Walk into a room full of startup founders, and you will find someone or the other recounting their first fundraise. And why not? It’s an important milestone in any company’s journey, and that sigh of relief after founders get the phone call telling them they’ve got it – that’s momentous, and very hard to forget.

Raising funds is a daunting task, especially for first-time entrepreneurs. To justify all the sweat, blood, and tears poured into a company, while someone with lifesaving funds tries to get into your brain and read you like a book could be nerve-wracking.

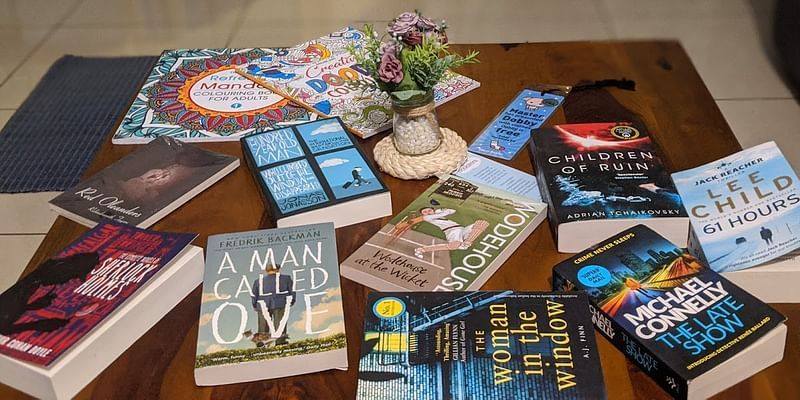

The technical processes and legalities of a fundraising exercise can also be quite confusing, and so being prepared goes a long way. And what better way to understand the startup and venture capital universe than between the pages of well-written books.

Here are five books we recommend to get you started on your journey to becoming a successful entrepreneur:

Recent books

The Art of Startup Fundraising: Pitching investors, negotiating the deal, and everything else entrepreneurs need to know - Alejandro Cremades

The book provides insight into how the landscapes around regulatory and technological changes in recent years have helped shape the startup world, and extrapolates those observations to explain what they mean for an entrepreneur looking to raise funds.

The book also advocates online funding, and how startups can source funding at different stages. It provides guidance to founders on what they need to keep in mind while pitching to investors and raising funds.

Introduction to Private Equity: Venture, Growth, LBO and Turn-Around Capital- Cyril Demaria

The book is a crash course in the various nuances of the private equity market, and how it has evolved over time. It talks about the different forms of capital available for a founder looking to raise funds, and how PE players evaluate opportunities.

Venture Capital for Dummies: Nicole Gravagna, Peter K Adams

As the name suggests, this book is a manual for beginners and first-time entrepreneurs. In simple, easy-to-understand terms, the book explains the fundamentals of venture capital, and what commonly used technical terms and jargons mean. It also gives entrepreneurs useful tips to make their business venture-ready.

Angel Investing: The Guest Guide to Making Money and Having Fun Investing in Startups - David S Rose and Reid Hoffman (Foreword)

In the book, angel investor David Rose talks about his experience in investing in close to 90 companies, over 25 years. With the aid of stories and examples, the book gives readers a first-hand peek into the world of startups – what makes them tick and what doesn’t. The book offers insights about regulations that affect the startup world, and enlists best practices a growing company should adopt.

What Every Angel Investor Wants You to Know: An Insider Reveals How to Get Smart Funding for Your Billion Dollar Idea - Brian Cohen

Brian writes from the perspective of angel investors, giving readers a glimpse into the way people across the table, such as startup founders, function. The book talks about ways to find the right investor fit, the ideal way of approaching a VC, and what angel investors focus on when evaluating job opportunities.

An early investor in Pinterest, and the Chairman of the New York Angels, the author writes at length about traits in founders that appeal to investors, and how investors evaluate opportunities.

(Edited by Aparajita Saxena)

Want to make your startup journey smooth? YS Education brings a comprehensive Funding and Startup Course. Learn from India's top investors and entrepreneurs. Click here to know more.

Link : https://yourstory.com/2020/06/ys-learn-5-must-read-books-funding-startup

Author :- Sindhu Kashyaap ( )

June 11, 2020 at 11:13AM

YourStory