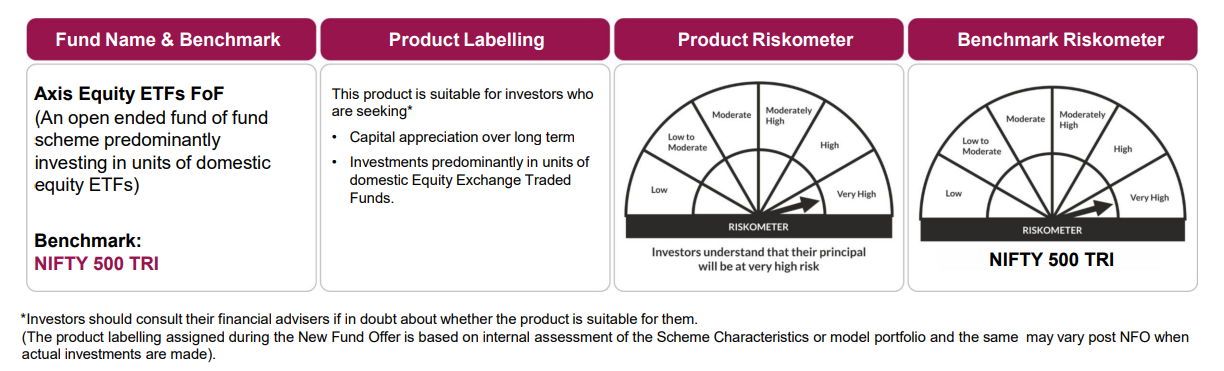

To help investors avail the benefit of market cap management as well as sectoral/thematic management, Axis Mutual Fund has launched the Axis Equity ETFs FoF, an Open Ended Fund of Fund scheme predominantly investing in units of domestic equity ETFs. The new fund will track the Nifty 500 TRI benchmark and endeavour to generate alpha by investing in domestic equity ETFs basis the fund manager’s top down investment view.

To decode Axis Equity ETFs FoF and understand the nuances of building wealth in the long run, we spoke to Ashwin Patni, Head Products & Alternatives, Axis AMC. Here are the key takeaways from the conversation.

How does an ETFs Fund of Fund work?

Fund of funds that leverage ETFs (exchange traded funds) in their portfolio are an increasingly popular investment tool in the country. Investing in ETFs through fund of funds is more accessible than a direct investment in this instrument since ETFs require a Demat trading account. On the other hand, ETF Fund of Funds are not limited by this pre-requisite.

“Mutual funds have today become a very mainstream product in India. As the base products gather popularity and people get more and more comfortable with the segment, a demand for more sophisticated or differentiated products such as ‘fund of funds’ is a natural progression,” said Ashwin.

Over the last three years, equity ETF assets have increased over three-fold. And while ETFs have an element of risk them, the diversified nature of the fund of funds makes them better poised to deal with market volatility.

What makes FoFs an attractive investment tool?

“Fund of Funds are attractive because there are a lot of stocks and mutual fund schemes out there which may frazzle investors because of the sheer volume and variety. Also, there are many investors who may not even find it easy to understand how the different schemes work,” said Ashwin, talking about the advantages of Fund of Funds, especially for new investors.

“FoF schemes are usually under the hands of professionally managed funds who apply a strategy to meet the scheme’s investment objective. Hence, these schemes might be considered by those who do not possess much knowledge about mutual fund investing. Investing in a Fund of Funds helps them allocate money through just one scheme into multiple schemes out there,” he added.

Ashwin also spoke about how Fund of Funds should be considered by new and seasoned investors, both. “For a new investor, firstly, there isn’t a need for a Demat trading account. Also, because it is passively managed, new investors can rely on the wisdom of a fund manager,” he said. “Even seasoned and active investors see it as a very natural complementary fit in terms of diversification,” he added.

What makes Axis Equity ETFs FoF stand out?

Asset allocation is important to building a sustainable long-term portfolio. However, investors who do not understand financial planning should take professional advice rather than investing in an ad-hoc manner. Each asset class offers its own set of merits and demerits and should not be ignored while building a financial plan.

“The beauty of Fund or Fund structures is that they can be cost and tax-efficient for investors” he said.

“The Axis Equity ETFs FoF provides investors an opportunity to take advantage of the benefits of diversification by investing in a variety of fund categories with a holistic approach to investing keeping in mind the market environment,” he added.

How can one invest in the Axis Equity ETFs FoF?

The minimum application amount is INR 5,000 and investors can invest in multiples of INR 1, thereafter. “The new fund offering (NFO) will be open from 4th Feb to 18th Feb 2022. Once the allotment is completed, the fund becomes open for regular subscriptions and redemptions on a daily basis,” said Ashwin.

“Investors can invest in Axis Equity ETFs FoF via lump sum investment or via SIP to give their mutual fund investments a disciplinary approach through systematic investment,” he added.

You can visit Axis Mutual Fund’s website www.axismf.com or download mobile app ‘Axis Mutual Fund’ (Android/IOS) and start your investment journey now.

Sources: AMFI, Axis MF Research data as on 31st December 2021 (Includes domestic Equity ETFs as recognized by AMFI)

Product Labelling:

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

(The product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or the model portfolio and the same may vary post NFO when actual investments are made)

Note: Investors will be bearing the recurring expenses of the scheme in addition to the expenses of other schemes in which Fund of Funds scheme makes investment

About Axis AMC: Axis AMC is one of India`s fastest growing assets managers offering a comprehensive bouquet of asset management products across mutual funds, portfolio management services and alternative investments.

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

The information set out above is included for general information purposes only and does not constitute legal or tax advice. In view of the individual nature of the tax consequences, each investor is advised to consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the Scheme. Income Tax benefits to the mutual fund & to the unit holder is in accordance with the prevailing tax laws as certified by the mutual funds consultant. Any action taken by you on the basis of the information contained herein is your responsibility alone. Axis Mutual Fund will not be liable in any manner for the consequences of such action taken by you. The information contained herein is not intended as an offer or solicitation for the purchase and sales of any schemes of Axis Mutual Fund.

Past performance may or may not be sustained in the future.

Stock(s) / Issuer(s)/ Top stocks mentioned above are for illustration purpose and should not be construed as recommendation.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.