There has been a lot of excitement both in the startup world and the share market since Zomato made a concrete announcement on its IPO timeline. This is the first of many IPOs to come from the new-age startups of India.

We've all been hearing about retail investors in the US participating in IPOs of startups like Airbnb and being part of the startup revolution in some way. But retail investors in India have been waiting a long time to get a piece of this action.

SEBI regulations were seen as favourable for startups and there was a lot of talk of major Indian startups looking to list in foreign stock exchanges. When SEBI made several changes to listing rules in March 2021, IPO talks of Indian startups gained momentum in mainstream business media and retail investors have been eagerly waiting for the IPO.

Given the fact that I practically live in the middle of the startup world, deal with startup founders and investors regularly and also having facilitated angel investments for many startups, I keep getting these questions from potential angel investors on what happens to their investments after they invest in a startup.

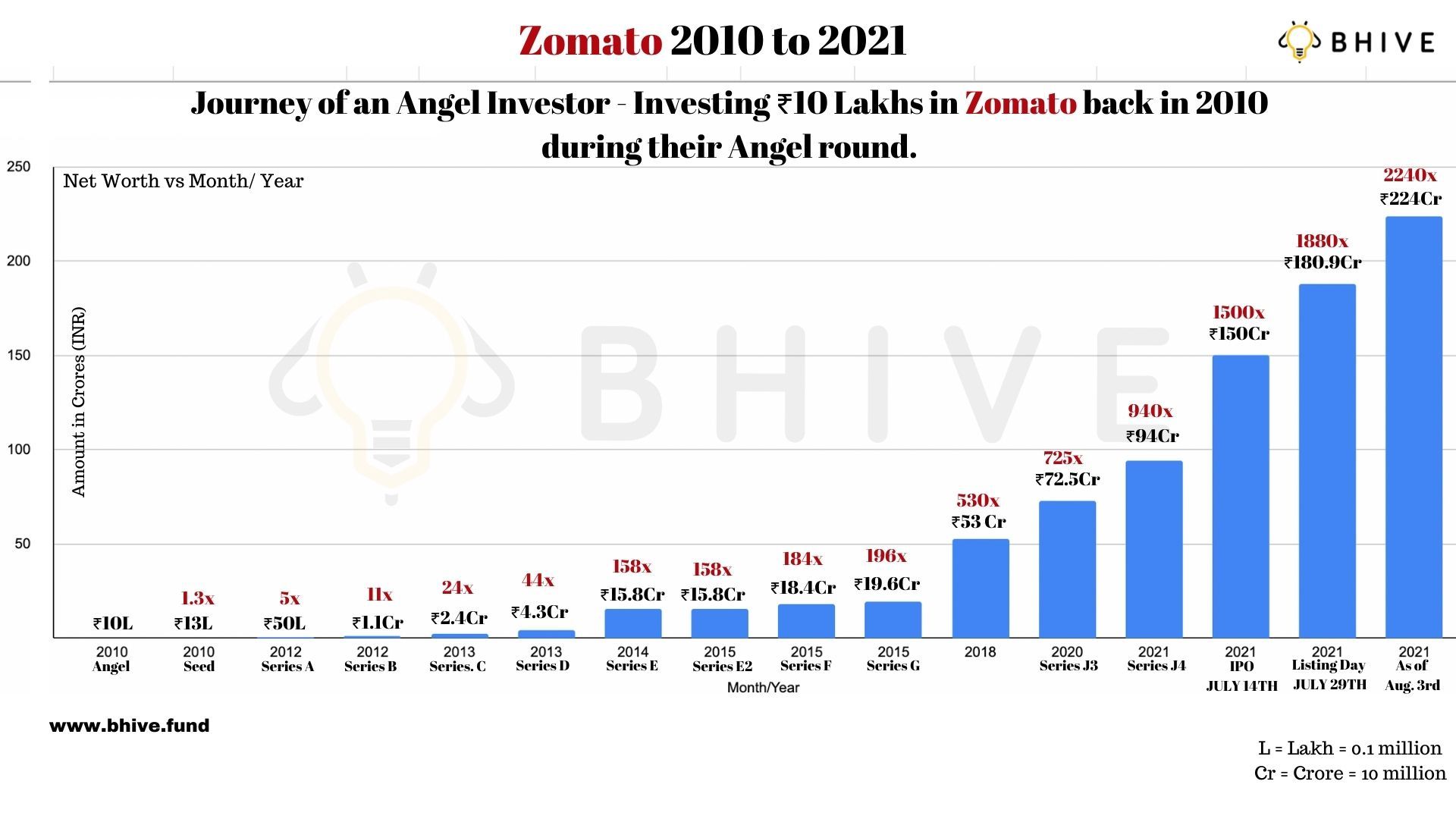

I had previously written about how angel investors, including myself and friends, had a good run by investing in LeadSquared. While startup investments can be highly risky and one can potentially lose their entire investment, in this article, I will focus on what would have happened if you were an angel investor who invested Rs 10 lakh into Zomato equity during their first angel funding round back in 2010. To make this easy to understand, let's follow the journey of a hypothetical angel investor Deepika Kapoor who participated in the first angel round and is still holding on to her equity.

Deepika’s angel investment

It's the year 2010. Deepika gets introduced to one of the co-founders of Zomato through a common friend who tells her that they have an interesting startup that is into aggregating restaurants. Being a foodie herself, she's able to instantly connect with the concept and feels that there is good potential for this startup. Moreover, she is impressed with the credentials of the founders and is sure that these guys will emerge as winners. While she understands that startup investments can be highly risky, she is willing to lose Rs 10 lakh in case things don’t turn out well for the startup. She decides to go ahead and invest in Zomato's funding round in July 2010. In return, Zomato allots Deepika equity and gets hee on to their captable.

Entry of Info Edge

To Deepika's surprise, Zomato does one more funding round in the same year, led by one of India’s most successful startups Info Edge, taking her stock price higher. Highly-driven founder Deepinder is able to get Zomato App developed at a fast pace for restaurant listing and rating, and the app gains worldwide popularity.

Series A round

Info Edge is convinced that they invested in a good startup and leads a Series A round of Rs 13.6 crore in February 2012. This gets the stock price soaring and Deepika’s net worth of Zomato stocks is now Rs 50 lakh which is an amazing five times in under two years!

Series B round

Info Edge goes more bullish and in the same year, invests in one more round, taking Deepika’s net worth in Zomato to Rs 1.11 crore which is an astonishing 11x in about two years.

Exit option for angels

Given that an institutional investor is in the mix, Deepika has been getting an option to exit in each of the funding rounds led by institutional investors. While some of the angels decide to exit after making a killer return in two years, Deepika decides to hold on to her shares, even though she gets tempted many times to at least make a partial exit and book some of her returns. She believes in the founders and the company and wants to stay on for the long run. After reading so many IPO stories in Silicon Valley, she hoped that Zomato would one day do its own IPO, giving her much larger returns than her current net worth.

Entry of a fund

Info Edge leads the Series C round as well, a fourth straight round that an institution is leading, which is not very common in the startup world. Now, Zomato funding reaches a new level with the entry of the Series D round in November 2013. Led by investor giant Sequoia Fund, it raises Rs 212 crore in this round. Deepika’s net worth is now Rs 4.4 crore which is 44 times the original investment in about three years.

Info Edge leads a large round

Zomato continues with more funding rounds. Info Edge decides to make a big investment of Rs 155 crore, leading a Series F of Rs 311 crore in April 2015. The market cap of Zomato now reaches Rs 5,000 crore, taking the net worth of Deepika to Rs 18.4 crore which is 184 times the original investment value in under five years! Zomato continues with one more large funding round in 2015, of Rs 388 crore led by Dunearn.

Entry into food delivery

At this stage, Zomato is well capitalised. It realises that its core offering of restaurants aggregation and discovery is not leading to the kind of revenue growth it was hoping to achieve. It decides to enter the food delivery space as it continues to explore multiple revenue streams. The food delivery business gets a major boost when it acquires Blume-backed company Runnr. It is interesting to note that now Zomato is primarily seen as a food delivery company by customers, whereas for the majority of its lifetime it was not even into food delivery!

Fundraising goes to a new level in 2018

In 2018, Zomato does three different rounds raising a total of Rs 2,638 crore, of which a total of Rs 2,500 crore came in from marquee Chinese company Ant Financial. This was a time when Chinese investors were betting big on Indian startups like PayTM, Big Basket, Byju’s, Hike, Swiggy, Ola, etc. By the end of 2018, the net worth of Deepika in Zomato has reached Rs 53 crore which is 530 times the original investment in about eight years!

Advanced funding rounds, acquisition of Uber Eats

Zomato continues with multiple funding rounds in 2019 and 2020. In January 2020, Zomato acquired UberEats and as part of the deal, Uber makes an investment of Rs 1,376 crore into Zomato. In August 2020, we see a mega funding round of Rs 4,580 crore led by Tiger Global. Although the capital raise now is big, the jump in the share price is no longer as big as it was in the initial years. During Series J3 in August 2020, the net worth of Deepika has reached Rs 72.54 crore.

Prepares for IPO in 2021

Zomato starts its 2021 funding with a J4 round in February. This round takes the net worth of Deepika to Rs 94 crore, which is 940 times the original investment amount in a little over 10 years from the investment date. At this stage, the share price of Zomato is Rs 58 in the private market. With SEBI making changes to listing rules in March, the IPO dream of Zomato finally looks to become a reality.

The IPO of Zomato

In April, Zomato files the draft red herring prospectus DHRP with SEBI which is a key step towards IPO. The process moves further and bankers set a price band of Rs 72 to Rs 76 for the share price for IPO. The IPO opens on July 14 and sees a stellar response from the market with the shares getting subscribed 38 times! At a share price of Rs 76, the net worth of Deepika has reached Rs 150 crore, which is 1,500 times the original investment value.

Post IPO on Dalal Street

Zomato gets listed on BSE and NSE on July 23, opening at Rs 116 which is a 53 percent premium from the final offer price of Rs 76. This makes the journey for an angel investor from angel investment to IPO a very successful one! At the listing price, the net worth of Deepika is at Rs 188 crore.

While writing the article, the share price of Zomato is at Rs 138, making the net worth of Deepika Rs 224 crore. This is a stellar 2,240 times the original investment value in about 11 years.

Link : https://yourstory.com/2021/08/zomato-angel-investor

Author :- Shesh Rao Paplikar ( )

August 09, 2021 at 02:31PM

YourStory