The COVID-19 pandemic has heightened uncertainty over everything - our health, the economy, employment, and finances. But this might also be a great time to finally start investing in equity markets to ‘grow’ your money. While there are plenty of apps to let you explore and invest in the stock market, Groww, a new-age investment app, lets people with DIY investments with the tap of a button.

Groww is a simple Demat and stock trading app that allows you to open a Demat account and trade on the BSE and NSE listed stocks in the market at zero brokerage on investments. Apart from mutual funds and stocks, Groww also lets people invest in US stocks and gold.

Incorporated in 2016, Bengaluru-based Groww was started by four ex-Flipkart executives - Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal to help users invest in mutual funds directly. Since then, it has grown remarkably, and has gained users as well as investors’ trust. Groww is backed by marquee investors including Ribbit Capital, Y Combinator, Sequoia Capital, Kauffman Fellows Fund, Collin West, Propel Ventures Partners, Yinglan Tan, Cypher Capital, Insignia Ventures Partners, and Mukesh Bansal, Co-founder of Myntra and Curefit.

The app has been downloaded over 5 million times on the Google Play Store and has been rated 4.5 stars from users. The app is available on Apple’s App Store as well, and reportedly has a total of 8 million users on the platform.

For this week’s App Friday, we reviewed Groww, and here is how you can invest with this one.

Get started

The app’s welcome screen makes it clear that the app is simple, easy-to-use, and free to invest. To start using the app, users need to sign up with their Google account or any other email id. It is a one-tap sign up process, and the app automatically detects your phone number and lets you continue. After signing in, one can also create a four-digit pin to lock the app, which adds an extra layer of safety to its users.

The app has one-time e-KYC or paperless account opening procedure, which asks for details such as your PAN, Aadhaar card, and photo, and your account is ready to use in a few taps. If your Aadhaar is not connected to your mobile number, then you can still continue with the process with a quick document scan from your phone camera or you can upload from the phone gallery. However, it asks for a final e-sign, and if you do not have a virtual ID, then you might have to courier a form with your signature.

We could not complete the KYC while reviewing the app, and hence could not try our hands on transactions. But, besides that, we could explore Groww, and how one can do the transactions by buying and selling stocks, mutual funds (systematic investment plan (SIP) or one-time), and gold.

Buy and sell

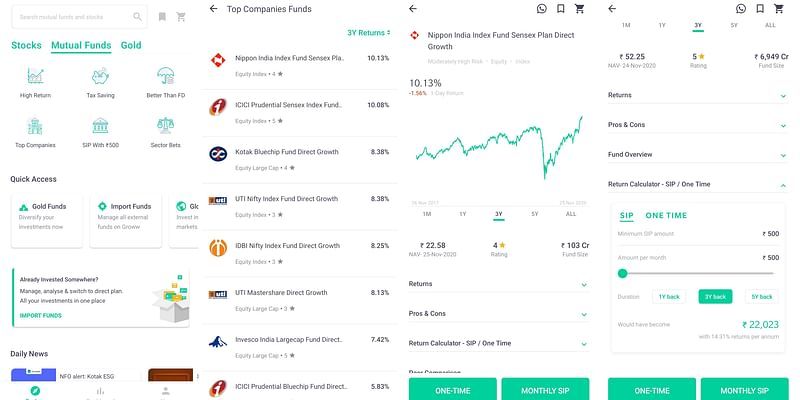

The home screen has three tabs on the top - stocks, mutual funds, and gold. When you tap mutual funds, you can explore a variety of funds across categories, and can also explore why one should invest in mutual funds. The app has some smart tabs like sector-focused bets, tax saving funds, and SIP with Rs 500. A user can also see mutual funds with highest returns, top companies, and funds with low risks dubbed as better than FD in the app. The app lists funds like SBI Mutual Fund, Reliance Mutual Fund, ICICI Prudential Mutual Fund, HDFC Mutual Fund, Aditya Birla Sun Life (ABSL) Mutual Fund, Franklin Templeton Mutual Fund, DSP Blackrock Mutual Fund, Kotak Mutual Fund, and so on.

When you tap on one of these categories, such as high return funds, the app unfurls a list of mutual funds with a return percentage mentioned to the right. You can further select a mutual fund and see its all-time performance in a smart clean graph. The app also has a mutual fund SIP calculator that helps you estimate the returns for an investment over a period.

Security features

The app makers have ensured the users feel secured while using the app. For instance, every time you leave the app page, you have to punch in the security code to log in again. The app makers say that Groww is secured with 128-bit SSL Encryption, which is said to be a high level encryption standard for its transactions, which makes Groww as safe as a bank.

The verdict

Groww is a beautifully designed app with clean and clutter-free user interface. The line and candlestick charts, which show share price movements, historical performance, and complete information about all companies, lets you make informed decisions.

However, the only thing we wished the app could do was pull out our previous investments and show a full investment portfolio for a clear picture of user’s financial stability. Besides that, Groww looks like an app which is actually making investment simple and accessible for everyone, and technology is at the heart of it. The app surely appeals to the sensibilities of digitally savvy millennials. We really loved the app as it looks consumer-focused, transparent, and clean. We cannot wait for our KYC to complete and start making some money from the equity market.

Edited by Megha Reddy

Link : https://yourstory.com/2020/11/app-fridays-made-in-india-groww-mutual-funds-stocks-gold

Author :- Rashi Varshney ( )

November 27, 2020 at 05:15AM

YourStory