When Harvard Business School alum Varun Mohan returned to New Delhi, he decided to invest in an asset class that would give him good cash flow, and was physical in nature. He spent three months evaluating opportunities in and around New Delhi, but found it very hard to buy a piece of an investment-grade asset.

As he continued his search, and while surveying for such an opportunity at DLF Cyber City in Gurugram, he wondered what people working in those office buildings would feel like if they were given a chance to own a piece of the space they worked in.

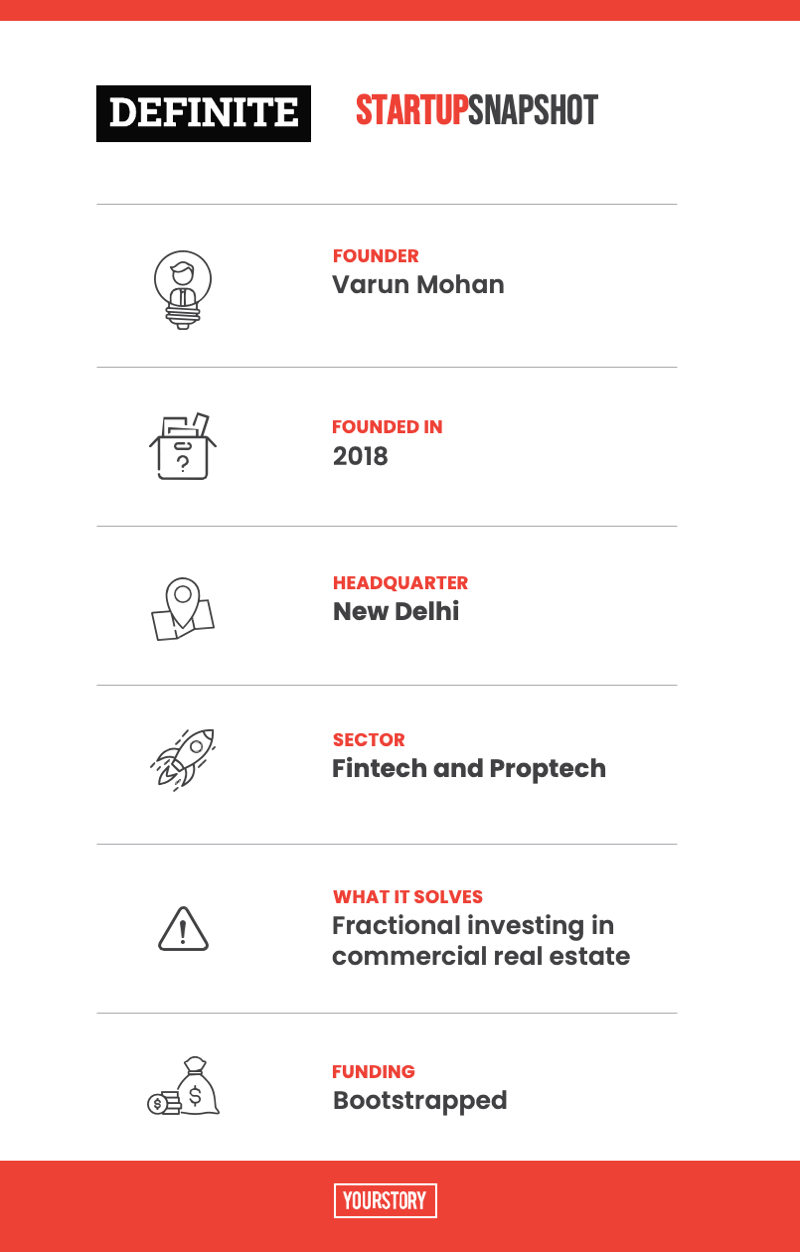

This is how the idea of building a platform to offer fractional investing in premium commercial real estate hit him, and Definite was born.

Fractional investing is neither a new nor a novel idea ever since companies like Strata, hBits, Pyse, and Frxnl came into being, offering investment opportunities in commercial and residential real estate, as well as sustainability projects.

In fact, the fractional ownership concept isn’t novel itself either. Earlier, people (high net-worth investors) used to buy timeshare properties, jet planes, luxury cars, and yachts for themselves, or to rent out, and would take a cut of the returns those assets generated in proportion to their investments.

Fintech and investing platforms such as hBits, Strata, and Frxnl allow investors to invest in real estate too, and they’ve already funded several projects already.

Definite says it’s different because it offers ownership in premium commercial real estate, where tenants are mostly multi-national corporations that have the financial discipline and are more likely to lease spaces out for a longer term.

“We enable retail investors to become part owners in premium institutional-grade assets that offer around 9 to 12 percent in yields. These assets can be anything — from office spaces and warehousing to data centres,” Varun tells YourStory.

“With Definite, I wanted to create a product, which could help people to own assets other than traditional residential real estate and create a portfolio where they can own yield generating, institutional-grade assets, and create financial futures for themselves,” he adds.

Investment opportunities on Definite start at Rs 25 lakh, and is mostly targeted at people in the 35 to 60 years age bracket. Indian HNIs, UHNIs, NRI, family offices, and institutional funds are the Delhi-headquartered startup’s intended audience.

Features and future

Getting set up on the platform is easy, and is done completely online.

Investors interested in a project can access details of the listings — the valuation report, title report, financial model, and lease terms — online, and initiate the purchase process on the same platform. Once the investment is completed, and funding for the project closes, investors will start receiving their yields and rents on a monthly basis.

For exiting the investment, Definite provides three options:

- Secondary market: Managed by the company, this option allows investors to sell their ownerships in secondary sales

- Private sale: Investors can sell their shares to anybody, privately.

- Final asset exit: Fractional owners can sell their share and receive the proportional share of the exit price, which could include any returns on investment or capital appreciation.

The startup is set to launch a feature by the end of the year where it guarantees exits within 15 minutes when needed — an option that could help people access their capital in cases of emergency.

So far, the startup has listed one project for which it has received a 30 percent commitment. It has 1,200 registered investors on the platform, and expects to add up to 10,000 active investors over the coming quarters.

It earns it money from a one-time asset acquisition fee, which ranges between 1 to 3 percent, and charges an annual maintenance fee for accounts, reports and compliances. A performance fee, beyond a pre-fixed hurdle rate, shared with investors on the platform participating in an opportunity, is also charged.

Definite recently announced plans to raise Rs 15 crore from private investors for a property in Magarpatta City, Pune, which has a prominent tenant.

By the end of 2021, the bootstrapped startup aims to list assets worth Rs 500 crore.

Fractional real-estate ownership is already a $5 billion market in India, and is slated to grow in the coming years.

The idea of fractional ownership has already seen considerable success in the US and Singapore, and could become a dominant investment trend in India over the next three to four years.

Edited by Saheli Sen Gupta

Link : https://yourstory.com/2021/06/fintech-proptech-startup-definite-fractional-investing-commercial-real-estate-harvard

Author :- Aparajita Saxena ( )

June 30, 2021 at 07:20AM

YourStory