I’ve been having a few debates with a few friends on the never-ending enigma of the entrepreneurship world — What makes a startup VC fundable?

How does one big a big company in a predictable manner?

Regardless of whether a startup is “fundable by VC’s or not,” I always believe the real investors in a startup are YOU, the founders! So, how do you decide as a founder of this startup is worth investing your time and weighing it against the opportunity cost of your investment in a different startup?

Clearly, while there is an emotional aspect of addressing a problem you feel passionately about and feel confident of doing a better job than most, it's also crucial to make sure the several years of toil and sacrifices could result in a worthwhile outcome.

Representational Image

From a pure venture capitalists perspective, it is important to understand that most VC’s also raise external capital — VC’s are not investing their own capital and rather are investing money from Limited Partners —often endowments, trusts, foundations, fund of funds, governments, pension funds, and HNI’s.

In other words, all VC’s you meet are doing a job of growing the capital people who have trusted them with a finite period of time (in most cases 10-12 years).

As such for any VC, the time frame within which your company can get to a certain scale and be in a position for VCs to get an exit from will play a key role in determining the 'venture fundability' of your business.

Contrary to what might seem fashionable in various forms of (social) media, VCs do not expect companies to become huge just by raising follow-on rounds at higher valuations. We are most interested in knowing "can we build a solid company here with good fundamentals, revenues, and profitability," thereby justifying a higher valuation and a good return on investment for all.

And companies that do provide such opportunities are strong candidates for VC investment. Again, not saying others are not, but in somewhat predictable businesses, it becomes a lot easier.

So what are some rules of thumb for founders to follow? Here is one exercise we give founders — even if it's early in their journey.

What’s the path to 1-10-25-100 million dollars of revenue?

Why do we ask this question? Because we want to see the following:

- Can the founders even visualise making $25-100 million in the future?

- Does the company simply need a single product with more bells and whistles or does it need to expand to adjacencies?

- Is geographic expansion a requirement? Are there true adjacencies?

- Will we be forced to take on established incumbents? Who are these?

Most importantly, “When do non-linearities kick in?" These could be in CAC, expansion revenue, upsell revenue, etc.

Last but not least, we want to know the answer to two critical questions:

- How much investment will the company need to get there?

- What percentage of the market do we need to win - assuming we do get there?

So let’s examine the ramifications of these with simple arithmetic and logic.

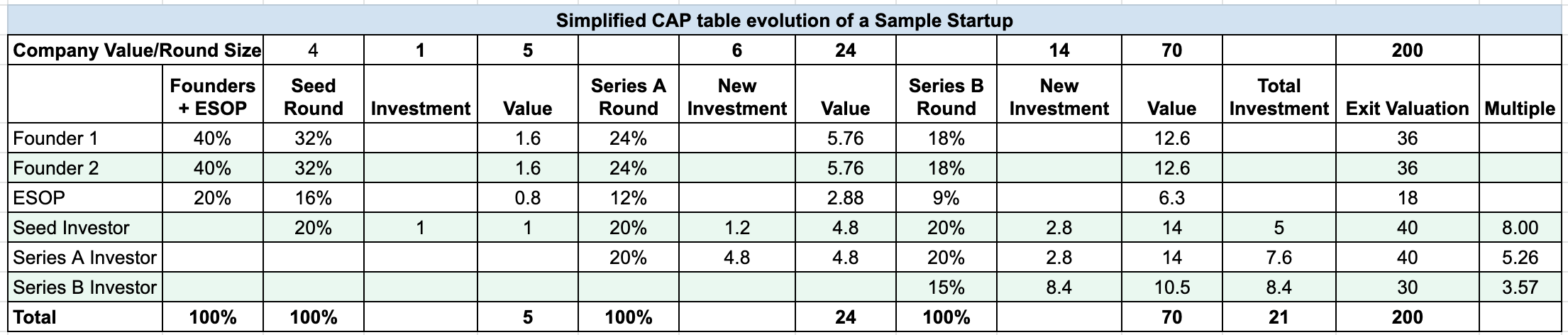

Assume that the company raises a seed round of $1 million at an about $5 million valuation, a Series A of $6 million at a $24 million valuation, and a Series B of $14 million at a $70 million valuation. Of course, one can model other numbers, but these are realistic median numbers, even for POSITIVE outcomes.

A Simplified CAP table evolution - not counting any ESOP top-ups, etc. - is shown here. Note that such an evolution of a CAP table rarely happens - it's often messier but intended to be indicative to make the uber point - that a large outcome is the only one that matters. [Image Credit: Sanjay Swamy, Managing Partner at Prime Venture Partners]

The multiples of Return on Investments shown in the last column are about what any VC would expect in the case of any investment. This doesn’t make a startup automatically venture fundable, but it sure is a good rule of thumb for you as a founder to present a plan to a VC, especially in B2B/SaaS startups.

Can you get to $25 million in revenue, profitability, and growth at 2-3x year-over-year with about $20 million or less invested?

Lastly, so what - once you get there, is there enough headroom to continue to grow — at least at 50-100 percent Y-O-Y — in a predictable manner. Companies that last are attractive if they can get to IPO-scale, not necessarily with torrid growth but with predictable and solid growth. This means that such companies may list on a public market, or maybe attractive enough to be acquired for a few hundred million dollars. And, in both cases, the reason will be that they are still only at a small percentage of the market.

In other words, the Total Addressable Market is a second and equally critical factor in determining the value of your startup in addition to the scale you have achieved. In many cases, TAM will determine the value of your startup a lot more than just the current scale. It's also important to understand that large TAM’s attract competition and other investment — that’s usually a good thing, especially if you are the first mover and category creator.

Not having a huge TAM or potential for strong growth doesn’t mean you don’t have a good business. I personally know a friend whose two-person SaaS startup is making multiple millions of dollars in a year. However, the smart thing they did was not to raise VC funding because they knew all along it wasn't going to scale beyond a point.

The bottom line for VC funding is simple — if you can’t get to scale ($25-100 million) with a reasonable investment and timeframe, with ample room for future growth, in my opinion, your startup isn’t VC fundable — though it may be a perfectly good startup.

That doesn't mean that every startup that gets to $25 million is fundable, nor does it mean that getting to $25 million is the 'Holy Grail' of startups — far from it. Nor does it mean you should only raise $20 million.

It's just a good rule of thumb — the amount of funding, the time taken to get to $25 million, and the exit rate of growth should help you triangulate and come to your own conclusion.

When you are addressing large problems, strangely the world conspires to help you and people go out of their way, but nobody steps up to help you if you are aiming for something small.

The early years are difficult in all cases, but employee enthusiasm, investor interest, and several other things come together and things "Snowball into Snowflakes."

As I've always advised founders, "It's easier to build a BIG Company than a Small One!"

Also, from a founders’ point of view is the opportunity cost. Given the effort and time commitment, it will take, I implore founders to aim to solve big problems with huge outcomes because, at the end of the day, YOLO-baby — You Only Live Once — make the most of it!

[The article first appeared on LinkedIn]

Edited by Suman Singh

Link : https://yourstory.com/2021/06/prime-ventures-partners-sanjay-swamy-startup-vc-funding

Author :- Sanjay Swamy ( )

June 20, 2021 at 05:55AM

YourStory