India may have finally moved past the tipping point in online gaming.

While the number of gamers had been growing steadily since 2016 riding on the 4G data revolution, the pandemic resulted in online gaming emerging as a mainstream entertainment option in the country.

In 2020, online gaming was the fastest-growing segment in India's media and entertainment (M&E) sector.

It competes with traditional forms of entertainment (like TV, radio, cinema) for the share of time spent on M&E consumption in a day, according to a report by KPMG.

“Gamechilling is something that has emerged over the last 12 months, as a direct consequence of the pandemic, resulting in the business of online gaming turning into a serious opportunity, and generating tremendous interest amongst corporates and investors alike,” stated the June 2021 report.

India went from having 250 million gamers in March 2018 to 433 million gamers in June 2020.

The online gaming growth story

Buoyed by a variety of factors like a dearth of recreational options in the lockdown, a tech-savvy young population, supply of high-quality games from local studios, growing 4G penetration, and expanding digital payment infrastructure, India went from having 250 million gamers in March 2018 to 433 million gamers in June 2020.

It is projected to have 657 million gamers by FY25.

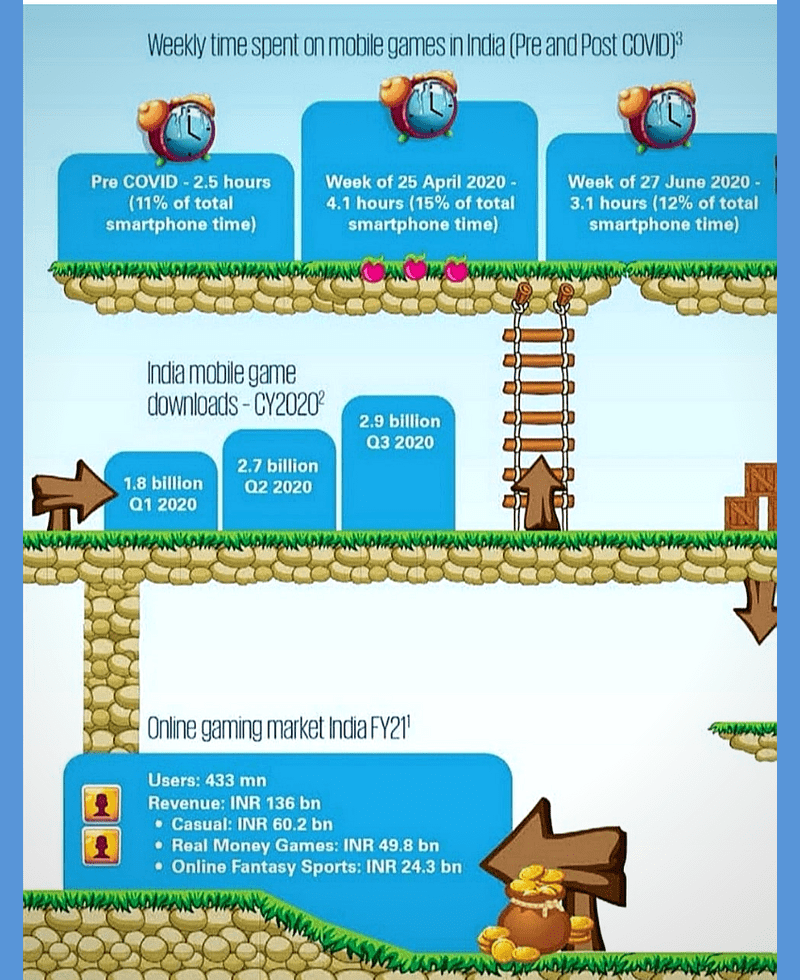

Weekly time spent on mobile games also went up from 2.5 hours (or 11 percent of screen time) pre-COVID-19 to 4.1 hours (or 15 percent of screen time) post the lockdown. MAUs for the top 100 mobile games are higher by 10-15 percent since March 2020.

Almost all other metrics, including game downloads, in-app purchases, conversion from DAUs to paid users, etc., are now “operating at a higher new normal as compared to the pre-lockdown time”, stated the report.

Satya Easwaran, Partner and Head of Technology, Media & Telecom, KPMG in India, said, “In the last five years, on account of the growth in digital infrastructure coupled with the availability of leading titles, India’s online gaming segment is now a serious business with the gaming market being overwhelmingly mobile first.”

Photo: KPMG India

The domestic online gaming sector was valued at Rs 136 billion in FY21 and is estimated to grow at a CAGR of 21 percent to Rs 290 billion by FY25.

Investor sentiment has picked up too. “We’ve been privy to the keen interest from corporates and investors who want to ride the wave of opportunity that the business of online casual gaming has to offer,” Satya added.

Between August 2020 and January 2021, the gaming sector saw capital inflows of $544 million. In contrast, between 2014 and 2020, Indian gaming startups drew total investments of just $350 million, according to Maple Capital Advisors.

The year also saw the launch of Lumikai, India’s first gaming-focused fund, which looks to unearth local winners like Ludo King.

“We are a micro VC dedicated to gaming, and are looking to turn on the capital to unlock a lot of innovation, creativity, and talent needed to build breakout successes,” Salone Sehgal, Co-founder and General Partner, Lumikai, told YourStory in an earlier interaction.

Increased funding also helped many local gaming companies achieve scale. Additionally, a surge in users and longer hours of engagement helped them reduce customer acquisition costs by 60-70 percent, improving operating margins.

Ludo King is India's most downloaded mobile game of all time

The meteoric rise of casual gaming

Casual gaming, particularly, has defined the sector so far.

India skipped a generation of gaming (PC and console-based games popular in developed markets like Japan, South Korea, US, UK) and took to mobile gaming because of significantly lower entry barriers in hardware and gaming titles.

In 2020, India saw the world’s second-highest casual gaming downloads (after China) at 7.3 billion (Q1-Q3 2020) or 17 percent of total mobile game downloads globally, according to Sensor Tower.

A whopping 420 million gamers in India play casual mobile games, and the segment was worth Rs 60 billion in FY21, accounting for 44 percent of total gaming revenues. It is poised to grow by 29 percent to Rs 169 billion by FY25.

Girish Menon, Partner and Head, Media and Entertainment, KPMG in India, explained,

“Online casual gaming saw its tipping point in 2020, with consumption and engagement at an all-time high. The growth potential of this sub-segment is immense, with improved monetisation helping the growth of the developer and publisher ecosystem, resulting in the likely emergence of players of scale.”

The growth of casual gaming was primarily led by Ludo King and Teen Patti, which were the only Indian gaming titles to appear on top of the app stores charts. “Ludo King [developed by Gametion Technologies] attracted a new demographic of players (45 years and older) that had been relatively lower, and turned gaming into a mainstream entertainment and a social media alternative” KPMG noted.

Add to that, most casual games added multiplayer features, chat functionality, leaderboards, and other social elements to spur group consumption and increase user engagement. Casual gaming ARPUs are projected to touch Rs 268 by FY25.

Teen Patti was one of the top games driving the growth of casual gaming

Homegrown studios and localisation

The increasing localisation of games and the emergence of homegrown studios on the global stage have added to the overall growth of online gaming in India.

There are the likes of Octro (which publishes Teen Patti and offers gamers the option to play in Hindi, Gujarati, Marathi, etc.), Gametion Technologies (which owns India’s most downloaded game Ludo King), Nazara Technologies (which launched its IPO in January and publishes popular titles like Chhota Bheem, Motu Patlu, etc.), Moonfrog (which got acquired by Sweden-based Stillfront), JioGames (which owns action games like WWE Mayhem, Real Steel Boxing Champions), and others.

Other notable homegrown studios include MindYourLogic Studios, which develops animated word and puzzle games in regional languages. Their most popular titles, Jigsaw Doors and Paheli, recorded over 2.5 million downloads.

There’s also nCore Games, which launched India’s first battle royale game FAU-G (an alternative to banned PUBG) and generated a lot of buzz. FAU-G’s localised storyline is based on the Galwan Valley clash between India and China.

Homegrown nCore Games released a desi PUBG alternative titled FAU-G

Adding the cherry on the cake was the $360 million buyout of PlaySimple by Swedish gaming giant MTG last week. “PlaySimple is a rapidly growing and highly profitable games studio that quickly has established itself as one of the leading global developers of free-to-play word games, an exciting new genre,” MTG’s Group President and CEO Maria Redin, said in a statement.

With increasing localisation of gaming, more and more Tier II and III markets are registering growth in active gamers.

An October 2020 report by Open Signal revealed that Ahmedabad was India’s top gaming market, and was one of the only two Tier I cities in the top 10 (the other was Mumbai). The rest included Tier II and III cities like Vadodara, Surat, Bhopal, Gwalior, Indore, and Rajkot.

“The success of gaming titles such as Ludo King and Teen Patti have shown that games which are localised and developed based on the local ethos of the target market, have the wherewithal to build a viable monetisation model,” as per KPMG.

Add to that, dedicated vernacular gaming platforms such as WinZO (where 80 percent of users play non-English games), Zupee, EWar Games, Bakbuck, etc. that have led to high traction from Bharat.

“Both consumer spends and advertising-based monetisation are likely to see strong traction, with India’s movement up the maturity curve and the supply of world class titles, the uptake of rewarded/incentivised ads and localisation of gaming titles being the key enablers,” Girish added.

Photo: Unsplash

Monetisation challenges remain

Despite the unbridled growth of gaming in the last 12 to 15 months, and the increasing seamlessness of digital payments, low monetisation ails the sector.

The Average Revenue Per Paying User (ARPPU) for online casual gaming in India was less than $2 in FY21, which is amongst the lowest in the world, and reflects poorly on a market that has the second largest base of casual gamers globally.

This is primarily due to the significantly lower penetration of gaming consoles, which have traditionally instilled a culture of paying for games in other markets.

“The segment is significantly under indexed on monetisation with lower ARPUs as compared to the gaming markets such as Indonesia, Malaysia and South Africa, which are comparable in terms of the per capita GDPs,” KPMG added.

However, game publishers are working around the problem, leading to the rise of ad-driven monetisation models. Nearly 54 percent of gamers choose rewarded ads — where they watch a video to progress — as their preferred mode to play.

Ad-driven monetisation drives gaming revenues in India

With an increasing share of time spent on gaming apps, marketers and advertisers are now looking at casual gaming as a viable channel to reach their target audiences. In fact, advertising accounted for 60 percent of casual gaming revenues in FY21.

“The dependence on advertising as a means of monetisation remains unique to India, and is not likely to go away in the near to medium term as free to play games dominate consumption,” the report explained.

Meanwhile, in-app purchases (IAPs) accounted for 40 percent or Rs 24 billion of casual gaming revenues in FY21.

However, this mode of monetisation is said to be growing at a CAGR of 30 percent, and will cross Rs 70 billion by FY25 on the back of the increasing number of mid-core titles on mobile. Gamers typically make IAPs to unlock milestones, new levels, badges, and other premium features.

Future trends: esports and cloud gaming

Over the next five years, esports is expected to grow rapidly due to rising interest from sponsorship and publishers, and the entry of new players across the value chain ranging from event organisers to participating teams.

In March, Reliance Jio and MediaTek conducted a 70-day esports tournament titled Gaming Masters, which saw 43,000+ teams vying for a prize pool of Rs 12.5 lakh.

Photo: Unsplash

There were approximately 10-15 million esports viewers in India in FY20, which is expected to grow more than 10X to 130 million viewers by FY25. The segment was worth Rs 1.7 billion in FY21 and is likely to reach Rs 5.7 billion by FY25.

Esports has also been officially recognised by the Indian Olympic Association, as well as added as a medal event in the 2022 Asian Games. This is expected to bring about strong growth across the esports value chain in the country.

With 5G technology becoming mainstream over the next few years, India is also likely to see a cloud gaming revolution, especially due to its limited capacity to invest in hardware.

“The launch of 5G from a commercial consumer standpoint can be the inflexion point for adoption of cloud gaming,” as per the report.

Cloud gaming could also lead to the rise of subscription-led monetisation models. Local cloud gaming services like The Gaming Project, Doofy, and Vortex have already launched subscription offerings ranging from unlimited day passes to yearly plans.

KPMG’s Girish sums up by saying, “With technologies such as cloud gaming on the anvil, we envisage the online gaming segment to be amongst the largest segments of the M&E industry in India in the years to come, garnering a share of both the time and the wallet of the Indian digital billion.”

Edited by Teja Lele Desai and Saheli Sen Gupta

Link : https://yourstory.com/2021/07/online-gaming-mainstream-india-ludo-king-play-win

Author :- Sohini Mitter ( )

July 08, 2021 at 05:55AM

YourStory