Launched in 2012, YourStory's Book Review section features over 275 titles on creativity, innovation, knowledge work, and digital transformation. See also our related columns The Turning Point, Techie Tuesdays, and Storybites.

Founders looking for rapid scale in their journey will find useful insights in the new guidebook, Startup Accelerators: A Field Guide by Richard Busulwa, Naomi Birdthistle, and Steve Dunn.

Accelerators have helped startups such as AirBnB, DropBox, and Reddit grow rapidly to billion-dollar valuations. But choosing the right accelerator and getting into it can be a complicated affair, and this book written by entrepreneurs and educators helps founders with assessment criteria and checklists.

Richard Busulwa is author of Strategy Execution and Complexity, and researcher at Swinburne Institute of Technology. Naomi Birdthistle is associate professor at Griffith University, and ran a consulting firm for 10 years.

Steve Dunn is CEO and Co-founder of IoT startup LEAPIN Digital Keys. His personal experiences with a number of international accelerators provide unique first-hand insights in the book.

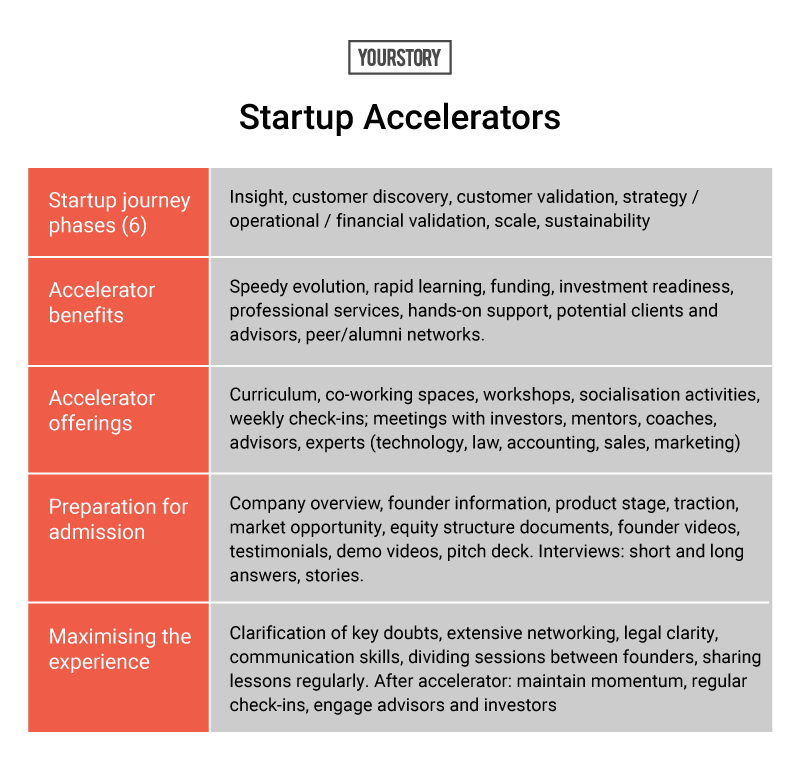

Here are my key clusters of takeaways from the nine chapters in this 350-page book, summarised as well in the table below. See YourStory’s Startup Hatch section for profiles of accelerators, incubators and entrepreneurship programmes. See also our reviews of the related books, The Startup Owner’s Manual, Lean Startup, Funding Your Startup, and Startup Leadership.

“Accelerator programmes have emerged as one of the most powerful vehicles for helping entrepreneurs to learn rapidly, create powerful networks, raise money, build their startups, and do this at speed and scale,” the authors begin.

The book is packed with research analysis, first-hand interviews with founders and accelerator managers, and useful tables comparing various accelerator offerings. The material is thoroughly referenced, but also written in an accessible style for founders.

It will appeal to entrepreneurs as well as researchers and educators in entrepreneurship. The book was written before the coronavirus pandemic, so it will be important to see how accelerators are pivoting their model to the new realities.

Foundations

The authors present a six-phase map of a startup’s journey, which can also be classified into formation, validation and growth; or pre-seed, seed, early-stage and late-stage; or idea, startup, growth and maturity. Funding comes from a number of sources in each stage, eg. friends/family, grants, customers, crowdfunding, angels, venture debt, early-stage and late-stage VCs.

The startup journey can be rewarding and impactful, but many startups fail for a number of reasons: no product/market fit, lack of revenue and funding, team mismatch, poor marketing, premature scaling, and bad timing.

Finding the business opportunity and getting customers to pay for the product is not enough, the authors caution: investors look for scalable businesses and innovation processes for the long term.

Entrepreneurship is complex because it requires “decision-making across all aspects of business activity”, under conditions of high uncertainty.

In this regard, a range of startup ecosystem players have emerged: incubators, accelerators, entrepreneurship support programmes, peer communities, startup competitions, and government initiatives. While supporting entrepreneurs, some of these players have additional objectives of boosting local innovation and employment.

Accelerators

Accelerators are of different types: corporate, non-corporate, government, NGO, university, and tech/industry specific. The book largely addresses non-corporate accelerators like Y Combinator and TechStars; more material on corporate accelerators would have been a welcome addition.

The accelerator movement worldwide was spurred by the launch of Y Combinator in 2005 and Techstars in 2006, and a whole wave of other players has emerged on all continents. Some accelerators have set up a presence in numerous countries, eg. Techstars, 500 Startups, Mass Challenge.

The book provides brief profiles of accelerators such as TLabs (India), Chinaccelerator (China), Sparklabs (Korea), IdeaSpace (Philippines), Tribe (Singapore), Creative Destruction Lab (Toronto), Barclays Techstars (UK), 50 Partners (France), Impact (Spain), Rockstart (Netherlands), Turn8 (UAE), XL Africa (South Africa), Savannah (Kenya), Flat6Labs (Tunisia), Avatech (Iran), Seed Accelerator (Brazil) and Startup Chile.

Accelerators generally look for startups with an MVP in a large or growing market, traction, low risks, and competitive differentiation. Admission criteria may differ depending on the accelerator’s focus in terms of startup phase, industry sector, and technology offering.

The kinds of traction accelerators look for can include customer profiles, revenue, profitability, active users, pre-orders, web traffic, customer engagement, partnerships, and media coverage.

“Accelerator turnoffs”, according to the authors, are startups who may be too early in the market, solo founder startups, and unfavourable prior financial commitments. Unfortunately, some founders are not serious about the programme; they lie about their achievements, or think they know it all, or are not coachable, the authors observe.

The fixed-term, cohort-based accelerator programmes usually span three to six months, with coaching and mentoring sessions culminating in a demo day attended by investors and industry players. The programme gives startups clarity on business model, strategy, tactics, and structure.

Established accelerators have a good reputation and a strong record of startup investments and exits.

At the end of the programme, startups will have better traction, clarity on plans for the next few years, proper legal documents, professional pitch decks, active online presence, seed funding, and a network of potential investors, corporate customers and business advisors.

Business models of accelerators

It is important for startup founders to understand the business models of accelerators so as to enable better alignment between objectives. Some accelerators make money from corporate sponsors and government grants, others from startup exits.

For a seed investment of $10,000-$250,000 in a cohort company, an accelerator may take 3-10 percent equity, according to the authors. Other accelerators may charge a programme fee, or give a stipend without taking equity. Non-profit startups may be given an outright donation.

The authors advise founders to carefully understand the conditions attached to the accelerator’s investment, eg preferred stock, liquidation clauses, anti-dilution requirements, vesting, voting rights on the board of directors, and room for negotiation.

Founders should probe into the partnership agreements of accelerators, entrepreneurial experience of managers, payment agreements with mentors, and the needs of their investors.

Mentors benefit by learning, promotion, investment opportunities, fees, equity, or the “pure joy of helping others and giving back to the community,” the authors describe. Programme managers are more hands-on, and are well connected and well resourced. In addition to fixed salaries, they may get shares in the startups.

Founders should distinguish between “good” and “good enough” accelerators, and investigate the accelerator’s reputation with investors. Corporate accelerators, on the other hand, engage with startups to better understand innovation, hire innovators, improve their own products and services, or buy the startup’s offerings.

Assessing accelerators and benefits

Some accelerators require founders to physically relocate to new countries. This may open up new local markets, but also entail challenges in moving to a new culture away from one’s family. Opportunity costs for startups who join an accelerator include equity dilution, time, and product paths.

Though many startup educational resources are available online, accelerators offer expert interactions which reveal nuances and hard-earned insights. The networking sessions also yield serendipitous contacts and opportunities. Accelerator networks, as compared to a founder’s own network, are like “networking on steroids.”

Accelerators can be a gamechanger for a startup, but also a waste of time in some cases. The authors document instances of poorly planned accelerators staffed by incompetent managers, inept mentors, and predatory investors. It is important for founders to do due diligence on the accelerator, which can include contacting alumni startups and social media research.

Preparation

Once accelerator-founder fit has been found, the entrepreneurs should prepare themselves thoroughly for the admission process, ranging from documentation to interviews. This can include submitting existing equity structure documents, founder videos, testimonials, and demo videos.

Short and long answers should be prepared and rehearsed, but without looking fake, formulaic, or inauthentic, the authors caution. They also provide samples of actual submitted responses to accelerator forms.

Interesting rapid-fire questions asked by some accelerators include What is the most impressive thing you have achieved, How did the founders meet, How do we know your team will stick together, Why do you think this team is right, What do you understand that others don’t, Who might become your competitors, What’s the biggest mistake you have made, and What hurdles do you see ahead?

Unfortunately, some founders become defensive or even hostile during interviews, the authors caution. They may go off on a tangent, oversell, contradict one another, cite the wrong data, try to hide weaknesses, or give off negative energy. Doing mock interviews and agreeing on basic facts in advance can help in this regard.

The pitch should be rehearsed so that the very first sentence conveys the essence of the message. Interesting and memorable stories about the founder, product, and customer also help, the authors advise. While it is good to show ambition, it is important to have humility and willingness to learn as well.

Because there is so much going on in an accelerator, the authors offer founders a number of useful tips for getting the most out of the experience. The pace may be hectic and the environment even loud and chaotic at times, but planning, prioritising, and commitment can help maximise the outcome.

Founders should clear out doubts on product and strategy, and smoothen legal and communication issues. Time management can be improved by dividing sessions between founders, and sharing lessons with one another periodically. Extensive networking and forming ties with other founders is important, the authors advise.

After the programme ends, the founders should keep the momentum going and institutionalise the approach to rapid progress, the authors emphasise. Some of the advisors should be retained, and some programme managers also agree to do regular check-ins. Investors, corporate partners and even alumni networks should be engaged with periodic updates.

Resources

The book is packed with useful resources, ranging from article links to organisational websites. For example, the F6 platform provides application forms for a range of accelerators. Seed Rankings, Seed-DB, Gust, and Crunchbase offer accelerator data and rankings.

The authors list a number of sites that provide access to startup legal documents, accelerator comparisons, submitted pitch decks, application forms, accelerator curriculum guides, and alumni stories. Six tables compare positioning statements and notable alumni of over 50 accelerators on all continents.

In sum, this book is a must-have guide for all startups looking for actionable advice on the accelerator route to growth. Even for startups who may not apply to an accelerator, the book provides useful material for self-reflection and understanding the viewpoint of investors.

YourStory has also published the pocketbook ‘Proverbs and Quotes for Entrepreneurs: A World of Inspiration for Startups’ as a creative and motivational guide for innovators (downloadable as apps here: Apple, Android).

Edited by Teja Lele Desai

Link : https://yourstory.com/2020/11/startup-accelerators-scale-speed

Author :- Madanmohan Rao ( )

November 12, 2020 at 06:10AM

YourStory