Earlier this week, Google officially joined Apple and Epic Games’ battle on platform monopoly. In a recent payments policy clarification, Google said that all developers selling digital goods in their apps must use Google Play’s billing system (from Jan 2021). Like Apple, Google too levies a 30% commission on all the Play Store distributed apps that use the native billing system.

The mandatory use of Google Play billing would apply to purchase of virtual items, subscription services (such as fitness, game, dating, education, music, and video), ad-free version of an app, data storage services, business productivity software, and financial management software. This has naturally rankled a few feathers and many Indian tech startups are now considering the possibility of moving away from Google Play and setting up an alternative app store.

While App Store’s commissions were not a big concern for Indian companies given the low market share for Apple devices in India, the commissions on Google Play Store have attracted considerable backlash from tech startups given that Android accounts for over 95% of the smartphone user base in India. Plus, most of these Android smartphones come with Google Play Store pre-installed and rely on Google services for optimal functioning.

“I think it is impossible for a digital company to replace the Play Store. I don’t think we will do that, we have 1.5 Mn subscribers on our Android app. Having said that, 30% commission is too much and we cannot afford it as a company,” said Gaurav Garg, cofounder of edtech startup StudyIQ, which claims to have a sustainable business with 30% profit margin.

Things could get way more darker for companies that have not yet hit profitability and are selling at zero margin in hope to expand the customer base. Giving 30% commission to Google Play would mean taking a 30% hit on the EBITDA, thereby worsening profitability.

Ravi Mittal, founder and CEO of dating app QuackQuack, told us that the repercussions of this payment policy will be huge for digital startups. “Majority of our users are on Android and enforcing Google Play billing will have a huge impact on our margins and user’s ability to pay,” he said.

Mittal added that while QuackQuack can offer a plethora of payment options since payments are so fragmented in India, Google Play doesn’t have such versatility which will further lead to a drop in revenue. In India, Google Play allows purchase of paid apps through credit/debit cards — MasterCard, Visa, and Visa Electron supported and Maestro and Rupay not supported — netbanking, UPI and carrier billing (added to the postpaid bill). In case of in-app purchases too, the same options are available, but that does not hold true for recurring payments for subscriptions, where apps have to use credit card or debit card billing, with UPI also supporting this recently, but hardly any apps are using UPI for subscriptions currently.

Vaibhav Vasa, director of a SaaS company Biz Analyst, which offers enterprise tech applications and services to SMBs said, “SaaS module companies in India have a less margin on the app pricing, so if we have to pay an additional 30% to Google, this increase in cost will directly impact SMBs or the end customers.”

Study IQ’s Garg also said that the only way to deal with the 30% commission is to increase the price of its courses.

The Hunt For Google Play Alternatives

While Android has supported third-party app stores from the very beginning and also allows users to install apps without an app store, these alternatives are far from ideal for startups, given the reach and ease-of-access for the Play Store.

The alternatives for Android users include the likes of Xiaomi’s Mi Store, Samsung Galaxy Store, Huawei AppGallery or Indus OS. Or they could bypass all stores and establish a massive brand presence which attracts sideloaded installs (like Dream11, MPL and others have done).

Founder of a fantasy gaming company Fantasy Akhada, Amit Purohit also noted that currently, a lot of users become circumspect about downloading an app if it is not available on Google Play Store. Further, he also agreed that the customer acquisition cost of fantasy gaming apps would come down further if they were allowed to be listed on the Google Play Store which is essentially a gateway to majority of smartphones (android) in India.

While, established companies like Amazon, Tinder, Netflix can still afford to drive subscriptions through their websites — it would be a humongous task for early-stage startups, novice developers and apps. It may even be feasible for edtech companies to drive subscriptions with their already established web presence, but the discovery of new and smaller games, fitness and dating apps is still largely driven by the Google Play Store and Apple’s App Store.

Ever since Google’s clarification, many Indian startups have called out for an Indian app store to replace the duopoly of Google and Apple. According to TechCrunch, more than 150 Indian companies are working towards forming an alliance for an Indian app store and cut India’s reliance on Google’s Play Store. Interestingly, another report by ET Now has claimed that Indian government is also planning to launch a domestic app store for India, and wants to make it mandatory for it to be pre-installed on Android phones in India.

The dating company, QuackQuack is also considering moving its app distribution out of the Play Store and is also working on direct app downloads, which it acknowledges that won’t be an easy feat.

“We need an India focused or alternative app store which can break the monopoly and arbitrary rules of Google and Apple which is effecting and going to affect all digital startups – small or big alike,” said QuackQuack’s Mittal.

Similar to Apple, Google has also prohibited apps from leading users to other payment methods through in-app promotions, app descriptions, or in-app interface flows. Which means, play-distributed apps will have to email users or advertise on other channels about their alternative payment options.

To circumvent these restrictions, Netflix asks iOS users to sign up for its service using the website. “You can’t sign up for Netflix in the app. We know it’s a hassle. After you’re a member, you can start watching in the app,” the app tells new users. Subscription-driven digital media company Ken also shows a similar message to new users on their android app.

Post the enforcement of Google Play Store billing policy, such messages could become a part of many more subscription-based applications.

The Need To Make Money

However, there is an important caveat here — at the end of the day, any app store or marketplace has to make money, whether it is India-focussed or not. If this ‘Made In India’ app store does not charge commission from the apps, it will have to solely depend on ads for revenue.

“They [alternatives] may likely resort to showing ads, or alternative options such as ads as promoted apps, which the not so sophisticated users of ‘Bharat’ wouldn’t be able to distinguish from others. Eventually, hurting the smaller developers, the ones who can’t invest in marketing and ads as much as the behemoths,” Navin Madhavan, VP at adtech unicorn InMobi, tweeted in his personal capacity.

However, the same can be said for any kind of paid marketing campaign, so it does not really change the reality much.

“I hate to say this, but I think Google isn’t entirely at fault here. They provided the distribution, built a fairly neutral app store that helps apps benefit from organic loops, algorithms and invested a lot in building this and they need to make money. But, the ecosystem’s ask for Google to consult them on changes and that 30% is too high for a market like India is a fair one” Madhavan added.

According to Google, the Play Store service commission covers everything from security updates to an array of developer tools for building and maintaining a global app marketplace. In addition to this, Google Play also enables user discovery and developer growth by curating relevant recommendations. “In fact, our investment in the curation process for the Google Play Store accounted for over 46% of all installs on the Google Play Store in 2018,” the big tech company noted.

Google also added that it removes 99% of the malicious apps before anyone can install them. However, fake versions of popular apps are a common sight on the Google Play Store, so it’s not like Google has a 100% record in this matter.

In terms of publishing cost on Google Play, developers have to pay a one-time fee of $25 to create a developer account, post which they can publish any number of apps on the Play Store. Which is way cheaper than the $99 annual fee that developers have to pay for publishing apps on Apple’s App Store.

Are We Discounting The Benefits Of Google Play Store?

Drawing a parallel to other ecosystems, Rajesh Sawhney, cofounder of InnerChef also noted that restaurants also have to pay a similar 30% cut to food aggregators like Zomato and Swiggy. Ola and Uber drivers pay a 20%-25% commision to the ride aggregators. In a physical commerce space too, B2C brands pay a cut to the offline stores that sell their products.

However, there are also developers who believe that Google Play Store is the fastest and cheapest way to distribute a new app in India. Roby John cofounder of social gaming app SuperGaming and five-year old game development company June Gaming, said, “This route fetches most organic users for us. We have had over 150 Mn organic installs of our games on Google Play in our previous games.”

John claims that other distributions systems are even worse and could be unstructured in requiring fees or hidden costs to be paid for user acquisition. “If I was to get on a third party app store, things are not so well distributed. I have practical experience of this, since I used to run on the Airtel Wynk Games Store earlier,” he added.

Further, commenting on the option of investing towards building a prominent brand presence to attract users and convince them to do a sideloaded install (through an APK file on Android), John said, this is quite expensive. Plus on the Play Store, good apps and developers get noticed through organic promotions by Google.

That being said, John acknowledged that 30% is a significant cut and he hopes that there is a reduction in Google’s commission percentage over time

On the other hand, Arvind Gupta, head and cofounder of Digital India Foundation believes that the issue at hand, is about lack of choice and monopoly. Google has an unfair advantage, because it owns the core experience of Android through Google Mobile Services, the Play Store and is also an app developer that competes with Indian startups.

QuackQuack’s Mittal compared payment gateway’s charges to Google Pay billing and said that 30% is a hefty commission in comparison to around 2% TDR charged by other payment gateways. “It’s a clear monopoly which needs to be addressed by the law of the land. This will nip the bud for any innovation in the digital startup ecosystem and affect all kinds of industries ranging from dating, education, consulting, fitness, and many more,” he added.

The Omnipresent Platform Fees

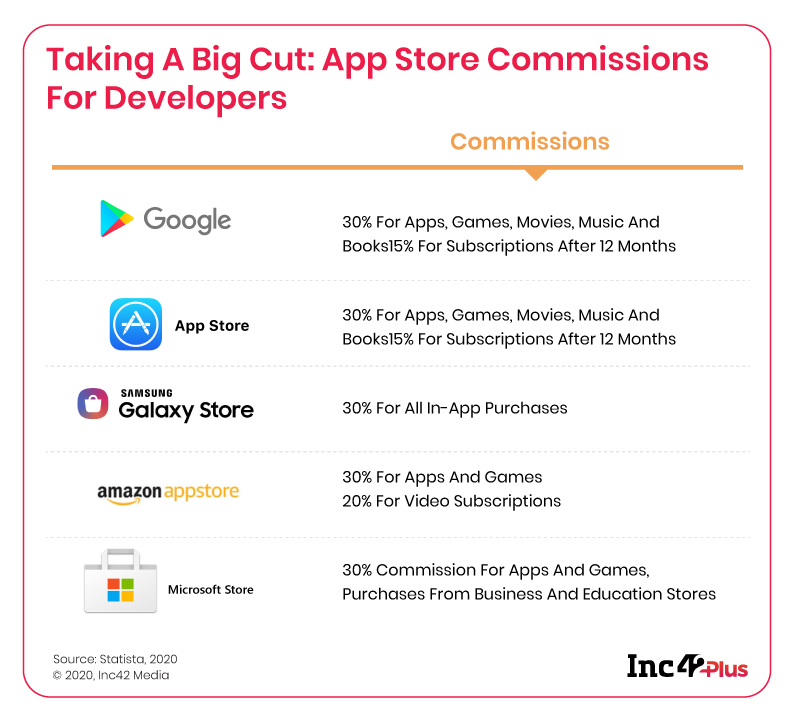

While the question of whether a 30% commission by Google is justified may not have an immediate answer, the reality is that alternatives may not exactly help startups. Most including Samsung Galaxy Store, Amazon Appstore, Apple App Store charge 30% on purchases. Even in the case of open source Android app store Aptoide, the commission rate is 25% (shared between Aptoide’s telco partner and Aptoide). Interestingly, in China where Google Play is not available, the commissions charged by alternative Android app stores often go as high as 50%.

Platform fees or commissions are not exclusive to app stores. Every other online marketplace or content distribution platform charges stakeholders for the services and technology support that they provide. Twitch charges a 50% subscription fee and a cut of advertising, YouTube takes 45% of adsense revenue from channels, Patreon charges 5% -12% commission and similarly SubStack too charges a 10% subscription fee from creators.

That’s the harsh reality of our times, either you build a brand recognisable enough to drive organic traction or you pay an aggregator or platform like Google Play Store to drive that organic reach. Even with the Indian government and startup alliance launching their own app store, it will be a tall task to match the global reach that Google Play Store and other popular app stores offer new tech products.

The post The Many Sides Of Google Play Store’s 30% Commission & India’s Search For Alternatives appeared first on Inc42 Media.

Author: Yatti Soni

Date : 2020-10-02T11:23:33.000Z