The insurance industry in India is a pool of insurance companies hedging insurance seekers against risk through the means of insurance contracts. The contract is an agreement between the insurer and the insured in which the insurer guarantees payment for an uncertain event against a premium paid by the insured regularly. The premium is mentioned in the contract.

Insurance is a commodity formulated to empower you with a criterion of financial safety lest a catastrophe happens. Life Insurance is precisely planned to protect your legatee financially should something unfortunate happen to you. For investors, the insurance industry is a slow-growing segment as compared to other financial sectors.

The Insurance Industry In India

The Insurance Industry Market Size In India

Government Initiatives

The Future Of Insurance Industry In India

The Insurance Industry In India

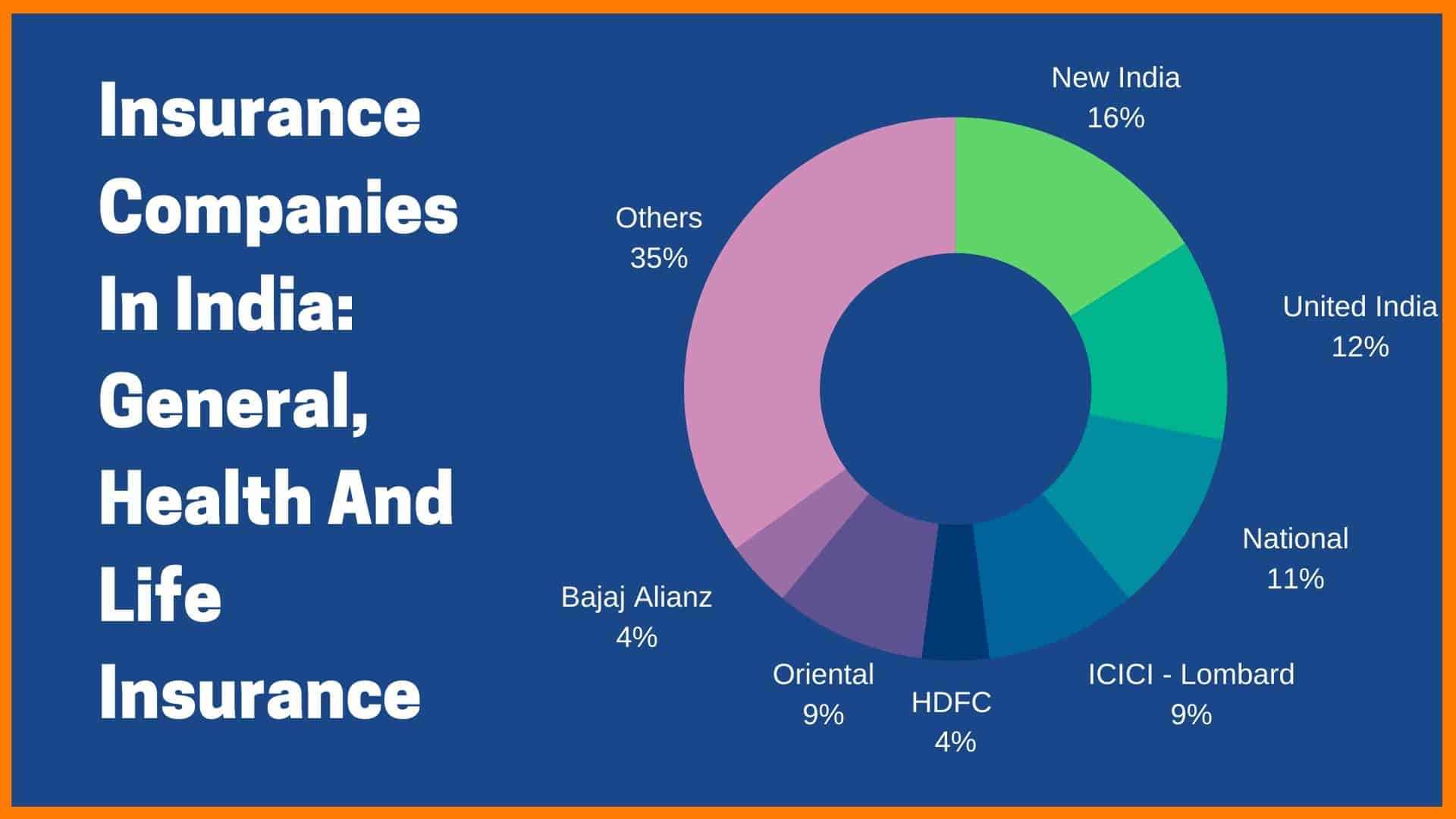

The insurance industry in India has two major players in Life Insurance Corporation Of India (LIC)and General Insurance Corporation Of India (GIC). However, there 57 companies in total among which 24 are in the life insurance business and the other 33 are non-life insurance companies. Most of them have international ties.

In the list, LIC is the sole public sector company under the life insurer segment, and there are six public sector companies in the no-life insurer vertical. GIC is the sole national re-insurer in the industry. The chain has many players such as brokers, surveyors, and third party administrators serving health insurance claims.

The Insurance Industry Market Size In India

The government has always pushed for insurance penetration in the economy. Gross direct premiums of non-life insurers in India in the financial year 2019-2020 alone reached $13.66 billion in FY 20.

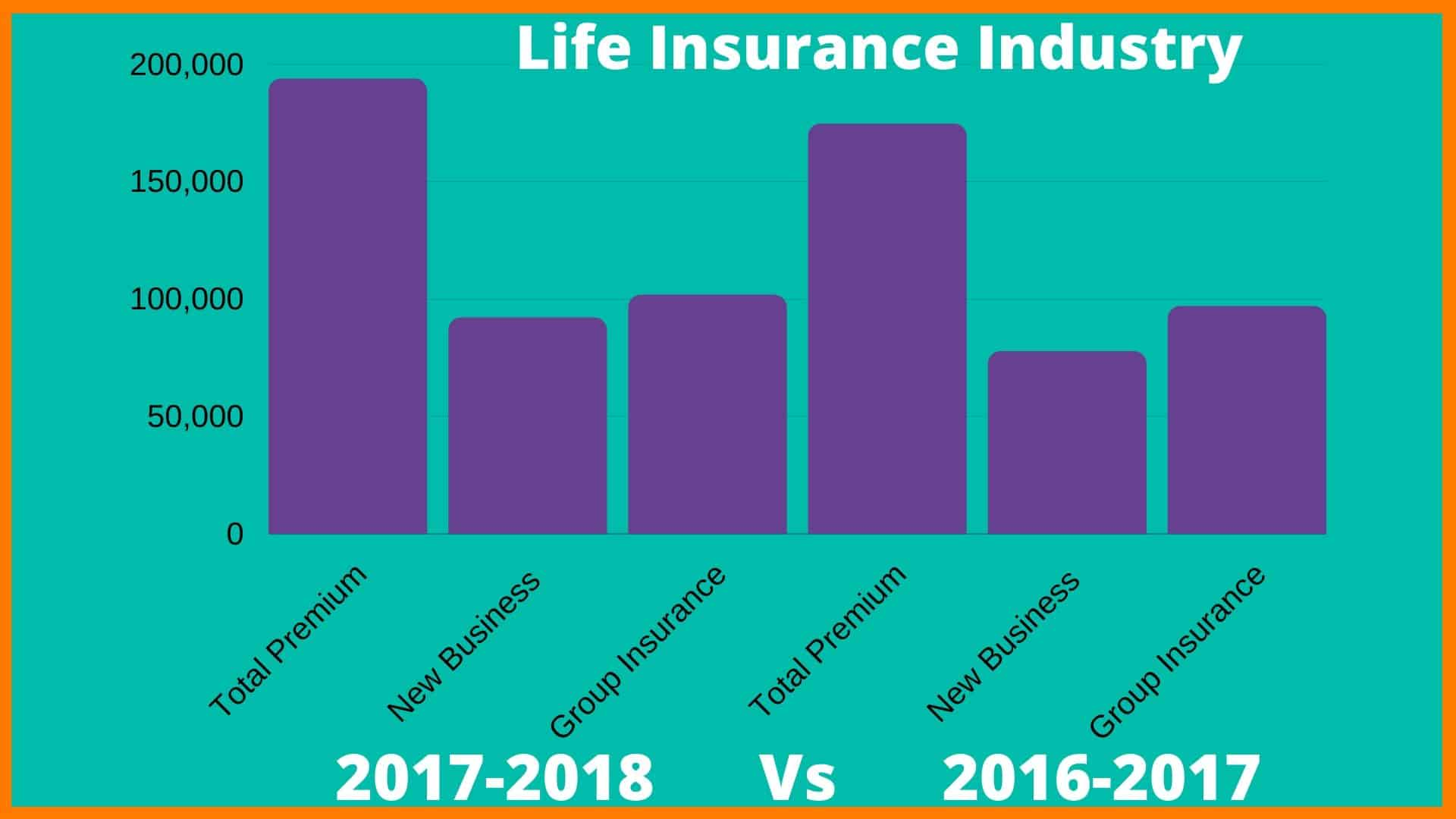

Gross direct premiums of non-life insurers in India reached $13.66 billion in FY20 (up to September 2019), and gross direct premiums reached Rs 410.71 billion ($5.87 billion), showing a year-on-year growth rate of 14.4%. Overall insurance penetration (premiums as % of GDP) in India reached 3.69% in 2017 from 2.71% in 2001.

In FY 19, the premium from new life insurance business increased 10.73% year-on-year to Rs 2.15 trillion ($ 30.7 billion). In FY 20 (till July 2019), gross direct premiums of non-life insurers reached $5.7 billion, showing a year-on-year growth rate of 16.65%.

The market share of private sector companies in the non-life insurance industry in India rose from 13.12% in FY 03 to 55.70% t in FY 20.

Government Initiatives

The Government of India has taken several initiatives to boost the insurance industry. Some of them are as follows:

The government has allowed 100% Foreign Direct investment and abolished many restrictions on FDIs in the Union budget of 2019. The government has also taken an initiative to provide for 100 million vulnerable families under the National Health Protection Scheme that was launched in September. This led to the proliferation of the Health Insurance sector in India by 50%. Over 47.9 million farmers benefited through the Pradhan Mantri Fasal Bima Yojana (PMFBY) in 2017-18.

The Insurance Regulatory and Development Authority of India (IRDAI) plans to issue re-designed initial public offering (IPO) guidelines for insurance companies in India which are looking to divest equity through the IPO route. IRDA has allowed insurers to invest up to 10% in additional tier 1 (AT1) bonds that are issued by banks to augment their tier 1 capital; this will help expand the pool of eligible investors for the banks.

The Future Of Insurance Industry In India

The future looks promising for the life insurance industry in India. Several changes in the regulatory framework have been proposed which will transform the way the industry conducts its business and engages with customers.

The overall insurance industry in India is expected to reach $280 billion by 2020. The life insurance industry in India is expected to grow by 12-15% annually for the next three to five years.

Demographic factors such as growing middle class, young insurable population, the ever increasing awareness of the need for protection, and retirement planning will support the growth of Indian life insurance segment.

Link : https://startuptalky.com/insurance-industry-in-india/

Author :- Devashish Shrivastava

August 06, 2020 at 06:00AM

startuptalky