The Indian startup ecosystem has grown by leaps and bounds in the last four years — from 35K startups in 2016 to over 55K startups in 2020, with over $48.7 Bn raised in disclosed funding rounds. Since 2018, 15+ unicorns have come up in India thanks to the rapid rise of the consumer market as well as the increasing adoption of digital services and products by individuals and businesses. Overall, India has 34 unicorns today, with the PharmEasy-Medlife merged entity aiming to be the latest entrant into this club.

In our The State of The Indian Tech Startup Ecosystem Report for 2018, we picked out 30 startups as soonicorns or businesses that had the potential to turn unicorns by 2020. Out of these 30, the likes of Zerodha, Icertis, Druva, Lenskart and Delhivery entered the unicorn club in the last two years.

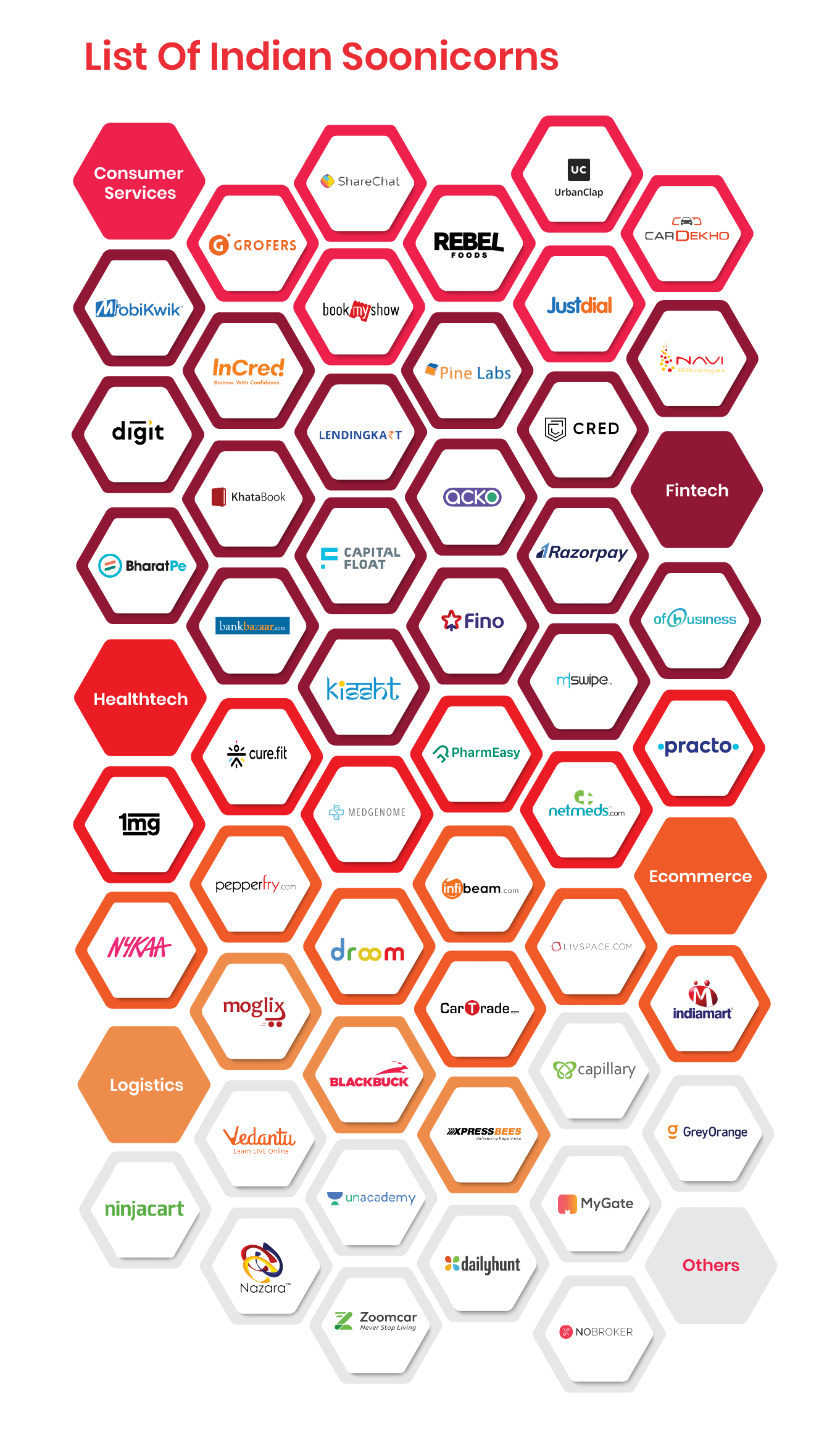

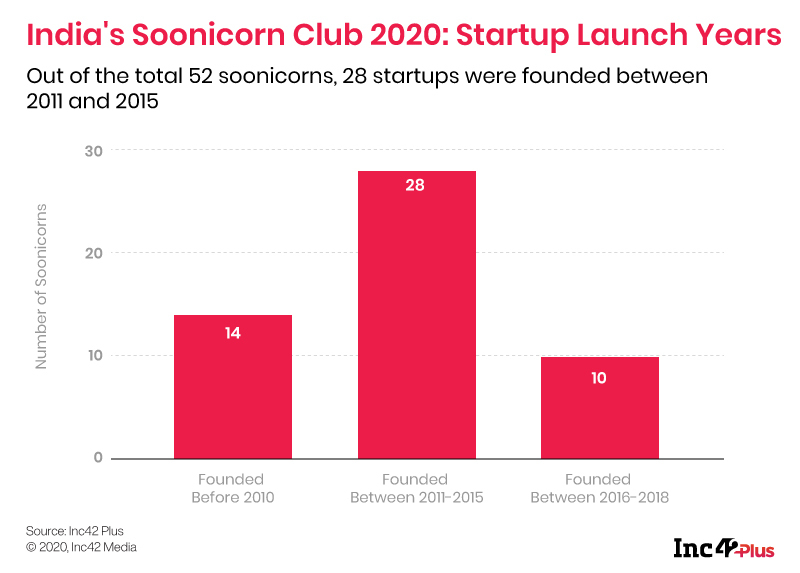

And now as part of the Inc42 Plus The State of Indian Tech Startup Ecosystem Report 2020, we have shortlisted 52 Indian soonicorns that have the potential to join the unicorn club by 2022.

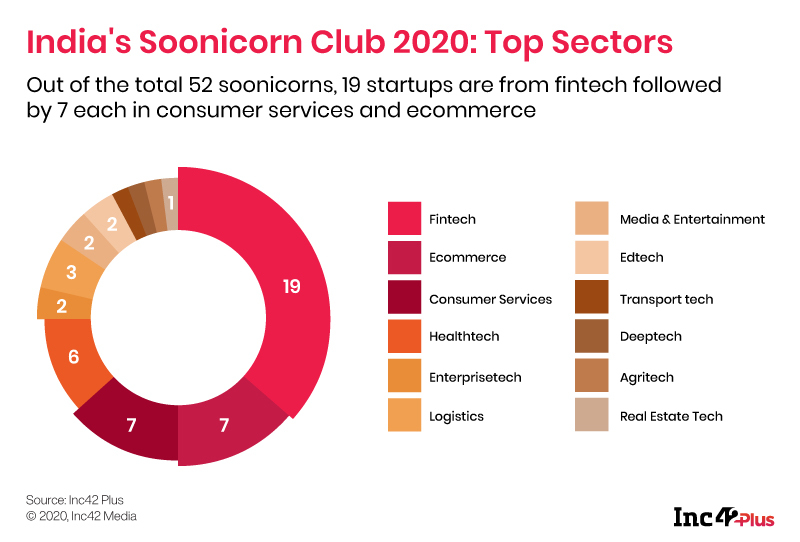

Cumulatively, these 52 upcoming unicorns have raised a total funding of $9.4 Bn (to date and in disclosed rounds). With 19 startups in the list, fintech leads among the sectors with seven ecommerce startups and consumer services each also most likely to reach the unicorn club.

Fintech’s lead in this regard is thanks to the fact that digital payments has achieved deep penetration in metros and Tier 1 cities and now, the addressable base is more likely to adopt other digital financial services such as lending, insurance and neobanking. In particular, startups in lending tech and payments have contributed the most to our fintech soonicorn list.

In the post-pandemic world, healthtech startups will finally rise in prominence, especially with India’s National Digital Health ID plan that will come into effect over the next couple of years. Six healthtech startups have been identified as potential unicorns or soonicorns in our latest report.

According to our analysis, fintech is among the three most funded sectors during 2014- H1 2020 with $10 Bn raised out of the total of $48.7 Bn across 692 deals. Fintech startups such as Navi Technologies, Pine Labs and Incred are among the soonicorns list for 2020.

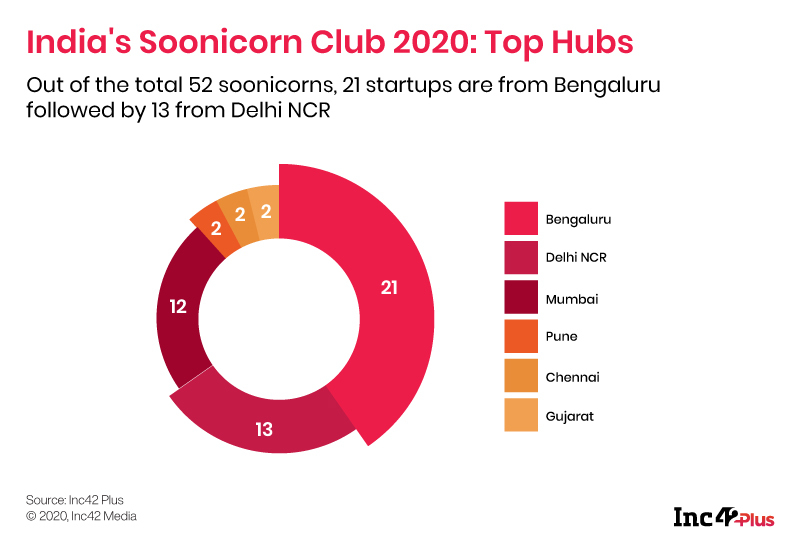

A broad geographical split of these soonicorns reveals that most of these tech startups – 21 are based out of Bengaluru. While 13 other startups are based in Delhi NCR and Mumbai is home to 12 potential unicorns.

Among the startups founded between 2016-2018, 10 of them have made it to the soonicorn list and the most prominent sector among these was fintech. Startups such as Bharatpe, Cred, Navi Technologies and Paytm Money are expected to make it to the unicorn club by 2022.

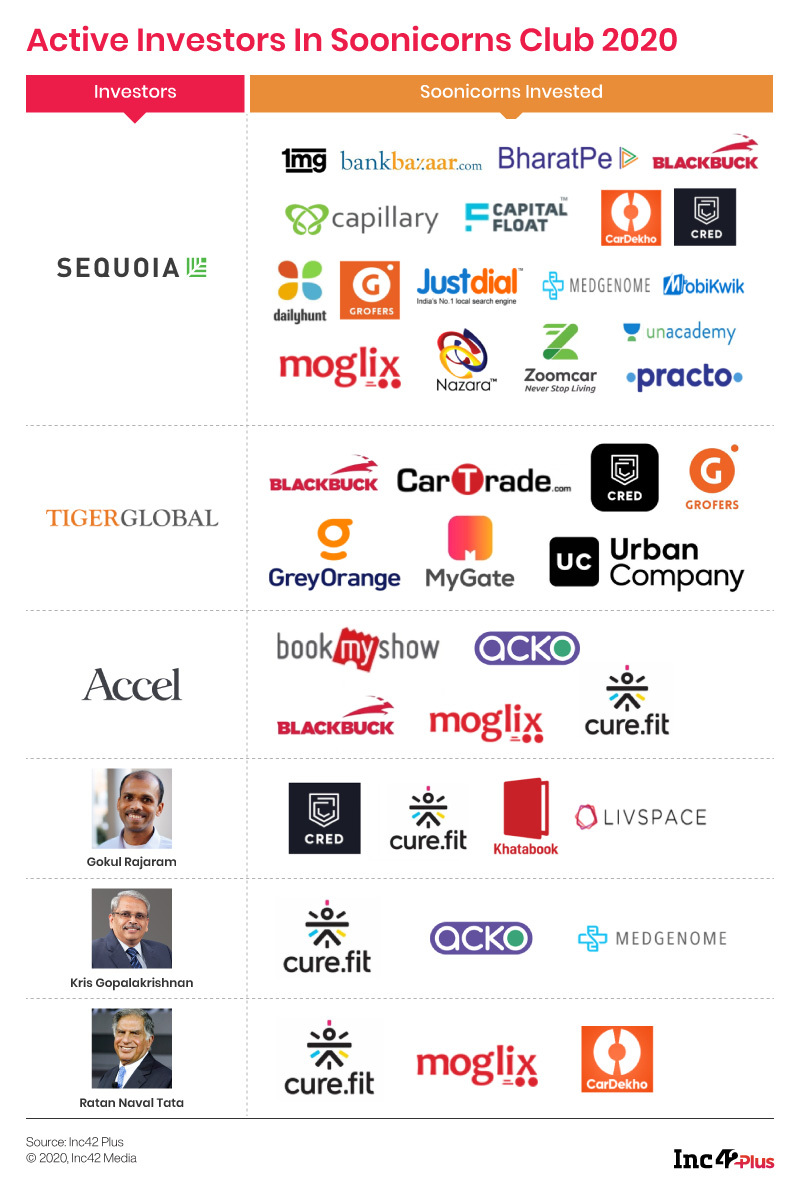

Active Investors In Soonicorns Club 2020

In terms of investors, venture capital funds such as Sequoia, Tiger Global and Accel Partners have backed the majority of these companies.

Sequoia Capital India: With over 350 investments uptil now, Sequoia Capital India has been the most active investor in the Indian startup ecosystem. It has made investments in around 18 startups in soonicorn club 2020. It has a diversified portfolio of investments in the soonicorns club 2020 with a focus on the fintech, healthtech and logistics sector. 4 out of 18 soonicorns invested by it are in the fintech sector.

Tiger Global Management: Tiger Global Management is an investment firm that deploys capital globally in both public and private markets. It has invested in 7 startups that have the potential to be unicorns by 2022. It has invested in various sectors such as ecommerce, logistics, consumer services, deeptech and fintech.

Accel Partners: This American Venture Capital firm has made around 19 investments uptil now and out of these 5 startups are in soonicorn club 2020. With a focus on the logistics sector, 2 out of 5 startups — Blackbuck and Moglix are in the soonicorn club 2020.

Among the angel investors, the leading investors in soonicorn startups are Gokul Rajaram, Kris Gopalakrishnan and Ratan Tata.

The Road Ahead For Indian Soonicorns

With 52 startups expected to join the unicorn club by 2022, India is moving fast towards 100 unicorns by 2025, as estimated by Inc42 Plus. Though currently there are only 4 fintech unicorns, this sector has emerged as the prominent sector in the Indian startup ecosystem with 357 unique funded fintech startups uptil H1 2020.

Fintech leads in the race of potential unicorns of 2022 and this means that India could well and truly become a majority digital economy by that age. The other emerging sectors in Indian soonicorn club 2020 are ecommerce, consumer services and healthtech and each of these has a huge addressable base to capitalise on.

The road ahead for the Indian soonicorns has become a bit difficult due to the Covid-19 pandemic — there’s little doubt about that — but it could actually produce startups that have built their valuation based on cash generation on a quarter-on-quarter basis, rather than ones which have gained inflated valuations due to investors fuelling cash burn. However, the conservatism in the spending scenario from the consumer and investor point of view will definitely have an impact on startup performance and valuations.

The post India’s Soonicorn Club 2020: A Closer Look At The Unicorns Of Tomorrow appeared first on Inc42 Media.

Author: Vaishnavi Dayalani

Source : https://inc42.com/datalab/india-soonicorn-club-2020-a-closer-look-at-the-unicorns-of-tomorrow/

Date : 2020-08-21T10:40:17.000Z