Soon after the coronavirus outbreak in March, many state authorities called for a hard stop on biometric systems, physical payments, and nearly everything that involved touch. It, of course, resulted in a mad rush for contactless payments, including remote transactions via UPI or mobile wallets.

Two quarters on, UPI transactions hit a record 2.07 billion last month, a whopping 80 percent increase from October 2019, according to NPCI data.

While digital payments have been the most obvious beneficiary of the pandemic, another area experiencing the winds of change are face-to-face payments (cash or card) — a space ripe for disruption.

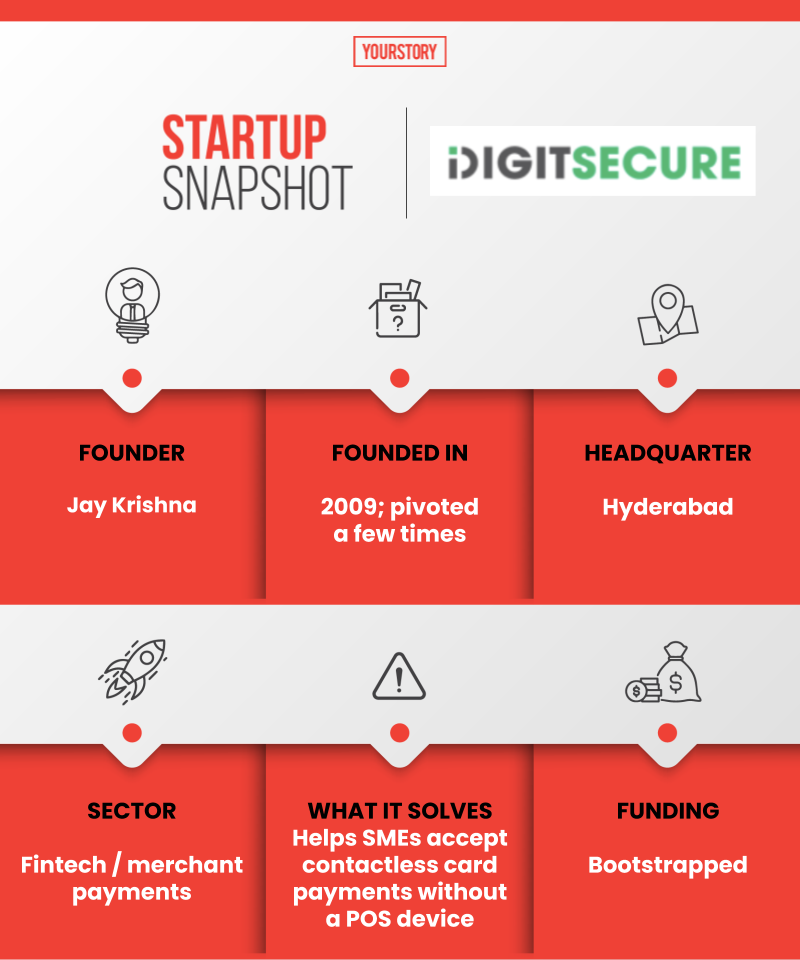

Hyderabad-based DigitSecure operates in this fast-growing segment.

The startup was founded in 2009 by Jay Krishna, who’s worked with the likes of FedEx and IBM across India and the US.

DigitSecure went through many pivots due to regulatory uncertainties and adoption challenges until 2018, when it started building a contactless payments platform for merchants.

The founder tells YourStory,

“We built a low-cost solution that can process multi-channel payments without a point-of-sale device. We went live with delivery merchants, and will target small-ticket transactions below Rs 2,000.”

DigitSecure’s plug-and-play SoftPOS solution found its product-market fit after Phase 1 of the lockdown, when people started returning to neighbourhood stores and small businesses, but continued to avoid touch-based transactions.

The payments platform and what it solves

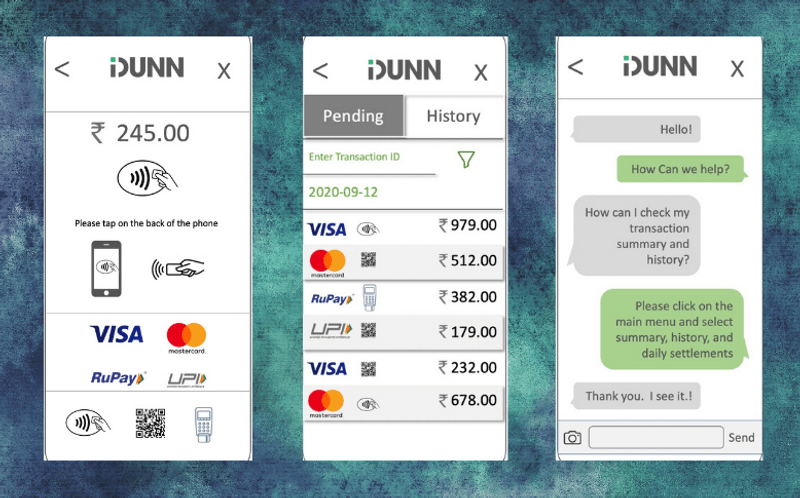

The cost-effective card acceptance solution enables SMEs, micro-merchants, and local businesses to accept contactless payments through their smartphones without investing in an additional point-of-sale (POS) device.

Simply put, the software turns any NFC-enabled smartphone into a POS machine. The best use of DigitSecure’s solution can be for ecommerce orders, courier deliveries, kiranas, tuition classes, toll booths, and transit stations.

Merchants can self-onboard on the DigitSecure platform. Besides processing payments, they can also use the B2B app to get daily transaction summaries, track dues, resolve disputes, and provide customer support.

Infographic: YS Design

Not only is the solution device-agnostic, but it is also safe and secure, and can conduct instant merchant verifications in a regulatorily compliant way.

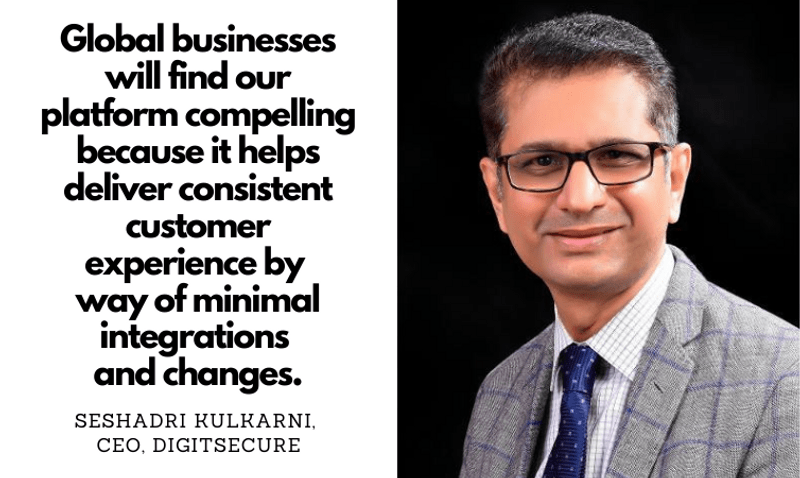

Seshadri Kulkarni, CEO, DigitSecure, tells YourStory, “The pandemic has solidified opportunities in the contactless payments space. The first arises from more cardholders switching to touchless payments for convenience and health safety reasons; and the second one from more merchants coming into the digital payment acceptance fold with our affordable app-first solution."

"We believe tap-on-phone technology will create a new paradigm, and empower on-the-go businesses to offer contactless payments to customers," he adds.

The startup claims that its cloud-based solution can reduce customer acquisition costs for merchants by 65 percent, and lower operational capex by 70 percent compared to traditional POS terminals. It is also quicker to deploy.

Photo: YS

Business model and growth plans

DigitSecure operates on a conventional SaaS model, where merchants pay a recurring subscription fee. It also charges a one-time implementation fee, and transaction fee (a cut of every payment processed on the platform).

The startup is targeting 180 million SMEs across India, APAC, Africa, and the Middle East, and is partnering with large financial services providers to drive adoption.

“These 180 million small merchants don’t accept digital payments. We’re working with banks to streamline the onboarding process,” Jay reveals.

The bootstrapped startup plans to onboard 100,000 to 125,000 merchants by March 2021, and is targeting gross revenues of $8-9 million.

It is also “in talks to raise money to expand to multiple markets”.

Merchants can self-onboard on the DigitSecure app

Partnerships and market opportunity

Earlier in November, DigitSecure formed a strategic partnership with VISA to integrate its tap-to-phone solution with the latter’s Cybersource platform.

The integration will create a single omni-channel commerce solution across segments, use cases, channels, and payment modes. With this deployment, India joins more than 15 markets that now provide the VISA tap-to-phone technology to merchants.

The global contactless payment market is estimated to reach $18 billion by 2025.

“Global businesses will find our platform compelling because it helps deliver consistent customer experience by way of minimal integrations and changes,” the CEO said in a statement.

In India, meanwhile, it’s a field day for anything that’s digital and that accelerates financial inclusion — like DigitSecure, whose time has come.

Edited by Teja Lele Desai

Link : https://yourstory.com/2020/11/startup-contactless-payments-solution-merchants-pos-device

Author :- Sohini Mitter ( )

November 09, 2020 at 05:45AM

YourStory