The Union Budget of 2022-23 has firmly placed the startup segment of the country in the forefront by laying down the vision of the digital economy and a start has been made with a few tax concessions with a bold promise of attracting further capital into this ecosystem.

Union Finance Minister Nirmala Sitharaman while presenting the Budget laid out the vision of the government of “promoting digital economy & fintech, technology enabled development, energy transition, and climate action” and “relying on virtuous cycle starting from private investment with public capital investment helping to crowd-in private investment.”

These form the very ingredients of the Indian startup ecosystem which is based on a digital framework with supportive venture capital.

Source: 3one4 Capital

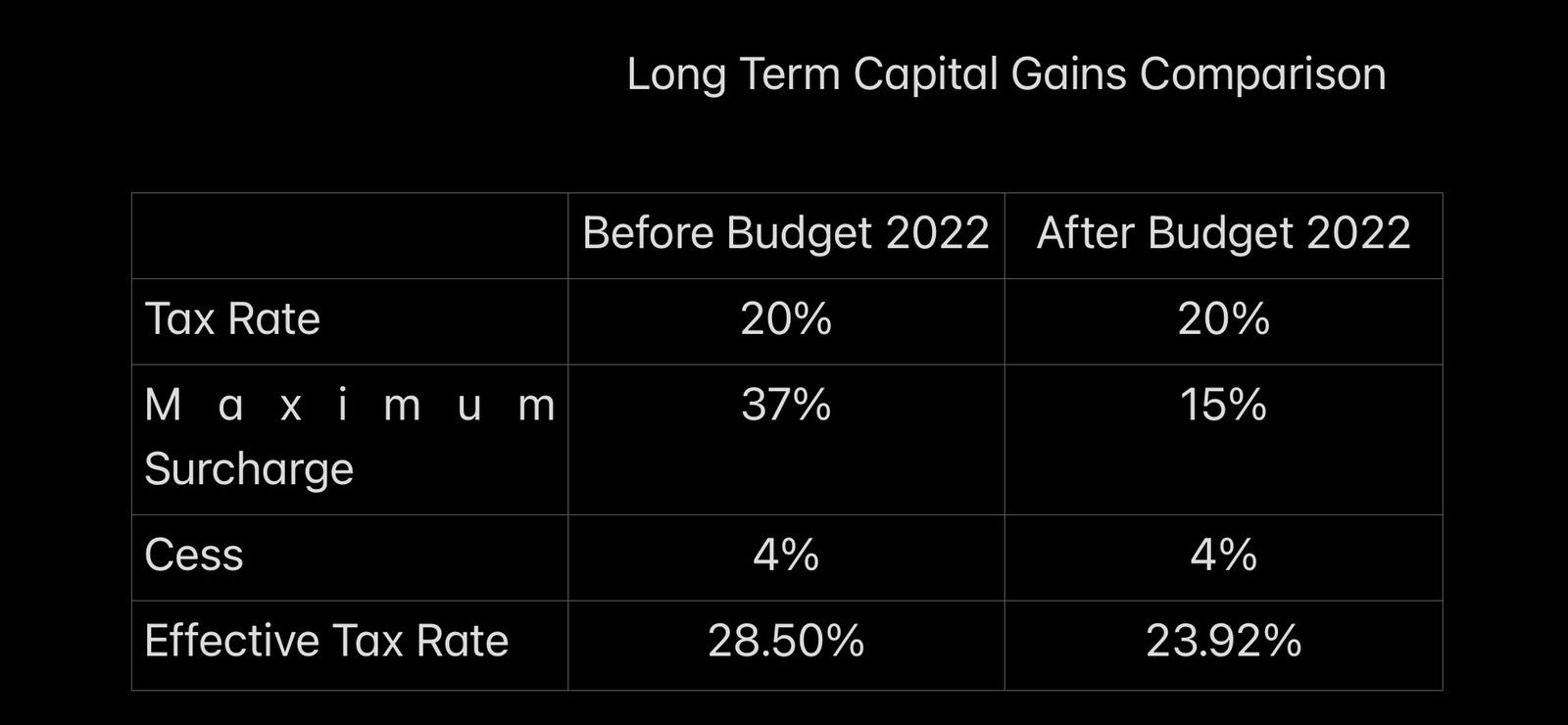

For starters, the proposal in the budget on bringing in a cap a surcharge on long term capital gains at 15 per cent will provide the parity for the startup vis-à-vis listed equity shares.

As the finance minister noted, “This step will give a boost to the startup community and along with my proposal on extending tax benefits to manufacturing companies and startups reaffirms our commitment to Atma Nirbhar Bharat.”

This proposal effectively brings down the effective tax rate to 23.92 per cent from the earlier level of 28.50 percent.

Gopal Srinivasan Chairman, TVS Capital Funds, said, “Most of the domestic money for the AIF Industry in India still comes from the large family offices where the rate of surcharge were at 37 percent, and that now stands reduced to 15 percent, the same as that of public markets. The will enhance the supply of investments into start-ups and the AIF industry.”

The Union Budget also laid out the roadmap on digital will play a key role in areas such as logistics, education, agriculture and even currency. These fit in very well with the aspirations of the startups engaged with these segments.

Siddarth Pai, Founding Partner, 3one4 Capital, says, “Budget 2022 is the Digital India Budget, which reinforces the government’s commitment to digital economy & digital infrastructure.”

The other positives for the startup ecosystem in the country have been the setting up of an investment committee to examine and suggest appropriate measures to scale up investments into this segment as the finance minister noted that venture and private equity invested more than Rs 5.5 lakh crore last year.

Amarjeet Singh, Partner, KPMG, said, “The new committee being appointed to look at regulatory and other challenges for PEs and VCs will increase the confidence of the community to look at India and its opportunities more favourably.”

The extension of the tax incentive for startups by one more year which was earlier applicable only to those established before March 2022 has now been extended till March 2023.

Also, the Union Budget has proposed that there will be the creation of thematic funds with a focus on segments like climate action, deep tech, digital economy, pharma and agri tech similar like NIIF and SIDBI Fund of Funds where the government share will be limited to 20 per cent and these being managed by private fund managers.

Vidit Aatrey, Founder and CEO, Meesho said, “We are happy about the government’s intent to continue supporting the new-age tech ecosystem by forward-looking initiatives such as the introduction of digital rupee, extending the existing tax benefits of startups by one more year and reduction of overlapping compliances which will improve the ease of doing business in India.”

At the same time, there were few misses for the startups in India as the Budget has remained silent on the topics such as bringing parity on taxation with respect to listed and unlisted securities, reducing the burden of ESOP taxation and no word on the move to allow direct listing overseas by Indian startups.

Welcoming the various proposals in the Union Budget which are expected to boost the startup ecosystem, Nimesh Kampani, Co-founder and CEO, trica, said, “The capping on LTCG gives some relief to those employees selling exercised options, but wider reforms are still needed."