And the countdown begins… especially if you’ve heard and have been tracking the projections for the number of unicorns that will emerge from the Indian startup ecosystem.

Six months into 2021, the Indian startup ecosystem has already added 15 new companies to the coveted $1 billion valuation club. The country is already cheering in its new unicorns — Digit Insurance (insurtech), InnovAccer (healthtech), Five Star Business Finance (NBFC), Meesho (social commerce), Infra.Market (B2B ecommerce), CRED (fintech), Pharmeasy (healthtech), Groww (fintech), Gupshup (conversational messaging), Mohalla Tech (parent company of social platforms ShareChat and Moj), Chargebee (SaaS), Urban Company (home services marketplace), Moglix (B2B commerce), Zeta (fintech), and the latest - BrowserStack (SaaS).

Heading into 2021, research firms and industry experts had predicted that India will see a significant increase in the number of unicorns. An earlier NASSCOM report had stated that India will have 50 unicorns before 2021 ends, but we have already surpassed that number.

In 2020, even with a pandemic wreaking havoc on the economy, 11 startups from India attained unicorn status while PhonePe reached a $5.5 billion valuation as an independent entity after its spin-off from Flipkart. Already, India’s unicorn club boasts startups like fintech majors Paytm and Zerodha, mobility player Ola, foodtech startups such as Zomato, and Glance, Cars24, Postman, among others.

Nevertheless, these new unicorns have boosted hopes higher for the ecosystem. Let’s have a look at the 15 unicorns of 2021.

Digit Insurance

Bengaluru-based startup Digit Insurance is the brainchild of Kamesh Goyal. The platform leverages technology to simplify the process of buying general insurance with services like smartphone-enabled self-inspection and audio claims.

Valued at $1.9 billion, Digit Insurance is the first Indian startup in 2021 to enter the much-coveted and tracked unicorn club. Although the fundraising amount was not disclosed, a few media reports suggest the funding took place in two tranches of $84 million and $18.5 million. A91 Partners, Faering Capital, and TVS Capital Funds participated in this round of funding.

Since its inception in 2016, Digit Insurance has so far raised a total of $244.5 million. It claims to be a profitable venture, having seen profits in all three-quarters of FY21. Also, it grew 31.9 percent between April and December of 2020, earning a premium of $186 million. It claims to have a customer base of 1.5 crores.

A few key milestones achieved by the company in its journey so far are:

- January 2021: Raised $84 million / Series Unknown

- August 2020: Launched an online DIY insurance advisory tool for SMEs

- February 2020: Actor Anushka Sharma and Indian cricketer Virat Kohli join investor consortium

- November 2019: Named Asia's Best General Insurance Company of the Year

- June 2019: Raised $50 million / Series Unknown

- July 2018: Raised $45 million / Series Unknown

- July 2018: Acquired ITI Reinsurance Ltd. for $72.8 million

- June 2017: Raised $47 million / Series Unknown

Innovaccer

Founded in 2014 by Sandeep Gupta, Abhinav Shashank, and Kanav Hasija, this YourStory 2015 Tech30 company is valued at $1.3 billion after its latest funding round led by Tiger Global Management.

Existing investors Steadview Capital, Dragoneer, B Capital Group, Mubadala Capital, and M12 (Microsoft's Venture Fund) participated in the round, along with new investor OMERS Growth Equity.

Although the amount of funding remained undisclosed, it is estimated to be around $105 million. Prior to this, the startup had raised $70 million as part of its Series C round in February this year.

Since its inception in 2014, the company has raised around $229.1 million.

A few key milestones achieved by Innovaccer in its journey so far are:

- February 2021: Raised $105 million / Series D

- February 2021: Earns NCQA PHM Prevalidation

- October 2020: Launched Risk Adjustment Solution for Improved Coding Accuracy

- February 2020: Raised $70 million/ Series C

- June 2019: Awarded as the "Best Healthcare Big Data Platform" in 2019 MedTech Breakthrough Awards

- February 2019: Launched Its AI-Based Data Activation Platform at HIMSS19

- January 2019: Raised $11 million/ Series B

- May 2018: Raised $25 million/ Series B

- July 2016: Raised $15.6 million/ Series A

- October 2015: Recognised among 30 most disruptive Indian startups in YourStory's Tech30 list

- May 2015: Raised $2.5 million/ Seed

Five Star Business Finance

Image Credit: Ahamed.

Five Star Business Finance, a lender to small businesses, raised $234 million for a valuation of $1.4 billion. The round was led by existing investors Sequoia Capital India, with participation from Norwest Venture Partners, as well as new investors, led by KKR with participation from TVS Capital.

The investment will be made through a combination of primary infusion in the company and secondary shares sold by existing investor Morgan Stanley Private Equity. The company’s other existing — Matrix Partners and TPG Capital — continue to stay invested.

The lender plans to use the capital to expand its lending business to provide much-needed financing solutions to more of India’s small businesses, which comprise a large and growing segment of the country’s economy.

Five Star Business Finance has its presence in 262 branches spread across eight states of India in the southern and central part of the country. As of December 31, 2020, the company’s AUM stood at Rs 4,030 crore, and its GNPA stood at 1.29 percent.

Meesho

Vidit Aatrey, Founder and CEO, Meesho

The social commerce platform Meesho joined the unicorn club earlier this week with its fund-raise of $300 million in a new round, led by SoftBank Vision Fund 2. The company is now valued at $2.1 billion.

The round also saw participation from existing investors Prosus Ventures, Facebook, Shunwei Capital, Venture Highway, and Knollwood Investment. With this funding, the startup plans to build a single digital ecosystem for 100 million small businesses.

The small businesses Meesho is targeting include individual businesses owned and run by women entrepreneurs and homepreneurs, who have become financially independent and successful over the years through Meesho and have carved out their own identities.

Infra.Market

The B2B commerce company Infra.Market raised $100 million Series C funding led by Tiger Global. Existing investors Nexus Venture Partners, Accel Partners, Sistema Asia Fund, Evolvence India Fund, and Fundamental Capital GmbH participated in this round of funding. The current fundraise takes Infra.Market's valuation to $1 billion.

Founded by Souvik Sengupta and Aaditya Sharda in 2016, Infra.Market is a procurement marketplace that leverages technology to provide an enhanced procurement experience for all players in the construction ecosystem.

The company is targeting the $140 billion construction materials market with a strong focus on the infrastructure sector.

CRED

CRED, the Bengaluru-headquartered fintech startup founded by Kunal Shah, has turned into a unicorn following the closure of its Series D funding at $215 million, with a post-money valuation of $2.2 billion.

CRED had last announced its Series C funding round of $86 million in January 2020, with a valuation of $800 million.

Now, with this latest round of funding, the fintech startup has closed to tripled its valuation. The Series D round was led by a new investor — Falcon Edge Capital — along with existing investor Coatue Management. It also said Insight Partners joins its cap table.

PharmEasy

As a digital healthcare platform PharmEasy connects over 60,000 brick and mortar pharmacies and 4,000 doctors in 16,000 zip codes across India. It digitises the entire supply chain to provide easy access for pharmacies to procure the products.

PharmEasy also provide SaaS solutions for pharmacies to use in procurement combined with delivery and logistics support, and credit solutions to buy over 200,000 medicines from over 3,000 pharmaceutical manufacturers.

The company raised $350 million in a Series E round led by Prosus Ventures and TPG growth at a reported valuation of $1.5 billion, making it the seventh startup from India to enter the unicorn club this year.

Groww

Online trading platform Groww was founded in 2017 by four former Flipkart executives — Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal. At present, Groww has over 1.5 crore users. Over 20 lakh new demat accounts were opened on its platform since June 2020.

The startup entered the unicorn club with its recent Series D round where it raised $83 million led by Tiger Global. Existing investors such as Sequoia India, YC Continuity, Ribbit Capital, and Propel Venture Partners participated in the round as well.

Groww focusses on simplicity and transparency, and has been designed as an adviser or ‘buddy.’ Its platform is powered by intelligent UI and UX. The startup offers paperless investing options, letting customers buy and sell mutual funds online.

The startup uses technology like image processing, which uses machine learning models. This helps automate manual workflows, reduce error, and increase user ease throughout the journey.

Gupshup

Gupshup, the Silicon Valley-headquartered conversational messaging tech startup, is co-founded by IIT-Bombay alumni Beerud Sheth. Gupshup’s mission is to build the tools that help businesses better engage customers through mobile messaging and conversational experiences.

It raised $100 million in funding from Tiger Global at a valuation of $1.4 billion, and entered the growing unicorn club.

According to Gupshup, its API enables over 100,000 developers and businesses to build messaging and conversational experiences, delivering over six billion messages per month across 30-plus messaging channels.

ShareChat

ShareChat — the Indian language social media platform's parent company Mohalla Tech, which also houses short video app Moj — on Thursday said it raised $502 million in its latest round led by Lightspeed Ventures and Tiger Global, along with participation from Snap Inc, Twitter, and India Quotient, among others. With this round, the Indic language social media startup has now become a unicorn, valued at $2.1 billion.

ShareChat will use the fresh funds to grow its user base and build a world-class organisation. It is also looking to strengthen its creator community, AI-powered recommendation engine, and platform health.

Chargebee

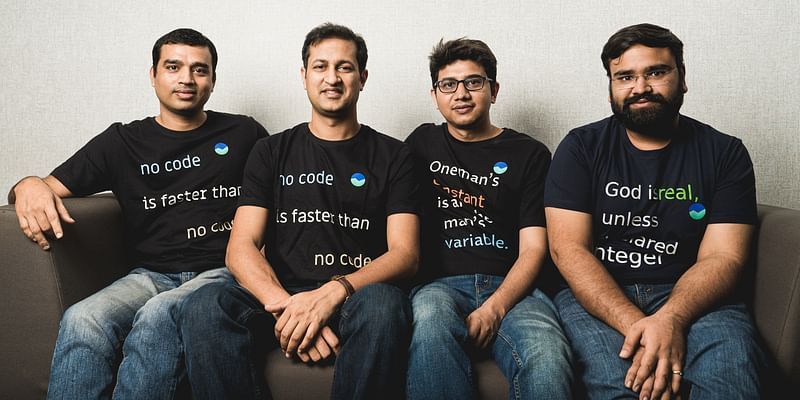

Rajaraman Santhanam, KP Saravanan, Thiyagarajan Thiyagu and Krish Subramanian, Co-Founders, Chargebee [Image Credit: Chargebee Website]

Founded in 2011 by four friends — Rajaraman Santhanam, Thiyagarajan Thiyagu, Saravanan KP(CTO), Krish Subramaniam (CEO) — Chargebee’s product automates complex billing and revenue operation challenges that arise as subscription businesses scale into large enterprises and also provides key reports, metrics, and insights into the subscription business.

San Francisco-based SaaS startup Chargebee has recently raised $125 million in series G funding, co-led by new investor Sapphire Ventures, and existing investors Tiger Global and Insight Venture Partners, along with participation from another existing investor, Steadview Capital.

Chargebee is now valued at $1.4 billion, which triples its valuation in less than six months.

The company recently brought out enterprise-class capabilities like usage-based billing and a dedicated data centre for Europe.

Urban Company

Urban Company co-founders (from left to right): Abhiraj, Raghav, and Varun

Urban Company, the home services marketplace startup, raised $188 million in its latest funding round led by Prosus. The latest fundraise by Urban Company also saw the participation of two new investors – DF International and Wellington Management. The startup is now valued at around $2 billion, according to reports.

According to the Registrar of Companies (RoC), Urban Company issued 2,613 equity shares and 50,490 compulsory convertible preference shares (CCPS). This latest round of capital infusion takes Urban Company into the coveted unicorn club as it was last valued at around $933 million during its funding round in 2019.

Formerly known as UrbanClap, Urban Company is backed by marquee investors such Tiger Global, Accel, and Elevation Capital (formerly known as SAIF Partners), among others. Ratan Tata and Kalyan Krishnamurthy are among the leading angel investors.

Urban Company's latest funding round saw the collective stake of its three co-founders — Abhiraj Singh Bhal, Varun Khaitan, and Raghav Chandra diluted to 24.66 percent.

Moglix

Moglix Team

, a Noida-based B2B industrial goods ecommerce marketplace, on Monday announced that it has raised $120 million in Series E round led by Falcon Edge Capital and Harvard Management Company (HMC). Existing investors including Tiger Global, Sequoia Capital India and Venture Highway also participated in this round.

With this round, Moglix becomes the first industrial B2B commerce platform in the manufacturing space to become a unicorn.

This latest round of funding takes the total funds raised by Moglix to $220 million.

Leaders from the startup and manufacturing communities such as Kalyan Krishnamurthy, CEO Flipkart, Vikrampati Singhania, MD, JK Fenner and Shailesh Rao, ex-Google, have been investors in Moglix.

Founded in 2015 by IIT Kanpur and ISB alumnus Rahul Garg, Moglix aims to digitally transform the supply chain of the manufacturing sector in India. It provides solutions to more than 500,000 SMEs and 3,000 manufacturing plants across India, Singapore, the UK and the UAE.

Zeta

, a banking tech startup, has become the latest unicorn after raising $250 million in a Series C funding round from Softbank Vision Fund 2 at a valuation of $1.45 billion.

Sodexo, a France-headquartered food service company, also participated as an additional minority investor in the round, with Avendus Capital acting as the financial advisor.

Founded in 2015 by Bhavin Turakhia and Ramki Gaddipati, the banking startup works with over 25 fintech firms and 10 banks, including HDFC Bank, Kotak Mahindra Bank, IndusInd Bank, Yes Bank, RBL Bank, and Axis Bank.

Zeta has close to 750 employees, with offices across the United States, Asia, United Kingdom, and West Asia.

BrowserStack

Homegrown SaaS startup has secured $200 million in Series B funding at a $4 billion valuation, making it India's 15th unicorn of 2021. It also becomes the year's second SaaS unicorn after Chargebee, which achieved the feat in April.

The funding round was led by BOND, with participation from Insight Partners and existing investor Accel, which had invested $50 million in a Series A round in 2018.

BrowserStack, which Ritesh co-founded with Nakul Aggarwal in 2011, has been a category leader in software testing on the cloud and counts over 50,000 customers and more than 4 million developer signups. It caters to giant corporations such as Microsoft, Twitter, Barclays, Expedia, and several others, powering over two million tests across its 15 global data centres every day.

The startup plans to use the capital to make strategic acquisitions, expand product offerings for developers, and ramp up scale across the globe to fulfil its vision of becoming the "testing infrastructure for the internet".

Road Ahead

Going forward, an October 2020 report by TiE-Delhi and research firm Zinnov predicted that India will have 100 unicorns by 2025, despite the impact of COVID-19.

In 2020, a key trend showcased by Indian unicorns is the continuous fall in the average age of attaining unicorn status. Going further in 2021, Indian startups are expected to continue to demonstrate this trend.

The potential soonicorns poised to turn unicorn in 2021 include agritech startup CropIn, logistics company BlackBuck, auto-tech startup CarDekho, and edtech startup Vedantu, among others.

(Written by Meha Agarwal, with inputs from Sindhu Kashyap, Sohini Mitter, Thimmaya Poojary, Aparajita Saxena, Trisha Medha, and Prasannata Patwa)

Edited by Tenzin Pema and Saheli Sen Gupta

Link : https://yourstory.com/2021/04/2021-unicorns-indian-startups-innovaccer-digit-insurance

Author :- Team YS ( )

June 17, 2021 at 11:52AM

YourStory