This year has been an unprecedented one for Indian startups. It won’t be an exaggeration to say that the last 10 to 11 months have wiped the slate clean for the entire ecosystem. From consumer sentiments to expansion strategies, the pandemic has reset everything.

But if history teaches us anything, it’s that opportunities present themselves only in adverse times. As Ratan Tata, Chairman Emeritus of Tata Group stated to the media earlier,

“In past difficult times, entrepreneurs have displayed farsightedness and creativity that could not have been believed to exist. These became the flagpoles of innovation and new technology today.”

Ratan Tata’s words have rung true as India continues to face the battle against COVID-19. Despite the funding slowdown and a fall in the number of funding deals, the ecosystem saw the emergence of many new sectors, absorption of new technologies, and paved the way for a collaborative global future.

The opportunities presented during the pandemic and in the ensuing lockdown come at the back of initiatives like Startup India, Stand up India, and Make in India — showing how much the Indian startup ecosystem has evolved since when the startup boom began in 2015.

As we draw near to the end of 2020, let's take a look back at how the startup ecosystem fared in the year of The Great Lockdown, and how deep the impact has been.

Indian startup ecosystem: Key observations

Funding insights: Year-on-year comparison

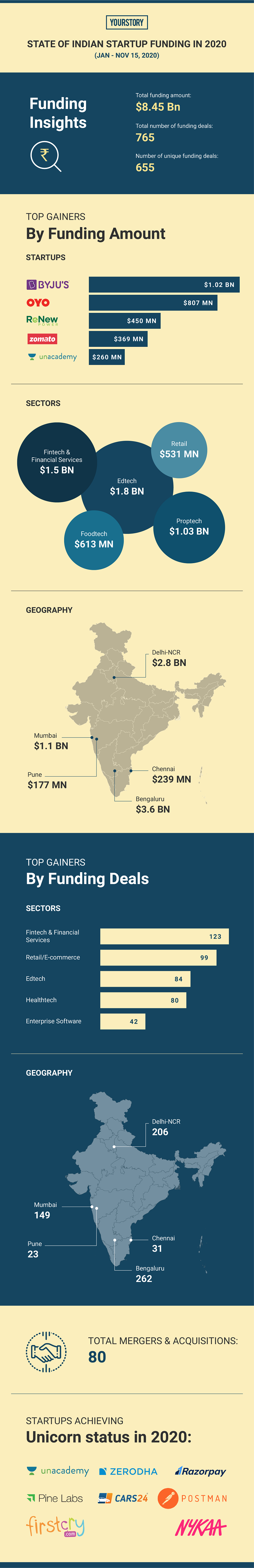

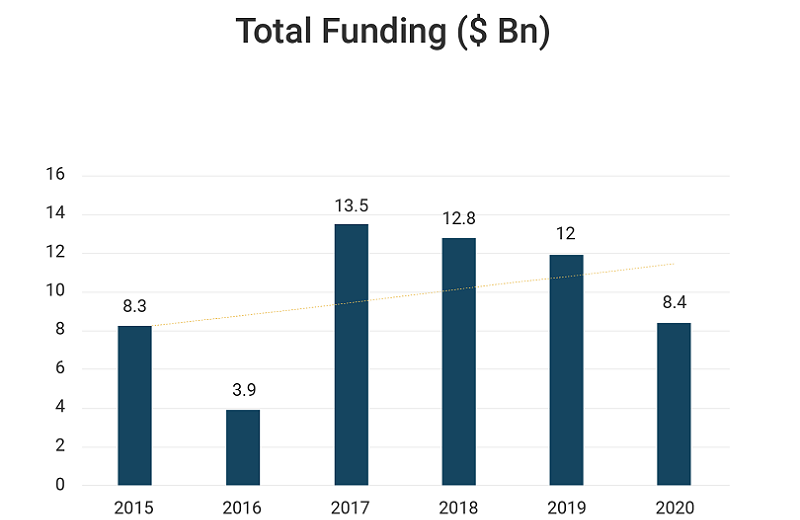

Indian startups gained a total disclosed funding of $8.4 billion between January 2020 and mid-November 2020. This was a 30 percent decline as compared to the funding gained by startups in 2019, and is almost equivalent to the funding amount raised in 2015.

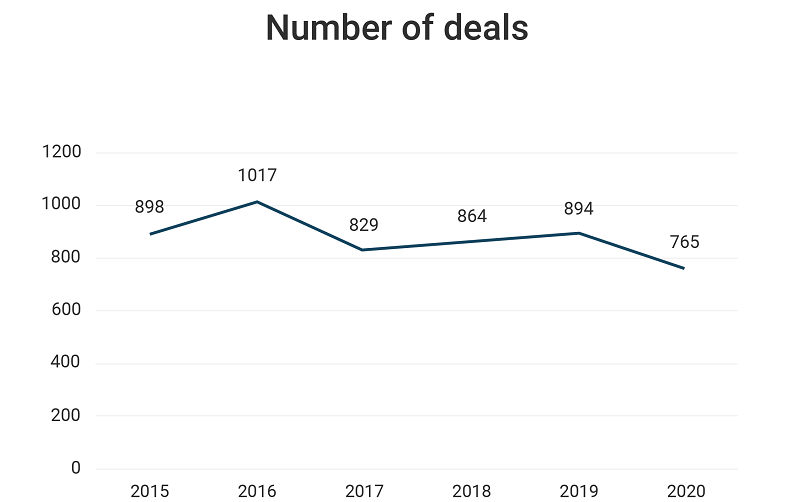

In terms of the number of deals, Indian startups registered a total of 765 deals in the period between January 2020 and November 15, 2020. This is a 14.5 percent decline as compared to the previous year.

COVID-19 impact and reset: Funding trends

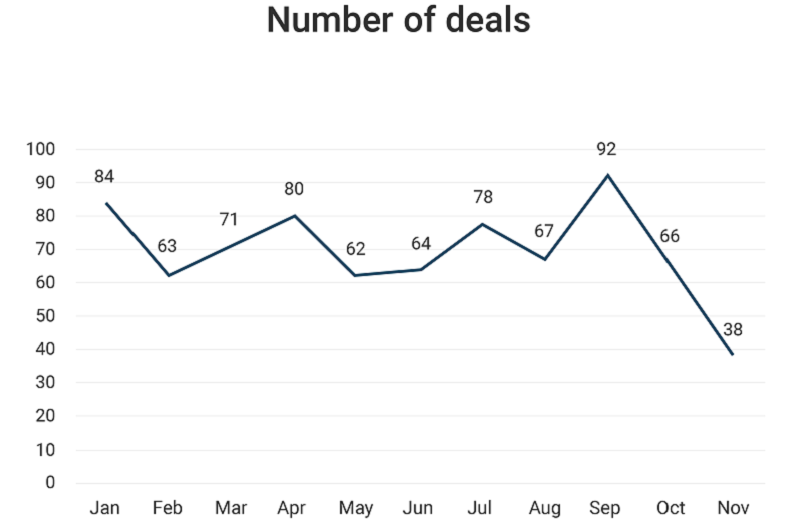

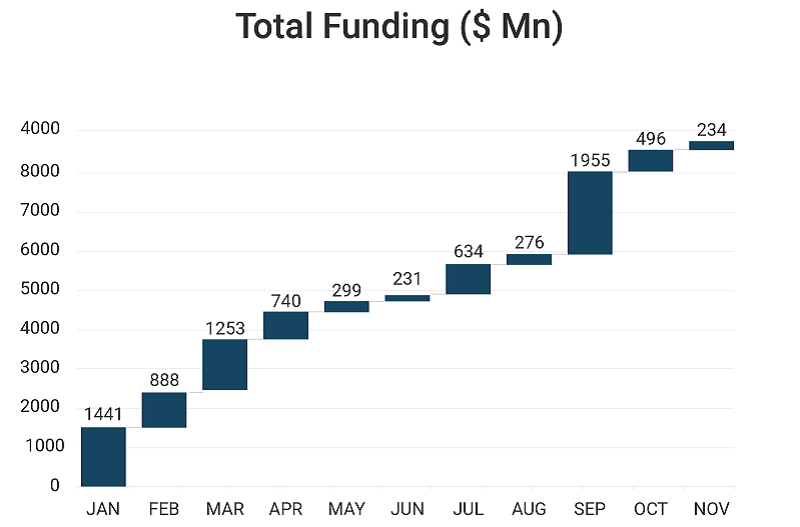

As the graph below depicts, the first quarter (Jan-March) showed signs of fluctuations, with unicorns like BYJU’S, ReNew Power, OYO Rooms, Swiggy, and Zomato holding the funding mast from dropping.

However, with the lockdown taking hold in the second quarter, the funding amount fell drastically. At around the onset of the third quarter, as the business and economy started to recover, we saw a sudden plunge in the funding amount raised by startups in the month of September, scoring $1.9 billion across 92 deals. This hike can be attributed to the aggressive growth seen in sectors such as edtech, foodtech, OTT, and online gaming among others.

Although the last quarter is again experiencing a great fall in the funding amount raised by startups, this can be attributed to the uncertainty regarding where the customer aspirations lie in future. Also, with the country again witnessing an increase in the number of COVID-19 cases with the onset of winter, many states are considering reverting to either partial lockdown or curfews.

COVID-19 impact and reset: Sector trends

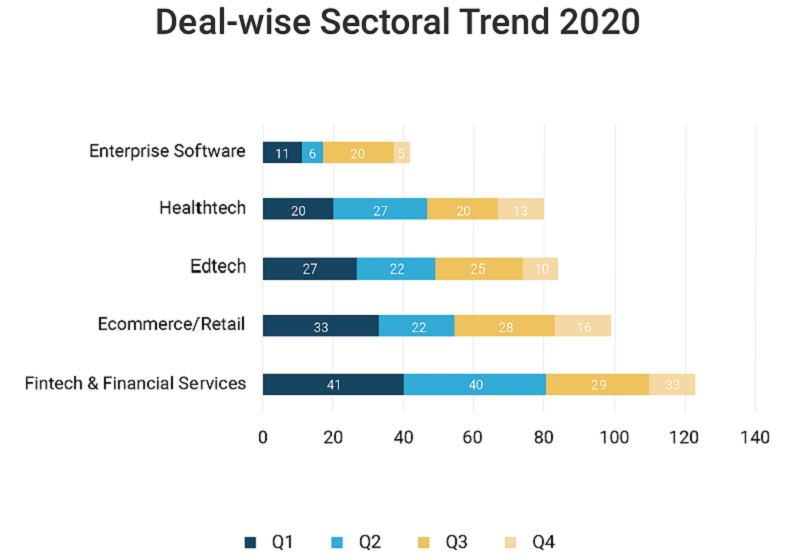

Overall, the top sectors which clinched the maximum number of funding deals between the period of January to November 2020 are fintech and financial services (123), ecommerce/retail (99), edtech (84), healthtech (80), and enterprise software (42). Together, these sectors constitute around 56 percent of the total deals raised by the ecosystem.

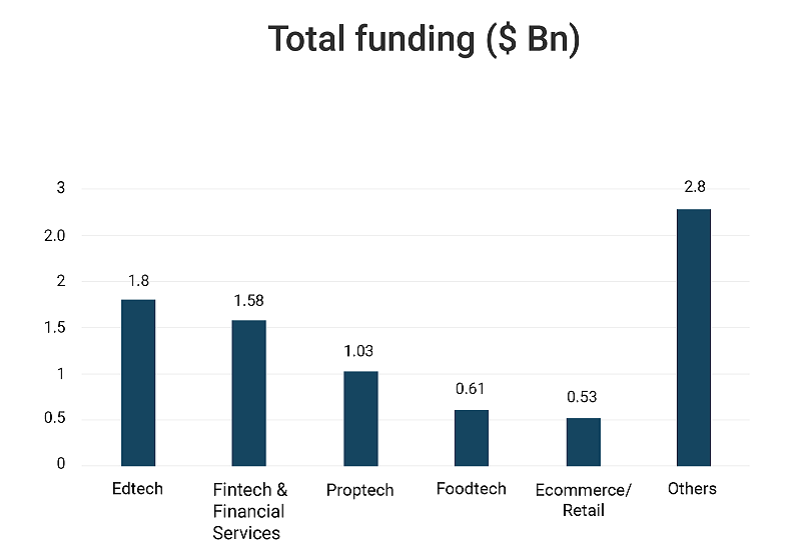

In terms of the funding amount, however, the top sectors were edtech ($1.8 billion), fintech and financial services ($1.58 billion), proptech ($1.03 billion), foodtech ($0.61 billion), and ecommerce/retail ($0.53 billion).

Investor focus during COVID-19

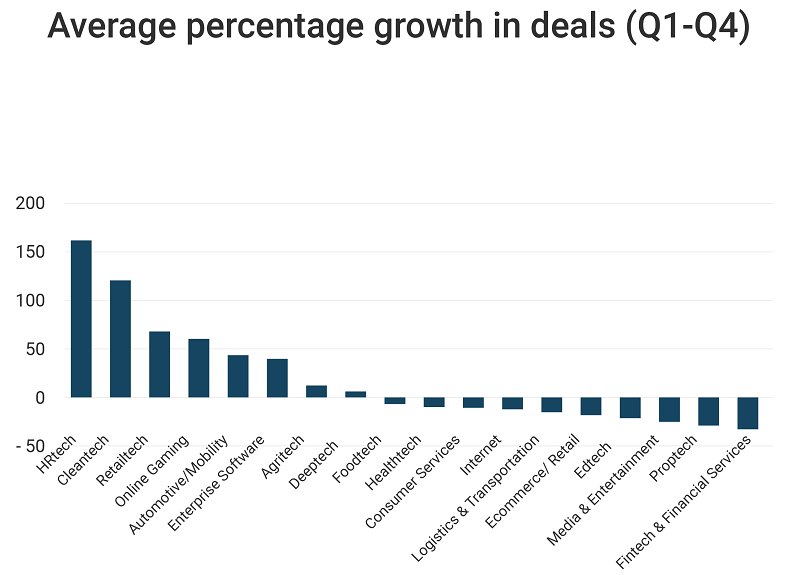

Traditionally, the investor focus has been on legacy sectors such as fintech, edtech, healthtech, foodtech, and cleantech, among others. As observed, in terms of total funding amount and total funding deals in 2020, these sectors still lead the charts, However, when the percentage growth across the quarters is compared, a new picture emerges.

For most of the top sectors, the number of deals fell substantially or saw a significant fluctuation. For instance, across Q1-Q4, on average, the number of deals accrued by the fintech and financial services sector fell by almost 28 percent. Similarly, other top sectors such as proptech (-27 percent), edtech (-21 percent), media and entertainment (-16 percent), among others, also suffered. This indicates that the investor focus in these sectors has primarily shifted towards late-stage companies.

On the other hand, some sectors surprisingly showed signs of positive growth and increasing investor interest. These include HRtech (159 percent), cleantech (119 percent), retailtech (66 percent), online gaming (59 percent), automotive/mobility (43 percent), enterprise software (37.6 percent), agritech (11.66%percent), and deep-tech (5.87 percent).

COVID-19 impact and reset: Geographical trends

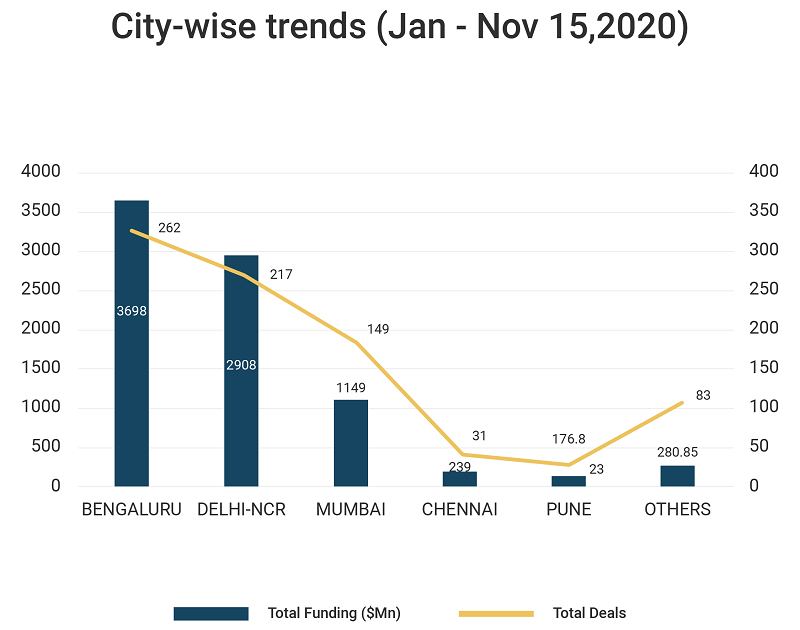

Both in terms of funding amount and the number of deals raised, Bengaluru tops the charts between January 2020 and November 15, 2020. Amid the Tier-II segment, cities such as Chandigarh, Jaipur, Kochi, and Indore gained traction.

COVID-19 impact and reset: Stage-wise trends

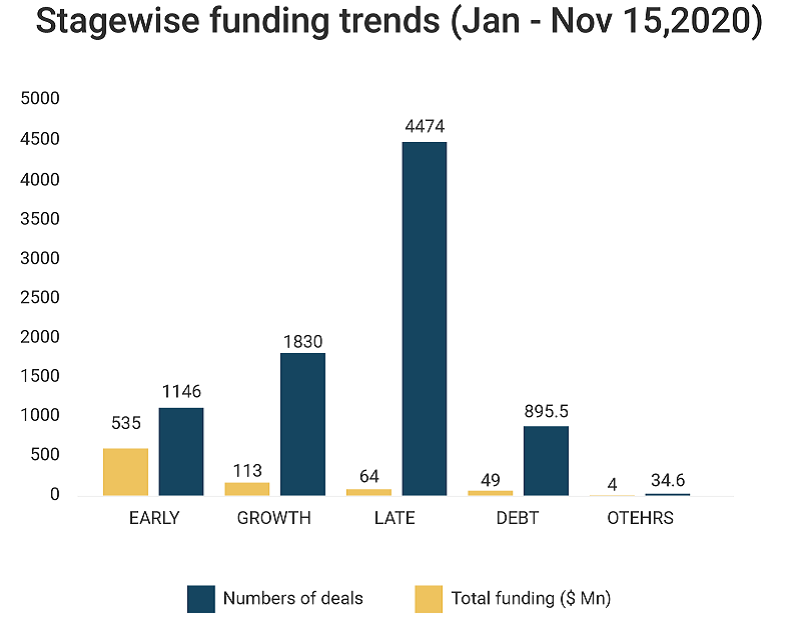

As expected, the late-stage startups raised the maximum funding amount ($4.4 billion) while early-stage startups led in terms of the number of deals (535). While battling COVID-19, the ecosystem saw the emergence of many early-stage startups while the existing ones raced ahead with innovative products and by integrating new-age technologies, thus drawing investor focus.

Despite the uncertainties and volatility prevailing in the market, investors continued to maintain a positive sentiment. The increase in the number of early-stage deals indicates support for innovation. At the same time, the continued investment in growth and late-stage companies signals support to scale. The support given by the Indian government in these desperate times was also commendable.

In the days following the lockdown which began on March 25, Rs 1.7 trillion (~$ 22 billion) relief package was announced by Finance Minister Nirmala Sitharaman. Later, on May 12, Prime Minister Narendra Modi announced a COVID-19 relief package of Rs 20 trillion (~$260 billion). The government also undertook many tax, employment, security, and economic stimulus-related measures to weather the impact of the pandemic. Going ahead, it is expected that the ecosystem will continue to adopt a collaborative approach and will support new innovations and trends.

Edited by Kanishk Singh

Link : https://yourstory.com/2020/12/2020-trends-indian-startup-funding-covid-19-ecosystem

Author :- Meha Agarwal ( )

December 02, 2020 at 05:35AM

YourStory