Bengaluru-headquartered edtech decacorn BYJU’S, late on Wednesday (August 5), announced that it has acquired Mumbai-based online coding platform WhiteHatJr for $300 Mn.

With the acquisition, BYJU’S aims to expand its product offerings, as well as widen its base in India and the US where WhiteHatJr already has a presence. BYJU’S will also make investments in WhiteHatJr’s technology platform, product innovation while expanding the teacher base to cater to demand from new markets.

BYJU’S is a significant player in India’s burgeoning edtech space catering to learning needs by offering online lessons to school-going students, as well as comprehensive courses for competitive exam preparation. The company, founded in 2011 by Byju Raveendran and Divya Gokulnath, launched its platform in 2015, and now boasts of 64 Mn students cumulatively learning from the app, 4.2 Mn annual paid subscriptions and an annual renewal rate of 85%.

BYJU’S claims to be creating personalised learning programs for students based on their proficiency levels and capabilities which help them learn at their own pace and style. The company says it doubled its revenue from INR 1,430 Cr to INR 2,800 Cr in FY 19-20. As of May, the company was raising funds at a $10 Bn valuation.

With the WhiteHatJr acquisition, BYJU’S will gain access to seven lakh registered users on the platform, benefiting from around 7,000 online classes every day. By teaching the fundamentals of coding, WhiteHatJr helps children aged 6-14 build commercial-ready games, animations and apps online. According to the company’s founder Karan Bajaj, inculcating coding in schools’ curriculum could further an active paradigm of learning instead of the passive one prevalent in India.

In an interview with Mint, BYJU’S co-founder Byju Raveendran also stressed on the importance of teaching coding to young children. “Even though students might not take up coding as a career option, it eventually helps them become active learners. Most of the changes in our traditional school curriculum in the last few decades were focused on passive learning methods, but we believe that the future of learning must be based on active learning methods.”

WhiteHatJr recently announced plans to expand to other global markets like Canada, UK, Australia and New Zealand after witnessing growth in the US for its one-to-one online coding classes. After launching their courses in the US, since February this year, the company claims to be growing at more than 100% MoM in the country.

Raveendran attested to the fact that the WhiteHatJr acquisition will help his company in its expansion plans. “The WhiteHatJr course format is very different from our current course format and offers live one-on-one classes, and there is a huge opportunity to scale this product not just in India, but in foreign markets as well. As part of our international expansion plans, we will be able to scale our offerings to new countries with the acquisition.”

The Edtech Wave In India

India witnessed the first signs of the edtech wave 10-15 years ago with the widespread adoption of smart boards and enterprise resource planning software (ERP) in physical classrooms. Soon, the popularity of ‘coaching classes’ for various competitive exams saw similar offerings for exam preparation being offered online, with live video sessions and mentor feedback pushing the demand for online learning platforms.

From then to now, as per DataLabs by Inc42+ estimates, there are a total of 4,450 edtech startups operating in India at present spread across various segments such as — test preparation, online certification, skill development, online discovery, and STEAM kit and enterprise solutions.

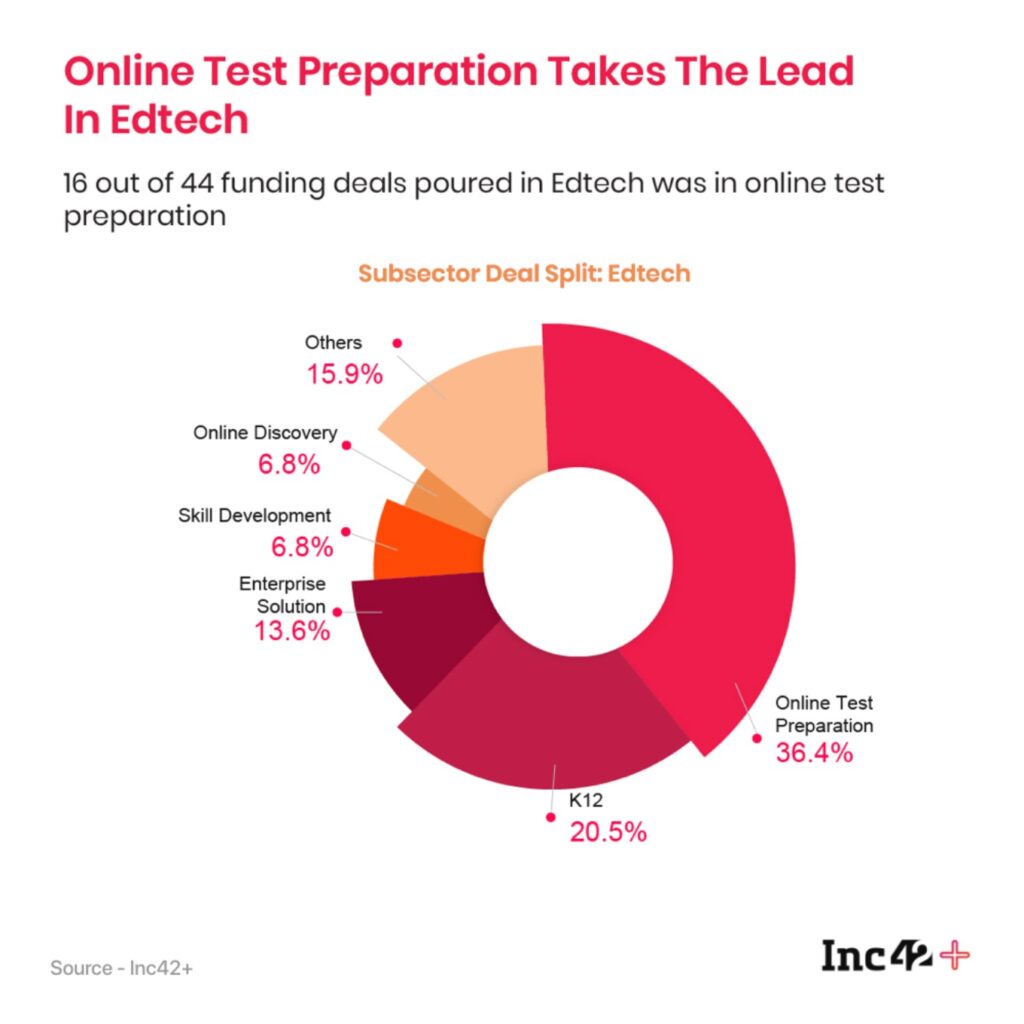

In the current scenario, test preparation and online certification startups are holding the majority market share. According to the ‘Future Of India’s $2 Bn Edtech Opportunity Report 2020’, capital inflows into the test preparation and online certification segments are comparatively higher. Together, K-12 and test preparation combined will make 66% ($1.3 Bn) of the total online education market size in 2021, the report noted.

BYJU’S, which is the world’s highest-valued edtech company — it was valued at $10.5 Bn after its fundraise from US-based venture capital firm Bond in June this year — has also expanded its suite of offerings over the years. In June, the company launched BYJU’S Classes to offer personalised after school tuition classes for students in the fourth to 10th standard, besides its other offerings for the school-going students as well as those preparing for competitive examinations. Now, with the acquisition of WhiteHatJr, BYJU’S is looking to expand into yet another relatively untapped segment in the edtech sector — coding.

BYJU’S & Unacademy The New Super Apps

Lately, BYJU’s seems to be a pioneer in the M&A play. In June, the company was reported to be in talks to acquire another edtech startup, the New Delhi-based two-year-old startup Doubtnut for a deal expected to be worth more than $125 Mn.

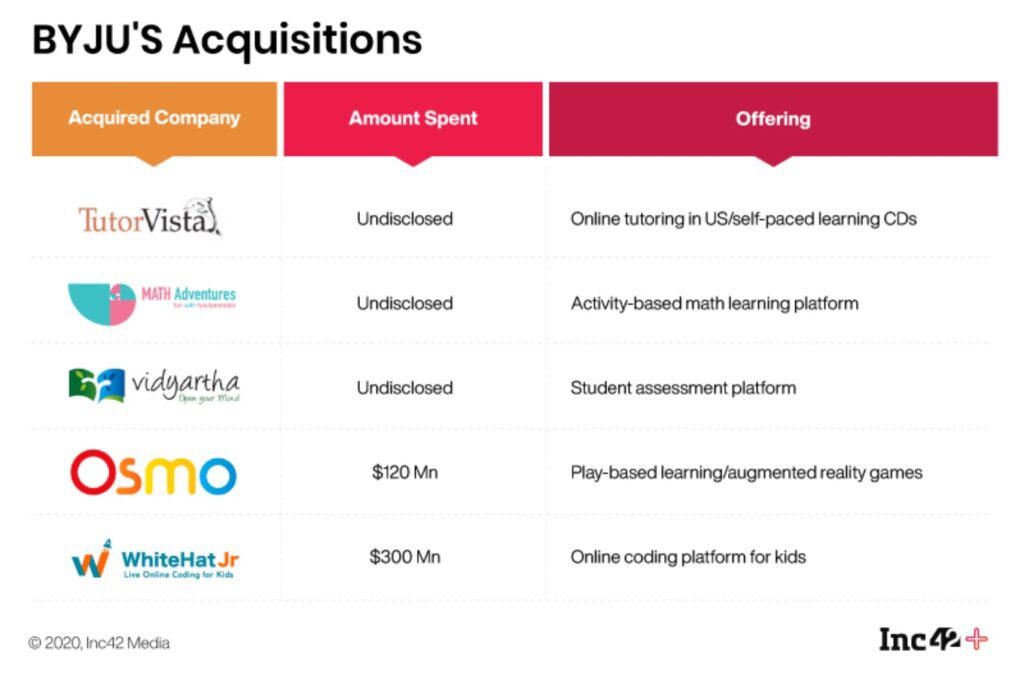

Last year, the company acquired US-based learning platform Osmo for $120 Mn as part of its international expansion plans. In 2018, the company acquired math learning startup Math Adventures. In 2017, BYJU’S also acquired US-based online tutoring app TutorVista and Edurite from Pearson (Edurite was acquired by Tutorvista in 2007 and Tutorvista was acquired by Pearson in 2013). In the same year, the company also acquired student assessment platform Vidyartha.

A closer look at the companies acquired by BYJU’s would reveal that the focus seems to be on assimilating younger startups with niche offerings, whether it be Doubtnut, which reported a spike in users from tier 2 and tier 3 cities since it allows students from the sixth to 12th grade to solve math and science problems in local languages, or the most recent acquisition of WhiteHatJr, which focuses on one of the most in-demand technical skills in our times – coding.

As for TutorVista, the platform gets around 70% of its users from the US, making it a viable acquisition for BYJU’S as it tries to further its global presence. Similarly, Math Adventures’ model involves a facilitator taking one class out of the allocated weekly math classes in schools and making students understand concepts they had learnt in the conventional class, but by using activities.

Shedding light on his philosophy behind mergers and acquisitions, Raveendran said that the focus for a deal is on whether the two companies have a complementary nature which could help scalability. “If a potential acquisition or merger fits into our strategy of building a product focused on the same age groups, brand vision, and demographics, then we will surely examine it. So, in the future, we will also look at companies that fit into our long-term vision of helping students get access to different learning formats of online learning.”

A similar trend can be witnessed with another Bengaluru-based edtech startup Unacademy. Last month, the company acquired PrepLadder, a postgraduate medical entrance exam preparation platform for $50 Mn. The acquisition is expected to strengthen Unacademy’s presence in the medical entrance examinations categories such as the National Eligibility cum Entrance Test (NEET) for medical postgraduate courses.

Earlier this year, Unacademy acquired edtech startup Kreatryx to strengthen its presence in the GATE and ESE segments in the test prep market, and Mumbai-based competitive programming platform CodeChef.

With the assimilation of a range of offerings in the edtech space, platforms like BYJU’S and Unacademy are seen to be moving closer to becoming ‘Super Apps’, those with a multitude of offerings that will give students a variety of choices and a complete learning experience.

So would the larger drive of consolidation in the edtech space by ‘Super Apps’ see the sector in India become a duopoly. “We’ve seen this trend with a lot of digital companies in other sectors as well, whether it be ecommerce or food delivery. The strong ones become stronger because scalability isn’t an issue for them and the weak ones eventually die a slow death,” said Santosh, adding that that the trend of M&A at play currently could unwittingly organise the edtech space.

“We saw a similar thing happen with ecommerce, where Amazon and Flipkart are now getting the smaller sellers and kirana stores on their platform. Similarly, the aunty who gives tuitions to kids from the neighbourhood could soon be roped in by BYJU’S. Coaching classes could be subsumed under the online learning space. It depends on the bigger players on how they exercise their power on whether an Indian edtech market with just two or three major players would be a good or a bad one,” he added.

The Rise Of Mergers And Acquisitions In Edtech

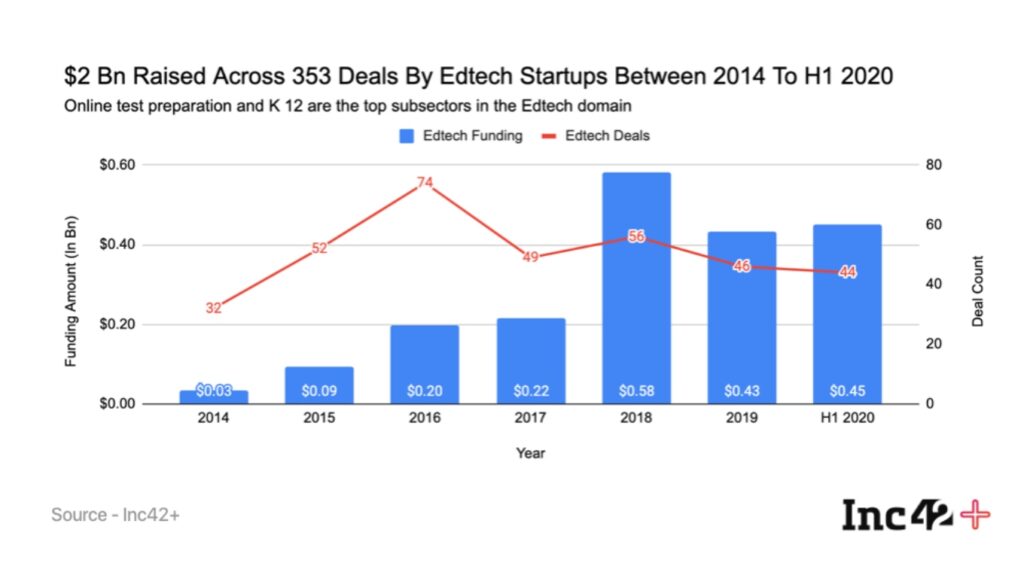

There’s been a recent wave of mergers and acquisitions in the Indian edtech sector, with DataLabs by Inc42+ estimates revealing that between 2014 and H1 2020 a total of 42 edtech startups underwent mergers or acquisitions.

While initial public offerings (IPO) and mergers and acquisitions (M&A) are two of the most prominent exit strategies in any startup ecosystem around the world, the fact that very few edtech companies globally, even fewer from India have gone the IPO route make it the road less travelled. The same is true for BYJU’S, with Raveendran confirming that the company need not do it soon to give an exit to early investors, while the company is profitable and generating net cash flow.

On the other hand, the M&A strategy allows edtech startups to acquire competitors and their niche capabilities, thus gaining market advantage.

Arpit Jain, CEO and co-founder of SplashLearn, an online K-5 math learning program told Inc42, “Acquisitions are mainly done to acquire niche capabilities, or for a growing customer base. Whereas mergers can be done to gain inroads into an alien market with the partner company providing the know-how, and dealing with the local nuances.”

“With so much movement and potential in the edtech sector, consolidation within the industry is possible, with companies finding technology, talent, and offerings complementary to each other. Another ideal exit for an Indian edtech company can be, to be acquired by a global education company,” Jain added.

For the smaller edtech startups, the Covid-19 induced growth in online learning has seen many of these companies utilise the spike in user growth and revenue to exercise their exit options. He further added, “A lot of the smaller startups which we see being acquired now, they’ve probably exited at the peak, as the shutdown of schools and colleges in the past 5-6 months of the pandemic has seen the edtech space boom in India.”

“This is because many of the extra-curricular activities for school-going students weren’t possible because of the lockdown, so naturally, these edtech offerings were natural alternatives for students to make use of their time, also for working professionals looking to upskill and everyone else,” said Santosh N, managing partner D and P Advisory LLP and external advisor, Duff and Phelps, a financial consultancy firm.

“These platforms offering niche services in the online learning space must have seen a growth in users. This would have helped them get a better valuation and deal. For the larger companies, it’s plainly about consolidation and increasing their bouquet of services,” he added.

According to DataLabs analysis, test prep and K-12 edtech startups combined are estimated to be worth $1.3 Bn by 2021. Further, according to a study by KPMG, the estimated market size for the online certification and the reskilling industry is estimated to be $463 Mn (2021) growing at a compounded annual growth rate (CAGR) of 38% since the year 2016. The edtech sector is blowing hot during the lockdown with the very visible consolidation wave by the bigger players. Whether this trend proves beneficial or detrimental for the online learning space in India in the coming years remains to be seen.

The post How BYJU’S Is Leveraging Acquisitions To Build An Edtech Empire appeared first on Inc42 Media.

Author: Harshit Rakheja

Source : https://inc42.com/buzz/how-byjus-is-leveraging-acquisitions-to-build-an-edtech-empire/

Date : 2020-08-07T07:08:43.000Z