The financial disruption caused by the Covid-19 pandemic forced many businesses to adopt digital technologies. A recent report by management consulting firm RedSeer consulting now indicates that the growth of digital payments in India may have received a boost due to the pandemic and the resultant country-wide three-month-long lockdown, having possibly brought about a permanent change in consumer behaviour.

The report mentions that as the economy rebounds after the Covid-19 lockdown, there will be a consequent growth in digital payments, which are expected to grow 2x and touch $60 Tn by 2022, “driven by a continued rise in private expenditure, with retail consumption at the forefront, and a significant increase in digital maturity of the Indian customers,” says the report.

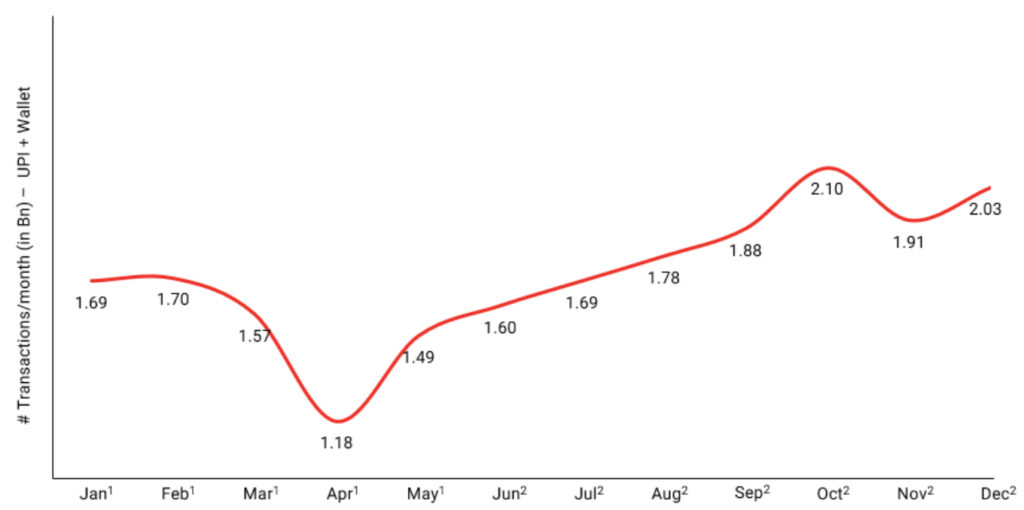

Moreover, the report mentions that mobile payments are likely to outplay other forms of digital payments and grow at a 60% compounded annual growth rate (CAGR) to reach $900 Bn by 2025. The report notes that while there was a 25% fall in the number of digital transactions through UPI and mobile wallets, — from 1.57 Bn in March to 1.18 Bn in April — the numbers have only grown since then. For July, the number of digital transactions were 1.69 Bn, and are expected to touch 1.78 Bn in August, and will continue to climb from there, according to the report’s estimates.

The report adds that increased health consciousness among people due to Covid-19 would lead to a rise in buyers through online insurance aggregators or insurance tech startups. According to the report, 17 Mn new online insurance buyers will get added in the next two years, to take the overall number to 30 Mn.

The other data points mentioned in the report that the digital credit lending sector has seen a 90% dip in loan disbursal from March to April this year, as MSMEs have been the hardest hit by the pandemic, severely affecting their creditworthiness. However, the market for digital lending is expected to recover, driven by significant headroom for growth available. Only 400,000 MSMEs are using credit-lending from digital platforms, out of a total addressable base of more than 20 Mn.

The government has also been making efforts to push to envelop for the adoption of digital payments. Recently, the National Payments Corporation of India (NPCI) announced the launch of a UPI AutoPay to enable e-mandate for recurring payments up to INR 2,000 on the UPI network. The NPCI also launched a RuPay business credit card for small businesses and startups. Further, it is also trying to add near-field communication (NFC) capabilities to its existing UPI infrastructure to enable offline-based digital payments.

The post Digital Payments Witness Organic Growth Amid Pandemic, Reveals Report appeared first on Inc42 Media.

Author: Harshit Rakheja

Source : https://inc42.com/buzz/digital-payments-witness-organic-growth-amid-pandemic-reveals-report/

Date : 2020-08-13T15:12:29.000Z